The Board of Directors of the Bank of Ceylon has pleasure in presenting their report on the affairs of the Bank together with the Audited Consolidated Financial Statements for the year ended 31st December 2012, of the Bank and the Group and the Auditors’ Report on those Financial Statements, conforming to the requirements of the Bank of Ceylon Ordinance No.53 of 1938 and Banking Act No.30 of 1988 and amendments thereto. The report also includes certain disclosures laid down by the Colombo Stock Exchange Listing Rules and certain disclosures required to be made under the Banking Act Direction No.11 of 2007 on Corporate Governance for Licensed Commercial Banks issued by the Central Bank of Sri Lanka and subsequent amendments thereto. The Directors approved the Financial Statements on 21st March 2013.

The Bank of Ceylon is a Licensed Commercial Bank under the Banking Act No. 30 of 1988 and was duly incorporated on 1st August 1939 under the Bank of Ceylon Ordinance No.53 of 1938. The Bank is wholly owned by the Government of Sri Lanka. The unsecured subordinated redeemable debentures issued by the Bank are listed on the Colombo Stock Exchange.

The principal activities of the Bank during the year were commercial banking, personal banking, development financing, mortgage financing, lease financing, investment banking, Islamic banking, bancassurance, corporate financing, dealing in Government securities, pawn broking, credit card facilities, off-shore banking, foreign currency operations and other financial services.

The principal activities of Subsidiaries and Associates are given under Significant Accounting Policies to the Financial Statements on page 244.

There were no significant changes in the nature of the principal activities of the Bank and the Group during the year under review, other than changes mentioned under Significant Accounting Policies.

The changes to the group structure during the year is given in Note 29 and 30 to Financial Statements on pages 280 and 282 of this Annual Report.

The Bank’s Vision and Mission are given on page 10 and 11 of this Annual Report. The Bank maintains high ethical standards in its activities whilst pursuing the objectives stated under ‘Vision’ and ‘Mission’.

The Chairman’s Message on pages 18 and 19 deals with the year’s performance of the Bank/Group and on the Sri Lankan economy.

The General Manager’s Review on pages 26 and 27 provides a detailed description of the operations of the Bank during the year under review.

Management Discussion & Analysis on pages 54 to 93, provides a detailed analysis of business operations of the Bank. These reports that provide a fair review of Bank’s affairs, form an integral part of the Annual Report.

The Bank extended its services through the addition of 28 new extension offices during the period under review. The number of branches were increased by 6. The network was further expanded enhancing customer convenience. The Bank installed 47 ATMs during the year across the island bringing out the total to 451. This number does not include peer bank’s ATMs through which customers of Bank of Ceylon can transact.

The Bank has granted no donations for the year 2012. But the Bank has incurred Rs.46.8 million on Corporate Sustainability & Responsibility activities.

The Directors are responsible for the preparation of the Financial Statements that will reflect a true and fair view of the state of affairs. The Directors are of the view that these Financial Statements have been prepared in conformity with the requirements of the Sri Lanka Accounting Standards, Banking Act No. 30 of 1988 and its amendments, Bank of Ceylon Ordinance No.53 of 1938 and its amendments and the Listing Rules of the Colombo Stock Exchange. In the case of Subsidiaries, the Financial Statements are prepared also in accordance with the provisions of the Companies Act No.7 of 2007.

The Statement of Directors’ Responsibility for Financial Reporting is given on page 236 of this Annual Report and forms an integral part of this Report of the Directors.

The Auditor General is the Auditor of Bank of Ceylon in terms of the provisions of Article 154 of the Constitution of the Democratic Socialist Republic of Sri Lanka. Report of the Auditor General on the Financial Statements of the Bank and the Consolidated Financial Statements of the Bank and its Subsidiaries as at 31st December 2012 is given on page 237 of this Annual Report.

The Group and the Bank prepared their Financial Statements for the periods up to and including the year ended 31st December 2011 in accordance with Sri Lanka Accounting Standards which were in effect until that date. Following the convergence of Sri Lanka Accounting Standards with the International Financial Reporting Standards all existing/ new Sri Lanka Accounting Standards were prefixed as SLFRS and LKAS to represent Sri Lanka Accounting Standards 227 BANK OF CEYLON

corresponding to International Financial Reporting Standards and International Accounting Standards respectively. Accordingly the Group and the Bank adopted these new Sri Lanka Accounting Standards applicable for financial periods commencing from 1st January 2012 for the preparation of Financial Statements.

The accounting policies adopted in the preparation of Financial Statements are given on pages 244 to 256.

An overview of the future plans and development of the Bank is presented in the new Chairman’s Message on page 22 and Management Discussion & Analysis on pages 77, 82 and 86 of this Annual Report.

The main income of the Group is interest income, which comprises 85% of the total income. The income of the Group for the year 2012 was LKR 115,527 million as against LKR 74,857 million in comparison to the previous year. The Bank’s total income accounted for 95% (2011 - 94%) of total income of the Group.

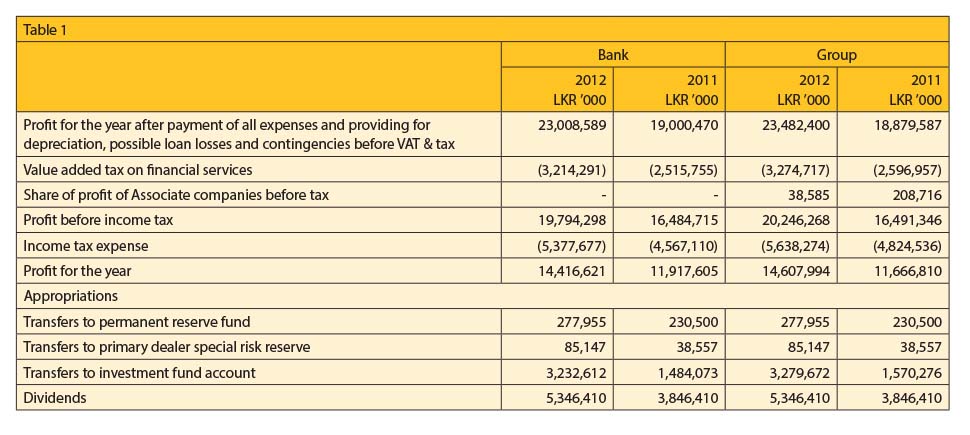

The Bank recorded a pre-tax profit of LKR19,794 million in 2012 reflecting an increase of 20%, compared to LKR 16,485 million recorded for the previous year. After deducting LKR 5,378 million (LKR 4,567 million in 2011) for income tax, the profit after tax for the year 2012 amounted to LKR 14,417 million, which is a 21% increase compared to LKR 11,918 million profit after tax reported in 2011. Details of profit relating to the Bank and the Group are given in Table 1.

The pre-tax profit of the Group also increased from LKR 16,491 million to LKR 20,246 million, an increase of 23% in comparison to the previous year. After deducting LKR 5,638 million for income tax (LKR 4,824 million in 2011) the profit after tax of the Group increased to LKR 14,608 million in 2012 from the profit after tax of LKR 11,667 million reported in 2011.

The Bank determines the dividends in consultation with the Government, the shareholder of the Bank, prudently based on profits after deduction of tax, loan loss provision and any such portion for reserves. Accordingly, a sum of LKR 5,346 million has been paid by the Bank as dividends for the year. (2011 - LKR 3,846 million)

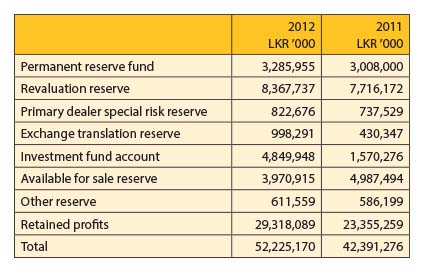

The total reserves of the Group stood at LKR 52,225 million as at 31st December 2012 (2011 - LKR 42,391 million). The Group reserves consist of the following -

The total capital expenditure incurred by the Group on the acquisition of property, plant & equipment during the year amounted to LKR 1,483 million (2011 – LKR 1,905 million) the details of which are given in Note 32 to Financial Statements on pages 286 of this Annual Report.

The value of freehold properties owned by the Group as at 31st December 2012 is included in Note 32 to Financial Statements at LKR 9,626 million (2011 - LKR 9,009 million).

The total issued and fully-paid up capital of the Bank as at 31st December 2012 was LKR 5,000 million consisting of 5,000,000 ordinary shares.

The Government of Sri Lanka is the sole shareholder of the Bank.

The Group had issued subordinated debentures (both listed and unlisted) amounting to LKR 6,000 million as at 31st December 2012 (2011 - LKR 5,000 million). The proceeds of these debentures were utilised to bridge the maturity gaps and to strengthen the supplementary capital base of the Bank. The details of debentures outstanding as at the date of Balance Sheet are given in Notes 41 and 45 to the Financial Statements on pages 297, 301 and 302.

The earnings per share and net assets per share of the Group were LKR 2,916 and LKR 11,445 respectively, for the period under review.

The programmes carried out under the Corporate Sustainability and Responsibility (CS & R) are detailed on pages 152 to 223 under the Sustainability Report.

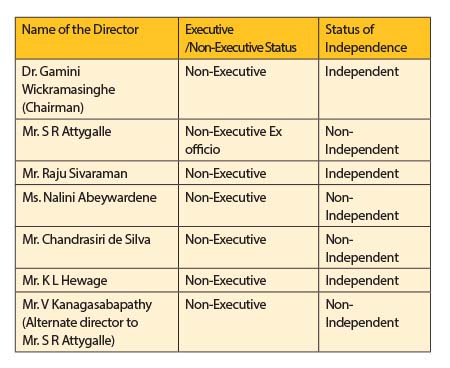

The Board of Directors of the Bank of Ceylon as at 31st December 2012 consisted of six members including the Chairman and they do not hold any executive positions in the Bank. They bring a wide range of skills and experience to the Board. The qualifications and experience of the present Directors are given on pages 34 to 36 of this Annual Report.

The Directors of the Bank who held office during the year under review were as follows -

The Directors are classified as Independent Directors on the basis given in Banking Act Direction No.11 of 2007 on Corporate Governance for Licensed Commercial Banks issued by the Central Bank of Sri Lanka.

The Board has formed four sub committees complying with the aforesaid Banking Act Direction No.11 of 2007 to ensure oversight control over affairs of the Bank. The sub committee composition is given on page 138 to 148 of this Annual Report.

Attendance of Directors at Board and sub committee meetings are given on page 149 of this Annual Report.

Directors’ interests in contracts with the Bank, both direct and indirect are given on pages 230 to 232 These interests have been declared at meetings of the Board of Directors. Except for the contracts given therein, the Directors have no any direct or indirect interest in other contracts or proposed contracts with the Bank.

Dr. Gamini Wickramasinghe (Chairman) during the year under review has invested USD 349,000 in debentures issued by the Bank during the year 2008 and appears in the Debenture Register as at 31st December 2012. There were no debentures registered in the name of any other Director as at the beginning and at the end of the year.

The allowances/fees payable to Board of Directors are made in terms of the provisions/contents in the Public Enterprises Circular Nos. PED 58 dated 29th April 2011, PF/PE/23 dated 19th July 2002, letter dated 24th March 2008 all issued

by the Department of Public Enterprises of the Ministry of Finance & Planning and Bank of Ceylon Ordinance No. 53 of 1938 and its amendments.

The Directors’ remuneration in respect of the Group and the Bank for the financial year ended 31st December 2012 are given on page 259.

The Board of Directors assumes overall responsibility for managing risks. The specific measures taken by the Bank in mitigating the risks are detailed on pages 96 to 105 of this Annual Report.

The Board of Directors has ensured the implementation of an effective and comprehensive system of internal controls in the Bank through the Audit Committee.

The Audit Committee helps the Board of Directors to discharge their fiduciary responsibilities. The Report of the Chairman of the Audit Committee is contained on pages 139 and 141 of this Annual Report. The Directors are satisfied with the effectiveness of the system of internal control during the year under review and up to the date of the Annual Report and the Financial Statements. The Board has issued a statement on the internal control mechanism of the Bank as per Direction No.3 (8)(ii)(b) of Banking Act Direction No.11 of 2007 on Corporate Governance for Licensed Commercial Banks. The above report is given on pages 233 and 234 of this Annual Report. The Board has confirmed that financial reporting system has been designed to provide reasonable assurance regarding the reliability of financial reporting and that the preparation of Financial Statements for external purposes has been done in accordance with relevant accounting principles and regulatory requirements.

The Board has obtained an Assurance Report from the Auditor General on Directors’ Statement on Internal Control and it is given on page 235 of this Annual Report.

The Board of Directors is committed towards maintaining an effective Corporate Governance structure and process. The financial, operational and compliance functions of the Bank are directed and controlled effectively within Corporate Governance practices. These procedures and practices that are in conformity with Corporate Governance directions issued by the Central Bank of Sri Lanka under Banking Act Direction No. 11 of 2007 and the Code of Best Practice on Corporate Governance issued jointly by the Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of Sri Lanka are described in the Corporate Governance Report appearing on pages 108 to 137 of this Annual Report.

The Board has obtained a report from the Auditor General on the compliance with the provisions of the above mentioned Direction No. 11 of 2007.

One of the most valuable assets of the Bank is its employees and it is important for the Bank to develop them. Several measures were taken to strengthen the muchvalued human capital in order to optimise their contribution towards the achievement of corporate objectives. The Bank’s Human Resource Management policies and practices are detailed in the Sustainability Report on pages 197 to 207 of this Report.

The Directors, to the best of their knowledge and belief confirm that the Group has not engaged in any activities contravening the laws and regulations. Details of the Bank’s compliance with the laws and regulations are given on page 105 under Report on Risk and Compliance which forms an integral part of this Report.

The Directors are of the opinion that the litigation currently pending against the Bank will not have a material impact on the reported financial results or future operations of the Bank.

The Board confirms that all statutory payments due to the Government and in relation to employees have been made on time.

The Bank has not engaged in any activity, which has caused detriment to the environment. Further, precautions taken to protect the environment are given in Sustainability Report on pages 161, 162 and 165.

The Directors are of the view that no material events have arisen in the interval between the end of the financial year and the date of this Report, that would require adjustments or disclosures.

The Directors are confident that the resources of the Bank

are adequate to continue its operations. Therefore, it has

applied the going concern basis in preparing the Financial

Statements.

By order of the Board

Janaki Senanayake Siriwardane

Secretary, Bank of Ceylon/Secretary to the Board

21st March 2013

Colombo