A very detailed analysis of our corporate governance philosophies, policies and practice.

The ‘Code of Best Practice on Corporate Governance 2013’ (The Code) issued jointly by the Securities and Exchange Commission and The Institute of Chartered Accountants of Sri Lanka recommends that a Senior Independent Director (SID) be appointed in the event of the Chairman heading the executive function of the Company.

The presence of a SID provides a workable mechanism to review the role played by the Chairman. Whilst the role of the Chairman entails providing leadership in observing best practices of corporate governance, my role as the SID calls for a review of the Board’s effectiveness. The presence of the SID also provides emphasis to transparency in matters relating to governance.

Dimo is committed to principles of good governance and always strives to live by the Best Practices of Corporate Governance. The governance culture of the Company is strongly embraced by the Board of Directors. The Company follows a policy of strict compliance with laws, regulatory requirements and the Code of Ethics.

A Director is permitted to obtain independent professional advice that may be required in discharging his responsibilities, at the Company’s expense.

As the SID, which role I have played since May 2009, I am consulted by the Chairman on major strategic and governance issues. As the SID, I make myself available to any Director to have any confidential discussion on the affairs of the Company, should the need arise. By virtue of being the Chairman of the Audit Committee, I also meet Independent Auditors and Internal Auditors and obtain their views on any matters of concern.

R.Seevaratnam

Senior Independent Director

23rd May 2014

Colombo

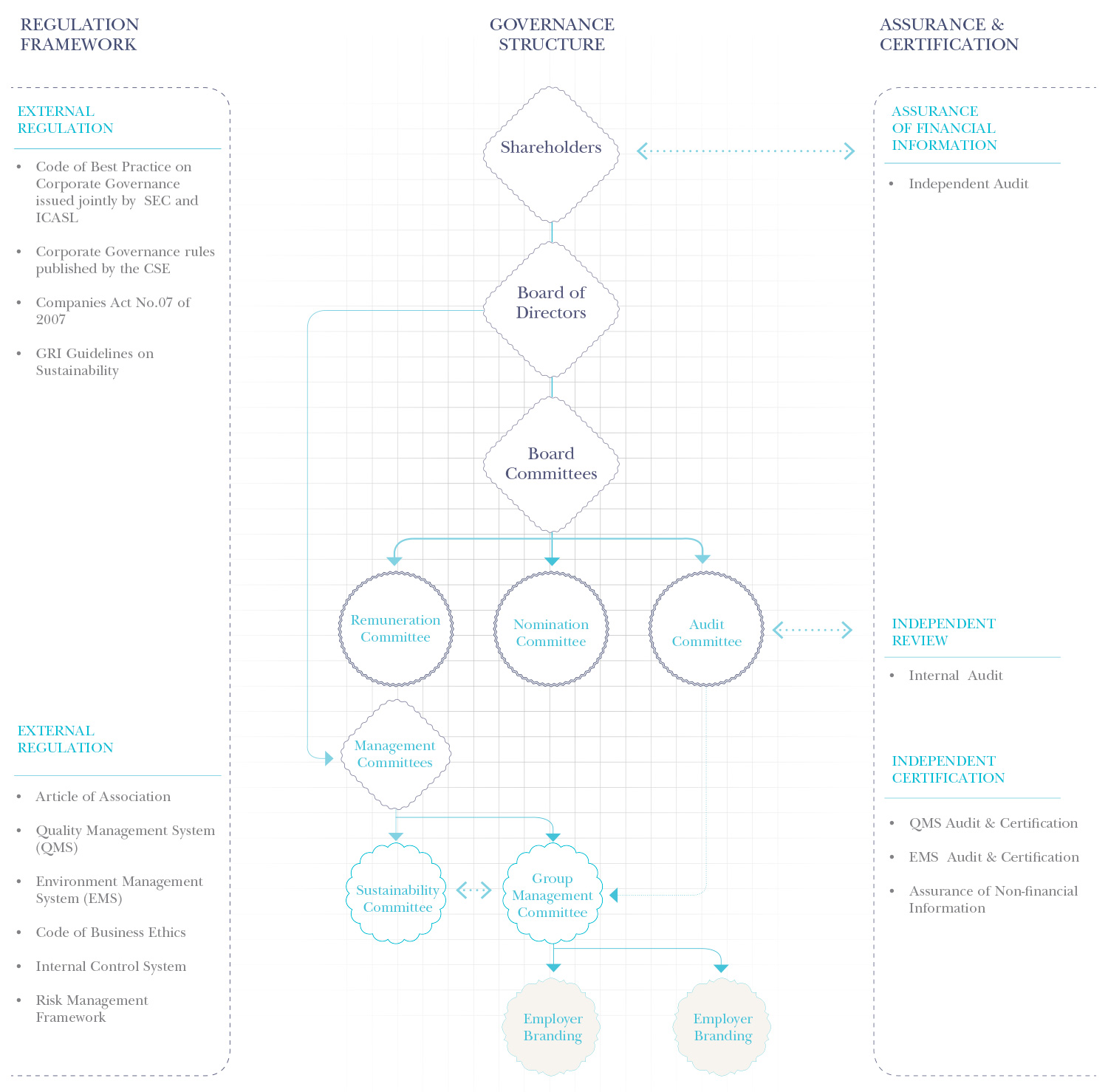

Enterprise Governance is at the core of the corporate philosophy of Dimo. It perceives good governance as an uncompromising pursuit that provides the platform for growth in a sustainable manner; not as a set of controls that stifles growth.

Dimo is committed to a policy of transparent, accountable and responsible governance. In doing so, the Board accepts the position of trusteeship, stewardship, and accountability that is placed upon it. The Board’s objective is to deliver superior returns to all stakeholders and it is done in conformity with acceptable corporate behaviour.

Primary authority for identifying, overseeing and evaluating economic concerns is vested in the Board of Directors and regular monitoring is delegated to the Group Management Committee (GMC), which consists of executive members of the Board and senior management. The GMC together with the heads of business units is responsible for implementing and monitoring the performance and conformance aspects of governance.

The Sustainability Committee, containing members of the Board and management, has the primary responsibility to oversee the Group’s activities with regard to the identification and management of environmental and social concerns and the achievement of the sustainability objectives. It is the duty of this Committee to report critical issues to the Board for action. Operational aspects relating to management of environmental and social impacts are delegated to the respective business units.

The Board identifies the scope of Enterprise Governance, which that is implemented starting from the Board Room throughout the Value Creation process. This signifies that the conformance and performance aspects of Governance should be identified in relation to managing the capitals and value creation activities. Duties of responsible trusteeship, faithful stewardship and uncompromising accountability underpin the manner in which Dimo is committed to good governance through its Value Creation process, in its pursuit of creating value and accumulating financial and non- financial wealth for its stakeholders. Conformance and Performance requirements demand a robust enterprise governance framework.

The ultimate responsibility for good governance rests with the Board of Directors. In order to effectively fulfill this responsibility, the Board has in place a governance structure and a process to monitor its effectiveness. The Audit Committee, Remuneration Committee and Nomination Committee together with the Group Management Committee play a leading role in ensuring effective enterprise governance.

The governance framework is designed taking into consideration the demands placed by the aspects of conformance and performance along with legislative and regulatory requirements and best practices of enterprise governance. It consists of a governance structure, regulation framework and assurance and certification sources.

Governance Framework

The driving force of conformance and performance is the onus that is placed upon the Board by the expectations of trusteeship, stewardship and accountability although there are many laws, regulations, best practices and expectations that shape these two dimensions of governance. Arising from the responsibilities placed upon it, the Board endeavours to meet the demands through the structures and the processes that are in place.

The table … illustrates key conformance and performance aspects arising from value creation activities and capitals and the point of reference through which they are addressed, regulated and reported. The point of reference is the source that provides guidance for conformance or performance. A point of reference could be a code of best practice, guideline, standard, system, process or even a body of persons that could provide guidance and direction in conformance and performance.

|

Capital / Activity |

Key Conformance Aspects |

Point of Reference |

Key Performance Aspects |

Point of Reference |

|

Value creation activities |

Meet regulatory standards with regard to product and services. |

Quality Management System |

Quality and safe products and services |

Quality Management System |

|

|

|

Code of Business Ethics |

||

|

|

Meet Regulatory standards and business ethics in performing supply chain activities. |

Quality Management System |

On-time delivery

|

Quality Management System |

|

|

|

Code of Business Ethics |

||

|

|

Product responsibility |

Quality Management System |

||

|

Monetised Capital |

Internal Control |

Audit Committee |

Business Strategy Formulation |

Group Management Committee |

|

|

|

Group Management Committee |

||

|

|

Internal Audit |

Audit Committee |

Operational Excellence |

Group Management Committee |

|

|

|

Quality Management System |

||

|

|

Uncertainty Management |

Risk Management Framework |

Environmental Management System |

|

|

|

Assurance |

Audit Committee |

||

|

|

|

Independent Auditors |

||

|

Customers |

Meeting Customer Expectations |

Quality Management System |

Customer satisfaction |

Quality Management System |

|

Customer Health & Safety |

Quality Management System |

Customer Relationship Management |

Quality Management System |

|

|

Customer Privacy |

Quality Management System |

Customer Complaint Handling |

Quality Management System |

|

|

Employees |

Employee safety |

Quality Management System |

Employee satisfaction |

HR Scorecard |

|

Employee Rights |

UN Global Compact Principles |

Training & development |

HR Scorecard |

|

|

Code of Business Ethics |

Retention |

HR Scorecard |

||

|

Equal opportunities |

UN Global Compact Principles |

Employee Engagement |

HR Scorecard |

|

|

Reducing gender inequality |

Sustainability Objectives |

|||

|

Comply with legislation and regulations relating to employees |

Code of Business Ethics |

|||

|

Business Partners |

Compliance with Principals’ requirements of ethical practices |

Quality Management System |

Expectation management |

Quality Management System |

|

Honor Agreements with Principals |

Quality Management System |

|||

|

Intellectual capital |

Data security and integrity |

Quality Management System |

Quality and accuracy of information |

Quality Management System |

|

Meet the requirements of the legislative enactments applicable to the Group. |

Code of Business Ethics |

Not applicable |

||

|

|

Enhance and preserve the reputation of the company by following best practices relating to good governance and sustainability. |

Code of Best Practice on Corporate Governance jointly issued by SEC and ICASL |

||

|

CSE Listing Rules |

||||

|

Articles of Association |

||||

|

GRI G4 Guidelines |

||||

|

Society |

Anti-corruption |

Code of Business Ethics |

Benevolence & Philanthropy |

Sustainability Committee |

|

|

UN Global Compact Principles |

Social development |

Sustainability Committee |

|

|

Environment |

Comply with all requirements of the Environment Management System- |

Environmental Management System |

Carbon foot-print Management |

Environmental Management System |

|

Meet Legal and Regulatory requirements regarding Environment |

Environmental Management System |

Energy & Fuel Management |

Environmental Management System |

|

|

UN Global Compact Principles |

Water Management |

Environmental Management System |

||

|

Code of Business Ethics |

Waste Management |

Environmental Management System |

||

|

Material Usage |

Environmental Management System |

|||

|

Noise & Air Emissions |

Environmental Management System |

|||

|

Re-cycle & Re-use |

Environmental Management System |

|

Point of Reference |

Aspect of Regulation |

Status |

|

The Code of Best Practices on Corporate Governance jointly issued by The Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of |

Best practices of Corporate Governance |

All requirements of the code and the compliance level is given on the table laid out in the company’s website at www.dimolanka.com/investors/stewardship |

|

Listing Rules of the Colombo Stock Exchange |

Listing rules to be followed by listed companies in Sri Lanka including on Corporate Governance relating to; – Non Executive Directors – Independent Directors – Disclosures relating to Directors – Remuneration Committee – Audit Committee |

Complied. The Compliance level is given on the tables Corporate Governance "Disclosures" Containing the level compliance with code |

|

Legislative enactments applicable to the Group |

Legal requirements that the Group is subject to |

The Code of Business Ethics specifically requires that all employees comply with all applicable laws. Employees sign a declaration to the effect that they will follow Code of Business Ethics. |

|

Articles of Association |

Requirements prescribed by the Articles of Association |

Complied |

|

Code of Business Ethics

|

Compliance requirements applicable to all employees |

All employees sign declarations to the effect that all requirements in the Code will be complied with. |

|

Global Reporting Initiative (GRI) guidelines on Sustainability Reporting. |

To report on sustainability related performance in a complete generally accepted manner as specified by GRI G4 guidelines. |

Complied. GRI index is available on the company’s website at www.dimolanka.com/sustainability/sustainability-performance The Report on the Independent Assurance obtained on Non- Financial Reporting is available in Appendices |

|

Environment Management System (EMS) |

Meet the requirements of the Group’s Environmental Management System accredited by ISO 14001:2004 Standard.

|

Complied. The Group’s Environmental Management System is certified with ISO 14001:2004 with certification provided by Det Norske Veritas AS (DNV) |

|

Quality Management System (QMS) |

Meet the requirements of the Group’s Quality Management System accredited by ISO 9001:2008 Standard. |

Complied. The Group’s QMS is certified with ISO 9001: 2008, with certification provided by Det Norske Veritas AS (DNV) |

|

UN Global Compact Ten Principles |

To comply with the requirements of the declaration made on UN Global Compact Ten Principles covering Human Rights, Labour, Environment and Anti – Corruption. |

Communication in progress is available on company’s website at www.dimolanka.com/sustainability/sustainability-performance |

|

HR Scorecard |

Specifies the KPIs to be attained with regard to HR related objectives that includes objective relating to Employee Satisfaction, Training & Development, Retention and Engagement |

HR scorecard is compiled every month and actual KPI’s are compared with targets. |

|

Audit Committee |

Among other responsibilities, to review effectiveness of Internal Control, Internal Audit and Independent Assurance |

Effectiveness of internal controls is reviewed with Internal auditors and Independent Auditors. Performance of Internal Auditors and Independent Auditors is also reviewed by the Audit Committee. Where necessary, members of the Group Management Committee are called upon to explain matters relating to internal controls. |

|

Group Management Committee |

Among other responsibilities, to install and review effectiveness of internal controls and to work towards operational excellence |

Effectiveness of internal controls is reviewed by the Group Management Committee from the feed – back received internally and from internal audit findings. Performance standards are set through KPIs and Objectives set for Business Units and Support Service Units and performance levels are reviewed periodically. |

|

Sustainability Committee |

To carry out the Group’s sustainability efforts as per its terms of reference |

Initiatives are planned and progress is reviewed by the sustainability committee. Key sustainability initiatives are reported in the Annual Report. |

|

Risk Management |

To manage risks that the Group is exposed to |

Please refer the Risk Management Report. |

The governance practices of the Company are conceived out of the corporate philosophy of achieving sustainable growth through good governance. While being fully compliant with demands of the laws and regulations relating to corporate governance, the Company recognizes that best practices provide a robust framework for sustainable growth and meeting stakeholder expectations.

Enterprise Governance requires a high level of commitment across the organization and it is essential that an enabling governance culture is created. This envisages creation of awareness at all levels. All employees are expected preserve the corporate values and respect the code of business ethics in achieving their own objectives set by the management and in achieving the objectives of the Company. The sustenance of enterprise governance principles is facilitated by aligning the corporate values into value creation activities, and making a conscious effort to continually improve the governance framework and processes.

Compliance is monitored through the monitoring of the point of reference/s. In the event of the points of reference being a code of best practice, guideline, legislation or a rule, the compliance is monitored through ascertainment of compliance with the point of reference. On the other hand where the point of reference is a body of persons such as a management committee, the compliance is monitored by comparing the stated expectations or goals with the actual status.

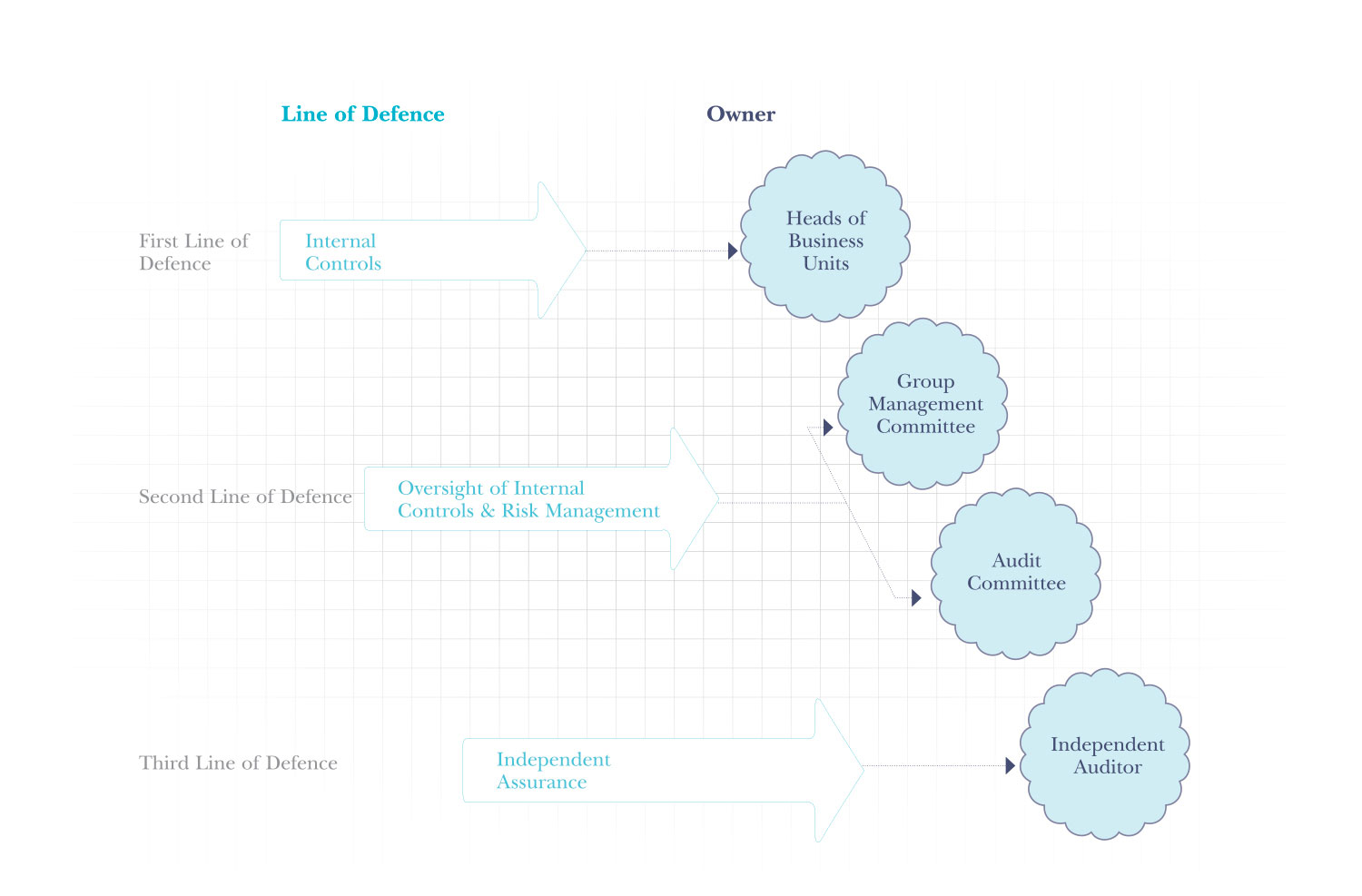

Independent assurance, independent review, oversight and independent certification are key sources of assurance and comfort with regard to integrity and due functioning of the enterprise governance framework. This is depicted in the governance framework appearing. The three lines of defence approach, which is described later, provides comfort on the effectiveness of internal controls and risk management.

The comfort level derived from assurance is reliant upon the internal controls that are in place. Whilst the internal controls focus on the current operations and decisions, the risk and management process focuses on the uncertainties that the Group is exposed to. The “Three Lines of Defence” model given below depicts the approach followed in ensuring effectiveness of internal controls and risk management.

The Board has delegated the oversight function of the internal controls to the Audit Committee. Implementation of suitable internal controls rests with the Group Management Committee (GMC). The internal audit function is constructed to Messrs SJMS Associates – Chartered Accountants. The internal audit findings include areas requiring improvements in internal controls and instances of any non- compliance. In addition, independent auditors present their findings with regard to possible improvements to the internal controls and instances of non- compliance that they come across during their engagement. The independent auditors present their findings to the Audit Committee.

Group’s code of business ethics provides guidelines for ethical business conduct. The Group also has a Human Resource Policy, Human Right Policy, Whistle Blowing Policy, Communication Policy and IT Policy.

The Company maintains an open door policy which encourages the prompt discussion of any issues relating to business conduct. The Whistle Blowing Policy has documented mechanisms to directly contact the personnel responsible in order to report any issues. The Code of Business Conduct, the Human Resources and Human Rights Policies contain grievance handling mechanisms. No external ombudsmen are involved in the identification and resolution of internal issues.

The extent of compliance with the code of best practices on corporate governance jointly issued by the Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of Sri Lanka is given below.

|

A. DIRECTORS |

A.1. The Board |

||||||

|

Main Principle: Every public company should be headed by an effective Board, which should direct, lead and control the company. |

|||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

|||||

|

A.1.1 |

The Board should meet regularly, at least once in every quarter |

The Board members meet regularly in accordance with a pre-agreed plan, which includes at least a quarterly meeting, to review the Company’s performance and to review its strategies and business practices, as appropriate. In addition, the Board meets, as and when there are specific corporate or commercial matters to be considered or decided upon. The Board met seven times during the financial year. The dates of the Board meetings during the year are given in the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014. Average attendance at Board meetings was 92% |

|||||

|

A.1.2 |

Board should be responsible for matters including: |

||||||

|

|

Ensuring the formulation and implementation of a sound business strategy |

The Board provides stewardship, vision and strategic direction to the Group and fosters a culture of integrity, transparency and accountability across the Group. A stakeholder centric approach is adopted in strategy formulation. A review of business, marketing, financial and other strategies and their implementation takes place during the Board meetings. The Board also meets Heads of Business Units at least once a year and discusses and provides direction on matters relating to strategy formulation. |

|||||

|

|

Ensuring that the CEO and the Management Team possess the skills, experience, and knowledge to implement strategy |

The Directors are from diverse backgrounds and bring to bear a wide range of experience and competencies that facilitates the effective discharging of Board responsibilities. The Board ensures that the Chairman/MD, CEO, Executive Directors and the Management team possess the skills to implement the overall strategy. The Board approves all appointments to the Group Management Committee (GMC), which consists of the senior management. The Board takes into consideration the skills and experience of the members prior to their appointments in order to ensure the members suitability to hold the position in the GMC as well as his/her regular position in the managerial capacity of the company. A brief resume of each Director including the Directors who offer themselves for re-election is available in the Directors' profiles of the Annual Report 2013/14. |

|||||

|

|

Ensuring the adoption of an effective CEO and key management personnel succession strategy |

Succession planning is given due recognition. Effective succession planning is a criterion in the performance appraisals of the key management personnel. The Board, with the assistance of the Nomination Committee, reviews succession plans available for succession of key management personnel. |

|||||

|

|

Ensuring effective systems to secure integrity of information, internal controls, business continuity and risk management |

The Board monitors and evaluates risks and performance, approves all important investment decisions and oversee installation of sound internal controls. Measures taken towards an effective internal control system given under D.2.1 of this table. Risk Management framework is set out in the Risk Management Report of the Annual Report 2013/14. The Board and the GMC reviews any information provided by Business Unit Managers regarding any risks pertaining to the Capitals and the value creation activities. |

|||||

|

|

Ensuring compliance with Laws, regulations and ethical standard |

The Board follows a policy of strict compliance with laws and regulations. ‘Never compromise on Dimo ethics’ is part of the Company’s Statement of Values. A document containing the company values and ethics is given to all employees. Whilst the Code of Ethics demands strict compliance, the Internal Auditors are expected to report to the Audit Committee on any non-compliance with laws and/or ethics. |

|||||

|

|

Ensuring all stakeholder interests are considered in corporate decisions |

Whilst fulfilling the obligation for increasing shareholder value, the Board has responsibility towards customers, employees, suppliers and the community where it operates, as all of these stakeholders are critical for success of the Company and its operations. The Annual Report 2013/14 extensively covers our interactions with stakeholders. |

|||||

|

|

Recognising sustainable business development in corporate strategy, decisions and activities |

|

|||||

|

|

Ensuring that the Company’s values and standards are set with emphasis on adopting appropriate accounting policies and fostering compliance with financial regulations |

The Code of Business Ethics requires compliance with laws, regulations and corporate policies at all times. These ensure that prescribed accounting policies, accounting standards and other regulations are adhered to. |

|||||

|

|

Fulfilling such other Board functions as are vital, given the scale, nature and complexity of the business concerned |

The size and the scale of the organization demands expertise in diverse areas of business at the level of Board of Directors. The Directors bring on board a wide range of skills, knowledge and experience. Expertise in Finance, Engineering, Law and Marketing is available in the present Board. |

|||||

|

A.1.3 |

The Board collectively, and Directors individually, must act in accordance with the laws of the country and there should be a procedure agreed by the Board of Directors, to obtain independent professional advice where necessary, at the company’s expense. |

Stewardship, Trusteeship and Accountability underpins the role of the Board. In assuming this role, the Board mandates that the Group adheres to the laws of the jurisdictions within which it operates, observing high ethical standards. This is an active, not a passive role played by the Board. The Directors individually and collectively are committed to conducting themselves, upholding the values of fair and good business practices ensuring confidentiality and, fair dealing. Any Director may obtain independent professional advice that may be required in discharging his/ her responsibilities effectively, at company’s expense. |

|||||

|

A.1.4 |

All Directors should have access to the advice and services of the Company Secretary, who is responsible to the Board in ensuring that Board procedures are followed and that applicable rules and regulations are complied with. Any question of the removal of the Company Secretary should be a matter for the Board as a whole. |

Members of the Board have unrestricted accesses to the advice and services of the Company Secretary. The appointment and removal of the Company Secretary rests with the Board. |

|||||

|

A.1.5 |

All Directors should bring independent judgment to bear on issues of strategy, performance, resources (including key appointments) and standards of business conduct. |

The Chairman plays a key role in ensuring views of all Directors are sought during Board meetings in order to bring each Director’s independent judgment to bear upon on matters relating to strategy, performance, resources and business conduct. |

|||||

|

A.1.6 |

Every Director should dedicate adequate time and effort to matters of the Board and the Company, to ensure that the duties and responsibilities owed to the Company are satisfactorily discharged. It must be recognised that Directors have to dedicate sufficient time before a meeting to review Board papers and call for additional information and clarification, and after a meeting to follow up on issues consequent to the meeting. This should be supplemented by a time allocation for familiarisation with business changes, operations, risks and controls. |

The Chairman, Non-Executive and Executive Directors are committed to discharging their duties as Directors of the Company and ensure that adequate time and attention is given to make their contribution effective. The Non-Executive Directors may have follow up meetings with the Chairman, Executive Directors or members of the Group Management Committee to follow up on matters discussed at Board Meetings and provide their expertise. The Board papers and the agenda received by the Directors ahead of Board Meetings, enabling the Directors to review the papers and obtain clarifications ahead of the meetings. The papers contain financial and non-financial information. The regular Board papers include financial statements, narratives on variances, working capital related reports, reports on compliance with statutory requirements, capital expenditure reports, staff appointments, bank facilities & utilization and any other report as required. |

|||||

|

A.1.7 |

Every Director should receive appropriate training when first appointed to the Board of a company, and subsequently as necessary. Training curricula should encompass both general aspects of directorship and matters specific to the particular industry/company concerned. A Director must recognise that there is a need for continuous training and an expansion of the knowledge and skills required to effectively perform his duties as a Director. The Board should regularly review and agree the training and development needs of the Directors. |

The Directors are given the opportunity to familiarise and obtain an in-depth understanding of the Company’s business, its strategy, risks and processes, at their discretion. Training is provided to Executive Directors to equip themselves to discharge their responsibilities effectively. This includes training provided by principals, external and in-house training. Directors are briefed on changes in laws and regulations, tax laws and accounting standards from time to time either during Board meetings or at specially convened sessions.

|

|||||

|

A.2. Chairman and Chief Executive Officer (CEO) |

||||||

|

Main Principle: There are two key tasks at the top of every public company – conducting of the business of the Board, and facilitating executive responsibility for management of the Company’s business. There should be a clear division of responsibilities at the head of the Company, which will ensure a balance of power and authority, such that no one individual has unfettered powers of decision. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.2.1 |

A decision to combine the posts of Chairman and CEO in one person should be justified and highlighted in the Annual Report. |

The Chairman continues to be the Managing Director of the Company after appointment of Mr. A.G. Pandithage as a CEO with effect from. 01.04.2012. The functions of Chairman and CEO was vested with the same person up to 31.03.2012. The appointment of a CEO with effect from 01.04.2012 will enable sharing of responsibilities of the Chief Executive function. The presence and involvement of the Senior Independent Director and other Independent Directors ensure that no single individual has unfettered powers of decision-making and provides the basis for prevalence of independent judgment over standards of business conduct. The presence of a Senior Independent Director adds more emphasis to transparency in governance affairs. The Audit, Nomination and Remuneration Committees are headed by Non-Executive Independent Directors. The composition of the Board Committees are available in Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 The performance of Chairman/Managing Director and CEO is reviewed by the Non-Executive Directors headed by Senior Independent Director. |

||||

|

A.3. Chairman’s Role |

||||||

|

Main Principle: The Chairman’s role in preserving good Corporate Governance is crucial. As the person responsible for running the Board, the Chairman should preserve order and facilitate the effective discharge of Board functions. |

||||||

|

A.3.1 |

The Chairman should conduct Board proceedings in a proper manner and ensure, inter alia, that: |

|||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

|

• the effective participation of both Executive and Non-Executive Directors is secured; • all Directors are encouraged to make an effective contribution, within their respective capabilities, for the benefit of the Company; • a balance of power between Executive and Non-Executive Directors is maintained; • the views of Directors on issues under consideration are ascertained; and • The Board is in complete control of the Company’s affairs and alert to its obligations to all shareholders and other stakeholders.

|

Board meetings are conducted in an atmosphere that encourages healthy debate by all members of the Board. The Chairman ensures that there is effective participation from all Directors, that their individual contribution and concerns are objectively assessed prior to making key decisions. The Chairman ensures that every Non-Executive Director and Executive Director is provided with an opportunity to present his view on matters discussed and that both Executive and Non-Executive Directors have opportunities for effective participation. He also ensures that the Board is in complete control of the Company’s affairs and that decisions made by the Board are implemented. Board members are free to suggest the inclusion of items on the agenda of Board meetings and carry out their duties in the interest of the Company without any undue influence from other parties. The Board members are encouraged to take advantage of a variety of expertise available in the Board in the areas such as finance, marketing, law and engineering in making decisions for the benefit of the Company. The Chairman and the Senior Independent Director satisfies themselves that the information available to the Board is sufficient to make an informed assessment of the company’s affairs as well as to discharge their duties to all stakeholders. The attendance details of Directors at Board Meetings are available in Enterprise Governance Report in the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 |

||||

|

A.4. Financial Acumen |

||||||

|

Main Principle: The Board should ensure the availability within it of those with sufficient financial acumen and knowledge to offer guidance on matters of finance. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.4 |

Availability of sufficient financial acumen and knowledge. |

The Board enjoys the services of three qualified Accountants who provide the requisite financial acumen and knowledge on matters of finance. In addition, the Audit Committee has the services of another qualified Accountant who serves as an Independent Consultant. |

||||

|

A.5. Board Balance |

||||||

|

Main Principle: It is preferable for the Board to have a balance of Executive and Non-Executive Directors such that no individual or small group of individuals can dominate the Board’s decision-taking. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.5.1 |

The Board should include Non-Executive Directors of sufficient calibre and number for their views to carry significant weight in the Board’s decisions. The Board should include at least two Non-Executive Directors or such number of Non-Executive Directors equivalent to one third of total number of Directors, whichever is higher. In the event the Chairman and CEO is the same person, Non-Executive Directors should comprise a majority of the Board. |

The composition of the Board of Directors meets the number of Non- Executive Directors required by this code and the Listing Rules of the Colombo Stock Exchange. A brief resume of each Director is available on the Annual Report 2013/14. Four out of ten Directors are (eleven Directors up to 28th June 2013) Non-Executive Directors.

|

||||

A.5.2 |

Where the constitution of the Board of Directors includes only two Non-Executive Directors, both such Non-Executive Directors should be ‘independent’. In all other instances two or one third of Non-Executive Directors appointed to the Board of Directors whichever is higher should be ‘independent’. |

Three out of the four Non-Executive Directors are ‘independent’, a composition that satisfies the criteria set by the code and the Listing Rules of the Colombo Stock Exchange. The names of independent Non-Executive Directors are as follows. |

||||

|

A.5.3 |

For a Director to be deemed independent’ such Director should be independent of management and free of any business or other relationship that could materially interfere with or could reasonably be perceived to materially interfere with the exercise of their unfettered and independent judgment. |

The Independent Directors match the criteria set by this section. The Board determines the Non-Executive Directors’ independence, based on the criteria set out in the code and the declaration submitted by them. The Company maintains the ‘Interest Register’ required by the Companies Act No. 07 of 2007, which shows details of Directors’ interests. A disclosure on related party transactions is available in Note 5.1 to the Financial Statements |

||||

|

A.5.4 |

Each Non-Executive Director should submit a signed and dated declaration annually of his/her independence or non-independence against the specified criteria set out in the Specimen in Schedule J. |

The Non-Executive Directors submitted the requisite declaration, which was used for determining the independence of the Independent Directors. |

||||

|

A.5.5 |

The Board should make a determination annually as to the independence or non-independence of each Non-Executive Director based on such a declaration made of decided criteria and other information available to the Board, and should set out in the Annual Report the names of Directors determined to be ‘independent’. The Board should specify the criteria not met and the basis for its determination in the annual report, if it determines that a Director is independent notwithstanding the existence of relationships or circumstances which indicate the contrary and should set out in the annual report the names of directors determined to be ‘independent’. |

The Board has made an annual determination as to the independence or non-independence of each Non-Executive Director based on a declaration made by the Non- Executive Directors and as per criteria set out by the Colombo Stock Exchange Listing Rules. The names of Independent Non-Executive Directors are given on the Annual Report 2013/14.

|

||||

|

A.5.6 |

Appointment of an alternate director by a non-executive independent directors. |

No alternative directors were appointed during the year. |

||||

|

A.5.7 |

In the event the Chairman and CEO is the same person, the Board should appoint one of the independent Non-Executive Directors to be the ‘Senior Independent Director’ (SID) and disclose this appointment in the Annual Report. |

Mr. R. Seevaratnam, an independent Non-Executive Director, functions as the Senior Independent Director. The Senior Independent Director presides at Board meetings in the absence of the Chairman. |

||||

|

A.5.8 |

The Senior Independent Director should make himself available for confidential discussions with other Directors who may have concerns which they believe have not been properly considered by the Board as a whole and which pertain to significant issues that are detrimental to the Company. |

The Senior Independent Director is available for confidential discussions, should there be any concerns regarding governance or issues that may adversely affect the Company, inadequately addressed by the Board. |

||||

|

A.5.9 |

The Chairman should hold meetings with the Non-Executive Directors only, without the Executive Directors being present, as necessary and at least once each year. |

Chairman meets with Non-Executive Directors, without the presence of Executive Directors at least once a year. In addition, the Chairman consults the Independent Directors to obtain their views on matters of importance, as and when the need arises. |

||||

|

A.5.10 |

Where Directors have concerns about the matters of the Company which cannot be unanimously resolved, they should ensure their concerns are recorded in the Board minutes. |

The Board minutes are prepared by the Company Secretary. In the event of a matter not being unanimously adopted at a Board meeting, the concerns expressed at such situations are recorded in the meeting minutes. Minutes of the Board meetings are circulated to all Directors and adopted at a subsequent Board meeting. |

||||

|

A.6. Supply of Information |

||||||

|

Main Principle: The Board should be provided with timely information in a form and of a quality appropriate to enable it to discharge its duties. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.6.1 |

|

|

||||

|

|

Management has an obligation to provide the Board with appropriate and timely information, but information volunteered by management may not be enough in all circumstances and Directors should make further inquiries where necessary. The Chairman should ensure all Directors are properly briefed on issues arising at Board meetings. |

A sophisticated management information system is in place and it provides relevant and current information. All Board Members including Non-Executive Directors receive information on the operations and performance of the Company on a monthly basis. This routine helps to eliminate information asymmetry between executive Directors and Non-Executive Directors. The Chairman ensures that the background is set for discussions at Board Meetings by introducing the subject of discussion, if the Board members were not previously aware of the matter at hand. |

||||

|

A.6.2 |

The minutes, agenda and papers required for a Board meeting should ordinarily be provided to Directors at least seven (7) days before the meeting, to facilitate its effective conduct. |

The Directors are provided with comprehensive data on financial and non-financial information prior to Board meetings in addition to the agenda of the meeting and the minutes of the previous meeting. Additional information may be requested by any member of the Board as and when required. Directors may also seek any information from the management team on matters discussed at Board meetings that requires follow up. |

||||

|

A.7. Appointments to the Board |

||||||

|

Main Principle: There should be a formal and transparent procedure for the appointment of new Directors to the Board. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.7.1 |

A Nomination Committee should be established to make recommendations to the Board on all new Board appointments. Terms of Reference for Nomination Committees are set out in Schedule A. The Chairman and members of the Nomination Committee should be identified in the Annual Report. |

The Board appoints the Directors based on the recommendations of the Nomination Committee. Nominations to the Boards of subsidiary companies and appointments to the Group Management Committee are also made based on the recommendations of the Nomination Committee. Appointments to the Board are made further to careful scrutiny of the required level and range of skills, knowledge, expertise and desired independence. The Committee consults the views of the Chairman/Managing Director, who is also a member of the Nomination Committee, on matters of succession at senior management level. The Nomination Committee is entitled to obtain professional advice at the Company’s expense.

|

||||

|

|

|

The Nomination Committee has specific terms of references defining its scope and authority. The Committee consists of three Independent Non-Executive Directors, one Non-Executive Director and the Chairman of the Board. The Chairman of the Committee is Dr. H. Cabral, an Independent Director. The composition of the Nomination Committee is as follows, 1. Mr. A.R. Pandithage 2. Mr. R. Seevaratnam 3. Dr. H. Cabral 4. Dr. U.P. Liyanage 5. Mr. A.M. Pandithage The Report of the Nomination Committee is available on the Annual Report 2013/14. |

||||

|

A.7.2 |

The Nomination Committee or in the absence of a Nomination Committee, the Board as a whole should annually assess board-composition to ascertain whether the combined knowledge and experience of the Board matches the strategic demands facing the Company. The findings of such assessment should be taken into account when new Board appointments are considered and when incumbent Directors come up for re-election. |

The Committee’s main role is to nominate suitable candidates as and when vacancies occur on the Board. The Committee is responsible for succession planning at Board and Senior Management level and in ensuring smooth management transitions. It reviews the size and structure of the Board on a continuing basis and constantly reviews the balance of skills, knowledge and experience of the Board of Directors. The Committee also reviews the independence of Directors including actual, potential or perceived conflicts of interest. |

||||

|

A.7.3 |

Upon the appointment of a new Director to the Board, the Company should forthwith disclose to shareholders: a) a brief resume of the Director; b) the nature of his expertise in relevant functional area c) the names of companies in which the Director holds Directorship or Membership in Board Committees and d) whether such Director can be considered ‘independent’. |

There were no new appointments to the Board of Directors during the year under review. However, new appointments to the Board, if any, are made known to the public through the Colombo Stock Exchange, in compliance with this Section of the Code. |

||||

|

A.8. Re-election |

||||||

|

Main Principle: All Directors should be required to submit themselves for re-election at regular intervals and at least once in every three years. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.8.1 |

|

|

||||

|

|

Non-Executive Directors should be appointed for specified terms subject to re-election and to the provisions in the Companies Act relating to the removal of a Director, and their reappointment should not be automatic. |

In terms of the Articles of Association, one third of the Directors including Non-Executive Directors, except for the Managing Director, retire by rotation and may offer themselves for re-election at the AGM. By virtue of being the Managing Director, the Chairman is not required to make himself available for re-election as per the Articles. |

||||

|

|

|

|

||||

|

A.8.2 |

All Directors including the Chairman of the Board should be subject to election by shareholders at the first opportunity after their appointment, and to re-election thereafter at intervals of no more than three years. The names of Directors submitted for election or re-election should be accompanied by a resume minimally as set out in paragraph A.7.3 above, to enable shareholders to make an informed decision on their election. |

The Company’s Articles of Association provides any Director appointed by the Board to hold office until the next Annual General Meeting (AGM), and to seek reappointment by the Shareholders at the said AGM. Based on the Articles and the current composition of the Board, a Director excluding the Managing Director has to come forward for re-election, every three years. The names of the Directors coming up for re-election at the AGM 2014 are given in the Notice of Meeting of the Annual Report 2013/14. A brief resume of each Director coming up for re-election is given on the Annual Report 2013/14.

|

||||

|

A.9. Appraisal of Board Performance |

||||||

|

Main Principle: Boards should periodically appraise their own performance in order to ensure that Board responsibilities are satisfactorily discharged. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.9.1 |

The Board should annually appraise itself on its performance in the discharge of its key responsibilities as set out in A.1.2. |

The effectiveness of the Board is vital to the success of the Group. The Board undertakes a process that appraises its performance in discharging its key responsibilities set out earlier in this table. The methodology of evaluation involves each Board member completing a checklist and providing a rating on each item covered in the checklist involving areas of appraisal. The appraisal covers areas such as; • its contribution towards developing, implementing and monitoring of strategy, • communication with stakeholders, • processes involving the Board, • review of its own performance evaluation process and • other areas related to discharging its responsibilities

|

||||

|

A.9.2 |

The Board should also undertake an annual self-evaluation of its own performance and that of its Committees. |

|||||

|

A.9.3 |

The Board should state how such performance evaluations have been conducted, in the Annual Report. |

|||||

|

A.10. Disclosure of Information in respect of Directors |

||||||

|

Main Principle: Shareholders should be kept advised of relevant details in respect of Directors. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.10.1 |

The Annual Report of the Company should set out the following information in relation to each Director: Name, qualifications, brief profile. |

Available in the Board of Directors' profiles of the Annual Report 2013/14. |

||||

|

|

The nature of his/her expertise in relevant functional areas; |

Available in the Board of Directors' profiles of the Annual Report 2013/14.

|

||||

|

|

Immediate family and/or material business relationships with other Directors of the Company; |

Mr. A.R.Pandithage, Mr. A.G.Pandithage and Mr. A.M. Pandithage fall within the definition of “close family members” of the Code. |

||||

|

|

Whether Executive, non-executive and/or independent director |

Available in the Board of Directors' profiles of the Annual Report 2013/14.

|

||||

|

|

Names of listed companies in Sri Lanka in which the Director concerned serves as a Director; |

Available in the Board of Directors' profiles of the Annual Report 2013/14.

|

||||

|

|

Names of other companies in which the Director concerned serves as a Director, provided that where he/she holds directorships in companies within a Group of which the Company is a part, their names need not be disclosed; it is sufficient to state that he/she holds other directorships in such companies; |

Available in the Group Structure and Group Management Committee of the Annual Report 2013/14.

|

||||

|

|

Number/percentage of Board meetings of the Company attended during the year; |

Available in the Enterprise Governance Report.

|

||||

|

|

Total number of Board seats held by each Director indicating listed and unlisted Companies and whether in an executive or non-executive capacity |

|

Total No of Board Seats held by each Director in listed Companies, in the capacity of |

Total No of Board Seats held by each Director in Un-listed Companies in the capacity of |

||

|

Name of the Director |

Executive Director |

Non-Executive Director |

Executive Director |

Non-Executive Director |

||

|

A.R. Pandithage |

- |

- |

3 |

1 |

||

|

A.G. Pandithage |

- |

- |

2 |

- |

||

|

A.N. Algama |

- |

- |

- |

- |

||

|

S.C. Algama |

- |

- |

3 |

- |

||

|

Dr H. Cabral |

5 |

- |

6 |

- |

||

|

B.C.S.A.P. Gooneratne |

- |

1 |

2 |

- |

||

|

Prof. U.P. Liyanage |

- |

5 |

- |

- |

||

|

A.M. Pandithage |

10 |

2 |

117 |

10 |

||

|

R. Seevaratnam |

- |

6 |

- |

9 |

||

|

R.C Weerawardane |

- |

- |

2 |

- |

||

|

|

Names of Board Committees in which the Director serves as Chairman or a member; and |

Available in the A.1.1 of the Enterprise Governance Report and Composition of the Board and Board Committees and attendance at Meetings for 2013/2014of the Annual Report 2013/14.

|

||||

|

|

Number/ percentage of committee meetings attended during the year. |

Available in the A.1.1 of the Enterprise Governance Report and Composition of the Board and Board Committees and attendance at Meetings for 2013/2014of the Annual Report 2013/14. |

||||

|

A.11. Appraisal of Chief Executive Officer |

||||||

|

Main Principle: The Board should be required, at least annually, to assess the performance of the CEO. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

A.11.1 |

At the commencement of every fiscal year, the Board in consultation with the CEO, should set, in line with the short, medium and long-term objectives of the Company, reasonable financial and non-financial targets that should be met by the CEO during the year. |

At the commencement of every financial year, the Board in consultation with the Chairman/Managing Director, CEO and Executive Directors agree on the financial and non-financial targets, based on which the performance of Chairman/Managing Director, CEO and Executive Directors are evaluated. |

||||

|

A.11.2 |

The performance of the CEO should be evaluated by the Board at the end of each fiscal year to ascertain whether the targets set by the Board have been achieved and if not, whether the failure to meet such targets was reasonable in the circumstances. |

Whilst the performance evaluation of the Chairman/ Managing Director is done by the Non- Executive Directors led by the Senior Independent Director, the performance appraisal of the CEO and Executive Directors will be carried out by the Non- Executive Directors in consultation with the Chairman/Managing Director. |

||||

|

B. DIRECTORS’ REMUNERATION |

||||||

|

B.1. Remuneration Procedure |

||||||

|

Main Principle: Companies should establish a formal and transparent procedure for developing a policy on executive remuneration and for fixing the remuneration packages of individual Directors. No Director should be involved in deciding his/her own remuneration. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

B.1.1 |

To avoid potential conflicts of interest, the Board of Directors should set up a Remuneration Committee to make recommendations to the Board, within agreed terms of reference, on the Company’s framework of remunerating Executive Directors. (These also include Post-Employment Benefits as well as Terminal Benefits) Terms of Reference for Remuneration Committees are set out in Schedule C. |

The Remuneration Committee is responsible for determining the remuneration policy and the remuneration of the Chairman/Managing Director Chief Executive Officer, Executive Directors and Senior Management. The Board of Directors appoints members to the Remuneration Committee. The Board of Directors has set the terms of reference of the Remuneration Committee. Attendance details of the members at the Remuneration Committee meetings are disclosed in the Enterprise Governance Report on Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 of the Annual Report 2013/14. The Report of the Remuneration Committee of the Annual Report 2013/14. |

||||

|

B.1.2 |

Remuneration Committees should consist exclusively of Non-Executive Directors, and should have a Chairman, who should be appointed by the Board. |

The Chairman of the Remuneration Committee, who is appointed by the Board, is an Independent Non-Executive Director. The present Committee consists of three Independent Non-Executive Directors and one Non-Executive Director. The Chairman of the Remuneration Committee is Prof. U.P. Liyanage, an Independent Non-Executive Director. The composition of the Remuneration Committee meets the requirements of the Colombo Stock Exchange Listing Rules. |

||||

|

B.1.3 |

The Chairman and members of the Remuneration Committee should be listed in the Annual Report each year. |

Names of the Chairman and members of the Remuneration Committee are available in the Enterprise Governance Report and Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 of the Annual Report 2013/14. |

||||

|

B.1.4 |

The Board as a whole, or where required by the Articles of Association the shareholders, should determine the remuneration of Non-Executive Directors, including members of the Remuneration Committee, within the limits set in the Articles of Association. Where permitted by the Articles, the Board may delegate this responsibility to a subcommittee of the Board, which might include the CEO. |

The Board of Directors determines the remuneration of Non- Executive Directors. The Non- Executive Directors do not participate in any discussion that involves fixing their remuneration. |

||||

|

B.1.5 |

The Remuneration Committee should consult the Chairman and/or CEO about its proposals relating to the remuneration of other Executive Directors and have access to professional advice from within and outside the Company, in discharging their responsibilities. |

The remuneration of the Executive Directors is recommended by the Remuneration Committee in consultation with the Chairman/Managing Director. No Director is involved in deciding his own remuneration. The Committee is entitled to obtain professional advice at the Company’s expense in discharging their responsibilities. |

||||

|

B.2 The level and make up of Remuneration |

|

|||||

|

Main Principle: Levels of remuneration of both Executive and Non-Executive Directors should be sufficient to attract and retain the Directors needed to run the Company successfully. A proportion of Executive Directors’ remuneration should be structured to link rewards to corporate and individual performance. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

B.2.1 |

The Remuneration Committee should provide the packages needed to attract, retain and motivate Executive Directors of the quality required but should avoid paying more than is necessary for this purpose. |

The Company’s remuneration policy aims to attract and retain high calibre executives by ensuring that their rewards are competitive and linked to both individual and business performance. Whilst recognising the market demands and the contribution of the executives to the overall performance, the Company believes that the remuneration policy should at the same time be in congruence with shareholder interests. |

||||

|

B.2.2 |

The Remuneration Committee should judge where to position levels of remuneration of the Company, relative to other companies. It should be aware what comparable companies are paying and should take account of relative performance, but should use such comparisons with caution, mindful of the risk that they can result in an increase of remuneration levels with no corresponding improvement in performance. |

The Remuneration Committee in deciding the remuneration of the Directors takes into consideration the level of remuneration paid by the other comparable companies. By linking the remuneration levels to business and individual performance, the Committee ensures that any increase in the variable part of the remuneration corresponds to better performance. When required, the Remuneration Committee uses remuneration surveys to ascertain market levels of remuneration. |

||||

|

B.2.3 |

The Remuneration Committee should be sensitive to remuneration and employment conditions elsewhere in the Company or Group of which it is a part, especially when determining annual salary increases. |

Same criteria and measures adopted in B.2.2 are used for determination of remuneration of the senior management team, across the Group. |

||||

|

B.2.4 |

The performance-related elements of remuneration of Executive Directors should be designed and tailored to align their interests with those of the Company and main stakeholders and to give these Directors appropriate incentives to perform at the highest levels. |

Remuneration of Executive Directors consists of a fixed element as well as a variable element. The variable part (incentive scheme) is based on the performance of the individual as well as the company. |

||||

|

B.2.5 |

Executive share options should not be offered at a discount (i.e. less than market price prevailing at the time the exercise price is determined), save as permitted by the Listing Rules of the Colombo Stock Exchange. |

There was no share option scheme in operation during the year under review. |

||||

B.2.6 |

In designing schemes of performance-related remuneration, Remuneration Committees should follow the provisions set out in Schedule E. |

The guideline provided by Schedule E has been followed in determining Directors remuneration. There is no share option scheme available to the Directors. |

||||

|

B.2.7 |

Remuneration Committee should consider what compensation commitments (including pension contributions) their Directors’ contracts of service, if any, entail in the event of early termination. Remuneration Committee should in particular, consider the advantages of providing explicitly for such compensation commitments to apply other than in the case of removal for misconduct, in initial contracts. |

The compensation commitments of the Executive Directors are guided by their contracts of employment. This requirement is not applicable to Non-Executive Directors. |

||||

|

B.2.8 |

Where the initial contract does not explicitly provide for compensation commitments, Remuneration Committee should, within legal constraints, tailor their approach in early termination cases to the relevant circumstances. The broad aim should be, to avoid rewarding poor performance while dealing fairly with cases where departure is not due to poor performance. |

The Board is committed to acting fairly and in accordance with laws of the country, in the event of a termination. There was no termina tion of services of any Director during the year under review. |

||||

|

B.2.9 |

Levels of remuneration for Non-Executive Directors should reflect the time commitment and responsibilities of their role, taking into consideration market practices. Remuneration for Non-Executive Directors should not normally include share options. If exceptional options are granted, shareholder approval should be sought in advance and any shares acquired by exercise of the options should be held until at least one year after the Non-Executive Director leaves the Board. Holding share options could be relevant to the determination of a Non- Executive Director’s independence. (as set out in provision A.5.5) |

Non-Executive Directors, provide expert advice to the Board in their capacity as Directors. Time commitments and responsibilities of their role are taken into consideration when remuneration levels of Non- Executive Directors are determined. The Company does not have a share options scheme in operation. |

||||

|

B.3. Disclosure of Remuneration |

|

|||||

|

Main Principle: The Company’s Annual Report should contain a Statement of Remuneration Policy and details of remuneration of the Board as a whole and a specimen of a remuneration committee report followed by schedule D |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

B.3.1 |

The Annual Report should set out the names of Directors (or persons in the Parent Company’s committee in the case of a Group company) comprising the Remuneration Committee, contain a Statement of Remuneration Policy and set out the aggregate remuneration paid to Executive and Non-Executive Directors. |

The names of the members of the Remuneration Committee is given on Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 of the Annual Report 2013/14. The Remuneration Policy is available in the Report of the Remuneration Committee of the Annual Report 2013/14. Total Directors’ emoluments are disclosed in Note 4.5 to the Financial Statements of the Annual Report 2013/14. |

||||

|

C. RELATIONS WITH SHAREHOLDERS |

|

|||||

|

C.1. Constructive use of Annual General Meeting (AGM) and Conduct of General Meetings |

||||||

|

Main Principle: Boards should use the AGM to communicate with shareholders and should encourage their participation. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

C.1.1 |

Companies should count all proxy votes and should indicate the level of proxies lodged on each resolution, and the balance for and against the resolution and withheld, after it has been dealt with on a show of hands, except where a poll is called. |

A Form of Proxy accompanies the Annual Report, when they are dispatched to the shareholders. The Chairman makes an announcement of the proxies received, at the commencement of a General Meeting. |

||||

|

C.1.2 |

Companies should propose a separate resolution at the AGM on each substantially separate issue and should in particular propose a resolution at the AGM relating to the adoption of the report and accounts. |

The Company proposes a separate resolution at the AGM on each substantial separate issue, including the adoption of the Financial Statements. The Agenda for the AGM is given in the Notice of Meeting of the Annual Report 2013/14.

|

||||

|

C.1.3 |

The Chairman of the Board should arrange for the Chairmen of the Audit, Remuneration and Nomination Committees to be available to answer questions at the AGM if so requested by the Chairman. |

The Annual General Meeting provides a forum for shareholders to raise any queries. The Chairmen of the Audit, Remuneration and Nomination Committees are usually present at the Annual General Meeting and were present at the AGM held on 28th June 2013. |

||||

|

C.1.4 |

Companies should arrange for the Notice of the AGM and related papers to be sent to shareholders as determined by statute, before the meeting. |

The Notice of Meeting and related documents are dispatched to the shareholders 15 working days prior to the AGM, as per Section 135 of the Companies Act No. 07 of 2007. |

||||

|

C.1.5 |

Companies should circulate with every Notice of General Meeting, a summary of the procedures governing voting at General Meetings. |

The Notice of Meeting outlines the procedure relating to voting at the Annual General Meeting. Every shareholder is entitled to one vote per share at a poll. |

||||

|

C.2. Communication with Shareholders |

||||||

|

Main Principle: The board should implement effective communication with Shareholders |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

C.2.1 |

There should be a channel to reach all Shareholders of the Company in order to disseminate timely information |

The Company uses many channels to reach the shareholders in order to disseminate timely information. These include the Annual General Meeting, the Annual Report, Quarterly Financial Statements, Corporate Disclosures to the CSE and the Corporate Website. |

||||

|

C.2.2 |

The Company should disclose the policy and methodology for communication with Shareholders |

The Company’s policy pertaining to the communication with shareholders involves the sharing of all financial and non-financial information as per the applicable statutory and regulatory requirements and best practices adopted by the Company. The methodology of communication with shareholders is multi-faceted to ensure the accuracy of information disseminated and the timeliness of dissemination. The channels of communication are stated above. |

||||

|

C.2.3 |

The Company should disclose how they implement the above Policy and methodology |

The implementation of the policy and the methodology is done through the adoption of the above mentioned channels of communication. |

||||

|

C.2.4 |

The Company should disclose the contact person for such communication |

The contact person for shareholder communication is the Company Secretary. |

||||

|

C.2.5 |

There should be a process to make all Directors aware of major issues and concerns of shareholders, and this process has to be disclosed by the Company |

Major issues and concerns of shareholders, if any, are discussed at Board Meetings. There were no such concerns expressed by shareholders that warranted consideration at a Board Meeting. |

||||

|

C.2.6 |

The Company should decide the person to contact in relation to Shareholder’s matters. The relevant person with statutory responsibilities to contact in relation to Shareholder’s matters is the Company Secretary or in his absence should be a member of the board of Directors. |

The Contact Person in relation to all matters pertaining to the Shareholders is the Company Secretary. |

||||

|

C.2.7 |

The process for responding to shareholder matters should be formulated by the Board and disclosed. |

Appropriate responses formulated and actions taken to address shareholder concerns by the Board and the Management are communicated to the shareholders by the Company Secretary. The most suitable and expeditious method of communication would be determined by the Company Secretary. |

||||

|

C.3. Major and Material Transactions |

||||||

|

Main Principle: Further to compliance with the requirements under the Companies Act, Securities and Exchange Commission law and Colombo Stock Exchange regulations; as applicable, Directors should disclose to shareholders all proposed material transactions, which if entered into, would materially alter/vary the Company’s net assets base or in the case of a company with subsidiaries, the consolidated group net asset base. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

C.3.1 |

Prior to a Company engaging in or committing to a ‘Major related party transaction’ with a related party, involving the acquisition, sale or disposition of greater than one third of the value of the Company’s assets or that of a subsidiary which has a material bearing on the Company and/or consolidated net assets of the Company, or a transaction which has or is likely to have the effect of the Company acquiring obligations and liabilities, of greater than one third of the value of the Company’s assets, Director’s should disclose to Shareholders the purpose and all material facts of such transaction and obtain shareholder’s’ approval; by ordinary resolution at an extraordinary general meeting. It also applies to transactions or series of related transactions which have the purpose or effect of substantially altering the nature of the business carried on by the Company. |

There was no transaction during the year that fell within the definition of a major transaction defined by Section 185 of the Companies Act No. 07 of 2007. There were also no transactions during the year under review that would suggest a substantial alteration in the nature of the business carried out by the Company. |

||||

|

D. ACCOUNTABILITY and AUDIT |

||||||

|

D.1. Financial Reporting |

||||||

|

Main Principle: The Board should present a balanced and understandable assessment of the Company’s financial position, performance and prospects. |

||||||

|

Code Reference |

Requirement of the Code |

Compliance with the Code |

||||

|

D.1.1 |

The Board’s responsibility to present a balanced and understandable assessment extends to interim and other price-sensitive public reports and reports to regulators, as well as to information required to be presented by statutory requirements. |

In preparing annual and quarterly Financial Statements, the Company complies with the requirements of the; • Companies act No. 07 of 2007, • Sri Lanka Accounting Standards and • Listing Rules of the Colombo Stock Exchange. The annual and interim Financial Statements are published within the time periods prescribed by the Listing Rules of the Colombo Stock Exchange. Given below is a table containing the dates on which the Annual and Interim Financial Statements were uploaded to the CSE web site/dispatched to the shareholders during the year under review. |

||||

|

Interim Report |

Date of uploading/ dispatch |

Status |

||||

|

Annual Report for the year ended 31st March 2013 |

6th June 2013 |

Compliant |

||||

|

1st Quarter |

13th August 2013 |

Compliant |

||||

|

2nd Quarter |

25th October 2013 |

Compliant |

||||

|

3rd Quarter |

05th February 2014 |

Compliant |

||||

|

4th Quarter |

26th May 2014 |

Compliant |

||||

|

D.1.2 |

The Directors’ Report, which forms part of the Annual Report, should contain declarations by the Directors to the effect that: • the Company has not engaged in any activity, which contravenes laws and regulations; • the Directors have declared all material interests in contracts involving the Company and refrained from voting on matters in which they were materially interested; • the Company has made all endeavours to ensure the equitable treatment of shareholders; • the business is a going concern, with supporting assumptions or qualifications as necessary; and • They have conducted a review of the internal controls, covering financial, operational and compliance controls and risk management, and have obtained reasonable assurance of their effectiveness and successful adherence therewith, and, if it is unable to make any of these declarations, to explain why it is unable to do so. |

The declarations by Directors required by this section have been made in the Annual Report of the Board of Directors available in the Annual Report 2013/14.

|

||||

|

D.1.3 |

The Annual Report should contain a statement setting out the responsibilities of the Board for the preparation and presentation of Financial Statements, together with a statement by the Auditors about their reporting responsibilities. Further, the Annual Report should contain a Report/Statement on Internal Controls. |

Is available in the The Statement of Directors’ Responsibilities for Financial Statements of the Annual Report 2013/14. The Auditors' responsibilities regarding the Annual Financial Statements are outlined in the Independent Auditors’ Report of the Annual Report 2013/14. The statement on Internal Controls is available in the Annual Report of the Board of Directors of the Annual Report 2013/14. |

||||

|

D.1.4 |

The Annual Report should contain a ‘Management Discussion & Analysis’, discussing, among other issues: • industry structure and developments; • opportunities and threats; • risks and concerns; • internal control systems and their adequacy ; • social and environmental protection activities carried out by the Company; • financial performance; • material developments in human resource / industrial relations; and • Prospects for the future. |

The Board endeavours to present a balanced and an objective assessment of the Company’s position, performance and prospects. Information required by this section is included in the Annual Report 2013/14 as follows: |

||||

|

Information Discussion |

Section in the Annual Report |

|||||

|

Industry structure and developments |

Chairman’s statement and CEO,s Review |

|||||

|

Opportunities and threats |

Chairman’s statement and Risk Management Report. |

|||||

|

Risks and concerns |

Risk Management Report. |

|||||

|

Internal control systems and their adequacy |

Enterprise Governance Report. |

|||||

|

Social and environmental protection activities carried out by the company |

Society and |

|||||

|

The Environment. |

|

|||||

|

Financial performance |

Monetised Capital. |

|||||

|

Material developments in human resource |

Employees |

|||||

|

Prospects for the future |

Chairman’s statement and Value Creation Report |

|||||

|

D.1.5 |

The Directors should report that the business is a going concern, with supporting assumptions or qualifications as necessary. The matters to which the Board should give due consideration when adopting the going concern assumptions are set out in Schedule G to this Code. |