Foster mutually rewarding customer relationships with all our customers, exceeding their expectations.

Give all our staff the recognition and rewards to be the best team of achievers in service excellence.

Be a profitable catalyst for equitable development covering urban and rural areas.

Provide world-class banking services across the nation as a beacon for progress and growth.

Build one of the largest and most diversified financial services institutions in Sri Lanka

The corporate plan developed in 2009 in the aftermath of the resolution of the domestic conflict set the new direction for the Bank. This was a paradigm shift for the Bank under the banner "One 10 Twelve" corporate plan. The Bank achieved its goals in or well ahead of the time line 2012. Below we examine the main goals the Bank set out to reach as well as other achievements along this ambitious journey.

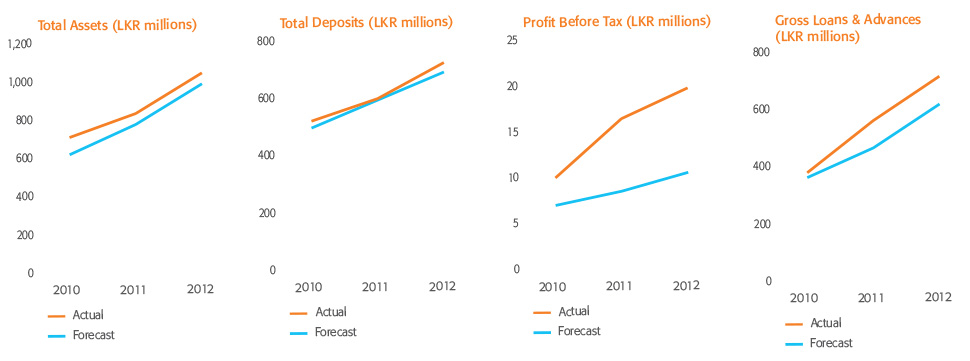

The Bank achieved a LKR 1 trillion balance sheet in May 2012, seven months ahead of schedule and became the first institution and first bank in Sri Lanka to have a one trillion rupee balance sheet. From a base of LKR 538,241 million in 2009, the Bank's asset base grew by 95% over the three years to reach LKR 1.048 trillion of which LKR 209,947 million was added in 2012.

The accelerated growth was underpinned by strong domestic GDP growth and infrastructure development. The Bank focused its efforts on greater penetration of the emerging growth in both rebuilding the Northern and Eastern Provinces and further developing the other regions.

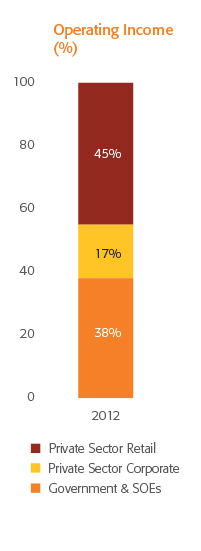

The asset growth has been driven by Investments and loans and advances, particularly in high yielding secured funding products driven by expansion in the provinces. The private sector has been the engine of growth with 62% of the advances as at end 2012. Credit to the private sector grew at 20% and the credit growth in the provinces was 33%.

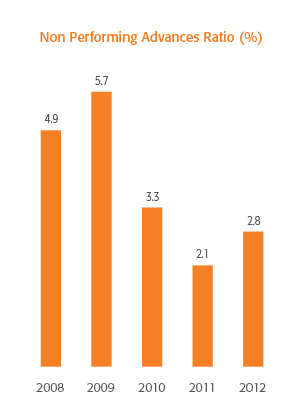

This growth has been achieved while maintaining asset quality. The NPA increased slightly to 2.8% which is a very competitive ratio compared with that of other industry players.

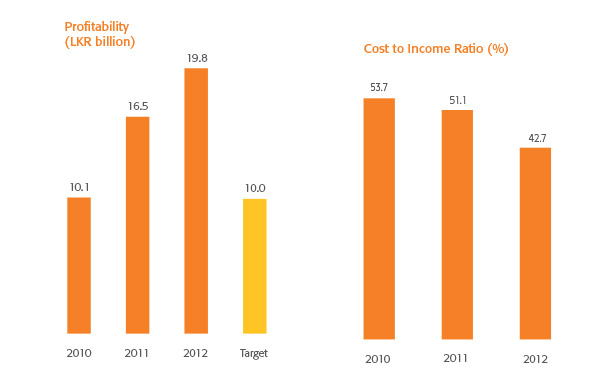

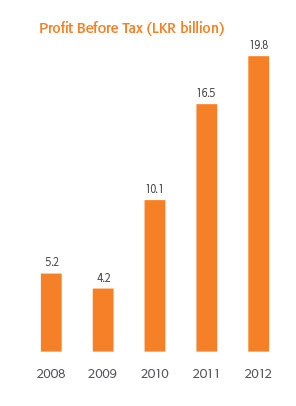

Bank of Ceylon will become the only banking entity in the Government sector in Sri Lanka to achieve a profit before tax (PBT) of LKR 19.8 billion for 2012. This is compared to the original corporate plan of LKR 10 billion for the year 2012. The doubling of the Banks profit is a testimony of the Banks ability to integrate into the rapid economic growth of the country.

The phenomenal achievement has been possible due to a combination of income growth along with cost of funds and operating expense control.

The growth in profit is through sustainable core banking income streams and maintaining a healthy net interest margin by supplementing the deposit base with external borrowings.

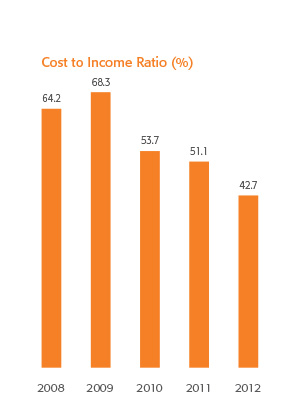

Process automation and benefits of scale were the main reasons for the improved cost to income ratio. The Bank is confident that the solid foundations created will enable the Bank to go from strength to strength.

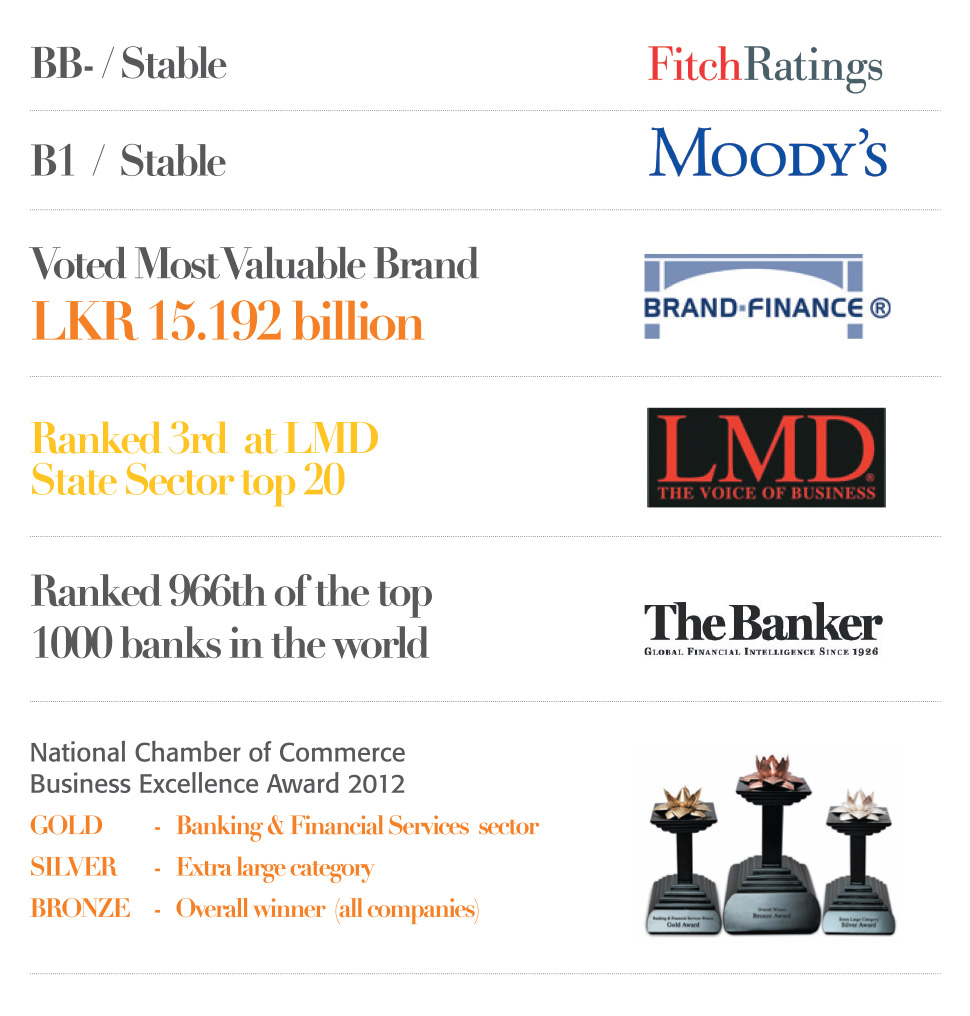

Highest possible International rating

equal in par with sovereign rating

Measurement: measures the profitability of the Bank after accounting for all expenses but before deducting the statutory taxes.

Outcome: Recorded an impressive LKR 19.8 billion. A growth of 30% mainly due to increased business volumes across all provinces.

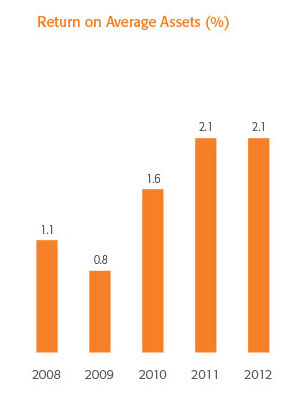

Measurement: measures how efficiently the Bank has utilised its assets.

Outcome; Maintained the RoAA at a similar level to 2011.

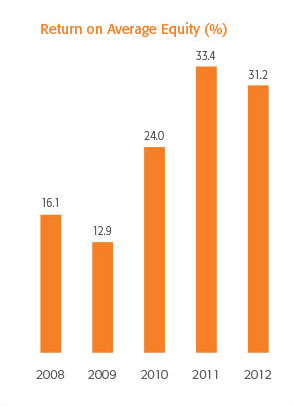

Measurement: measures how much the Bank has earned as a percentage of shareholder funds.

Outcome: RoAE marginally dropped to 31.2% merely due to the increased shareholder reserve base.

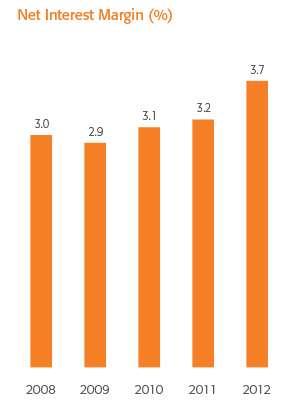

Measurement: measures the net interest income as a percentage to the interest earning assets.

Outcome: Notwithstanding the margin pressure posed by the rising cost of funding and lower market liquidity in the market during some parts of 2012, the Bank maintained interest margin at 3.7%

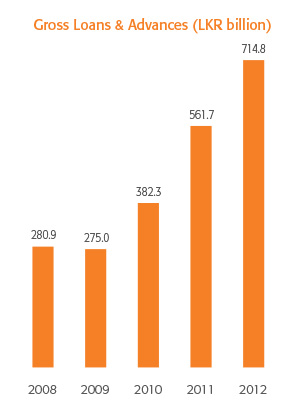

Measurement: the quantum of loans disbursed as overdrafts, trade finance, term loans etc.

Outcome: The loans and advances grew by 27% over the previous year. 19% of the growth came from the North East provinces.

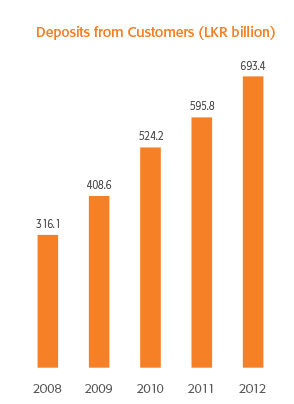

Measurement: the quantum of deposits placed by customers in the Bank in terms of current accounts, savings deposits, time deposits, CDs etc.

Outcome: Reached LKR 693 billion reflecting the Bank's continued effort in promoting savings awareness among the rural and urban people.

Measurement: Where a borrower fails to make interest or capital repayment on a timely basis and exceeds a stipulated period of time as per the Central Bank regulations, such loans are considered to be 'Non Performing'. The ratio calculates the quantum of non performing loans against total loans.

Outcome: Asset quality came under pressure in 2012 as a result of the drought, floods and the political turmoil in Maldives that prevailed. This situation was further accelerated by the rise in interest rates.

Measurement: operating costs as a percentage of operating income.

Outcome: this indicator was an efficient 42.7%, a reduction from 51.1% in the previous year. Mainly due to increased productivity achieved through process automation and economies of scale.

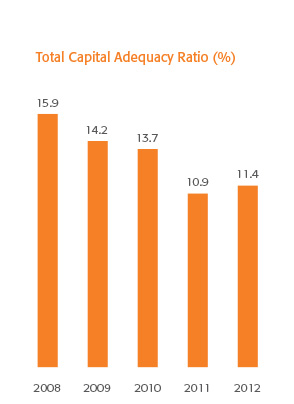

Measurement: a measure of the Bank's capital. This ratio is used as a measure of Bank's ability to withstand the risk assumed by the bank.

Outcome: The Bank's capital adequacy ratio came under pressure due to the high asset growth seen over the last three years. The Bank's CAR is 11.4% in 2012.

Measurement: Statutory Liquid Asset Ratio refers to the amount of liquid assets, such as cash, precious metals or other short-term securities, that a financial institution must maintain in its reserves.

Outcome: The Bank maintained adequate liquidity while balancing return on assets.

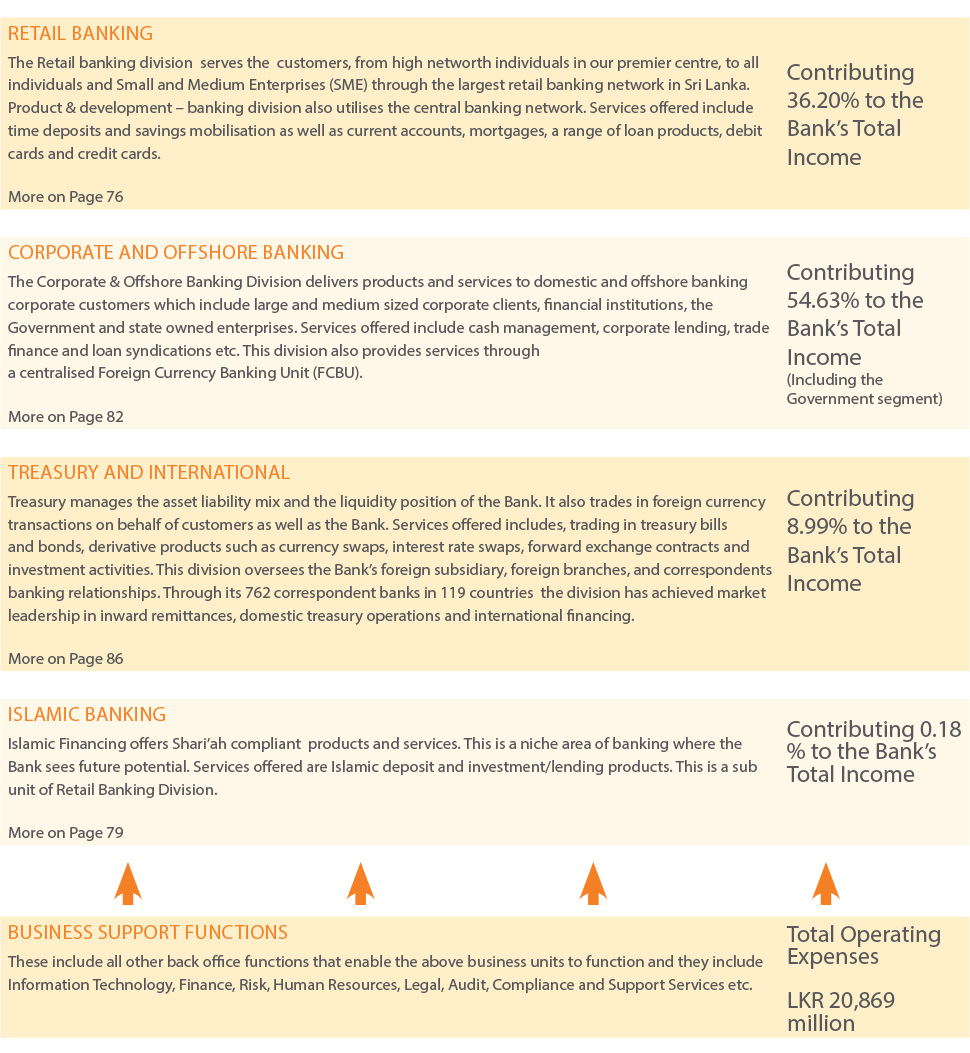

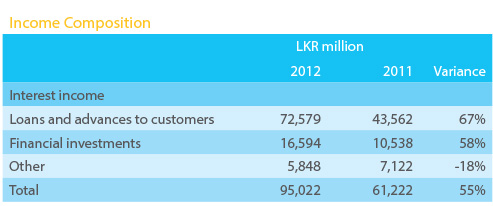

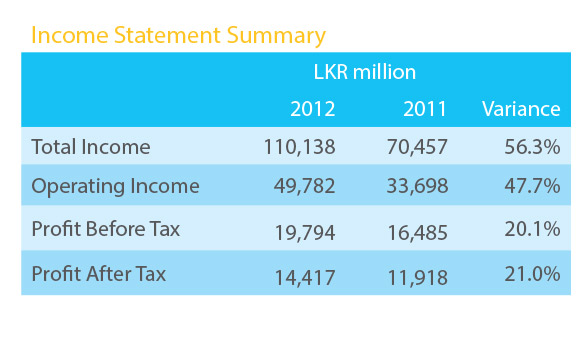

Total Income grew by 56% to LKR 110,138 million from LKR 70,457 million in 2011, a phenomenal increase largely due to increase in Interest Income. While Foreign Exchange Income also increased compared to previous year, fee based income remained stable as trade turnover was flat due to reduction in imports and weak global demand, which impacted exports. Increase in the balance sheet size and changes in the asset composition with more focus on high yielding assets has resulted in an increase in total income.

The increase in interest income is driven by the growth in interest earning assets across all business lines of the Bank. Major growth was seen in interest income from both loans and advances which grew by 67% and Financial Investments which grew by 58%. This is mainly attributable to growth in balance sheet asset of loans and advances by 27% and Financial Investments-loans and advances and financial investments- Held to maturity, which together grew by 49%. The rest of the income growth is mainly attributable to the increase in interest rates.

Other interest income is earned from Available for sale investments, Held for trading investments, Reverse repurchase agreements and Placements with Banks.

The income from these four categories decreased by 18% while the underlying assets as a portfolio decreased by 31%. The reduction in these assets was mainly due to reallocating them to loans and advances.

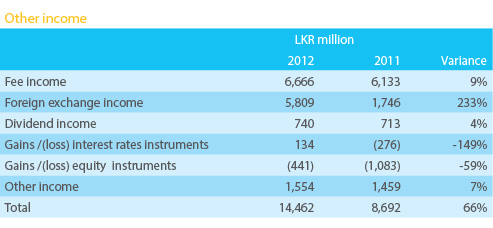

Fee based income has increased marginally by 9% compared to the previous year. Fee income was affected by the decline in import / export trades resulting in a lower growth notwithstanding that the Bank was able to sustain its trade finance activities by its strategy of expanding into remote provinces. Fee income from loan related activities grew by 17% while credit/ debit card expansion strategy resulted in increasing card related fees by 31%. The Bank's continued commitment to develop the inward remittances business was evidenced by its 8.1% increase in fee income. In addition guarantee fees increased by 8.5% while customer deposit related fees increased by 13.7%.

The European sovereign debt crisis and the US Fiscal cliff impacted the global currency market volatility, widening spreads and increased interbank trading were the major factors, which kept the forex market very volatile during the year 2012. Exchange Income more than doubled to LKR 5,809 million in 2012 from LKR 1,746 million in 2011. Of this income LKR 3,985 million or 69% was attributable to trading activities while rest was from mark to market revaluation. In the domestic market, volatility was caused by the devaluation of the Sri Lankan Rupee as the Central Bank decided not to intervene in the forex market and as a result trading gains increased by 150% compared to last year due to Rupee depreciation against the US Dollar. On the other hand the mark-to-market loss through trading instruments reduced to LKR 306,523.

Dividend income increased during the year by 4% mainly contributed by the increase dividend payments by the Bank's subsidiaries and associates as the Bank initiated a dialogue with subsidiaries and associates towards increasing their profitability and to pay-out market competitive dividends.

Trading gains from interest earning instruments slightly improved over the year while the Bank continued to make losses on equity instruments as stock market conditions have remained bearish in the second half of 2012. Other income which increased by 7% mainly comprises income from other banking services, Islamic banking income, sale of property, plant & equipment used by the Bank.

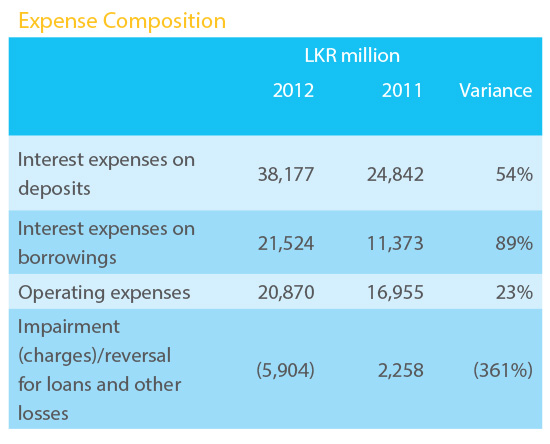

Total Expenses recorded for 2012 was LKR 80,571 million as against LKR 53,171 million in the previous year. Interest expense accounted for 69% of the total expense while the remainder was in Operating Expenses.

Interest Expenses of LKR 59,701 million in 2012 grew by 65% over 2011. The increase is mainly contributed by both the increase in interest paying liabilities which grew by 26% and increase in market interest rates. Interest paid on deposits increased by 54% as a result of deposits growing by 16% along with rates increase. The increase in the cost of funds was also due to the Bank trends showing a shift in customer behaviour from retaining monies in current and savings (CASA) accounts to moving them to term deposit accounts with higher rates in order to benefit from the increase in market interest rates.

Interest paid on borrowings also increased by 89% as the total borrowing increased by 55%. The increased mid term borrowings both internationally through the USD 500 million bond issue and domestically through the LKR 6,000 million debenture issue were the main reason for the increase. Overall the debt securities and debentures, (which included the newly issued LKR 6,000 million debenture), grew by 10.6% resulting in interest paid increasing by 22% to LKR 4,618 million. There is also a considerable increase in interest paid for monies due to the Bank which increased by 55.6%.

Operating expenses for 2012 was LKR 20,870 million as against LKR 16,955 million in 2011 an increase of 23%. This includes mainly two expense elements:

personnel costs and other expenses.

Increase in total personnel cost amounted to LKR 2,466 million. 23.6% of this is due to fresh recruitment for the branch network expansion and additional provision of LKR 600 million set aside towards initial past service cost of the proposed pension scheme for employees who joined the Bank after 01.01.1996 which is pending for approval. In addition the personnel cost of LKR 12,926 million for 2012 includes LKR 850 million as an adjustment for change in accounting policy from the application of new Sri Lanka Accounting Standards. (LKR 771 million was included for the previous year's comparative number).

Other operating expenses increased by LKR 1,448 million, an increase of 22.3% over 2011. The increase is mainly in the asset maintenance cost (16%), office administration cost (33%) and deposit insurance premium (28%). The asset maintenance and other office admin expenses increase were contributed by the expansion of the branch network and infrastructure enhancement as well as increased marketing expenditure. The marketing expense increase is a result of large promotional activities such as BOC Mega Wasi (special deposit mobilisation campaign) launched in 2012, the Leasing Fairs that were held to promote leasing business and inward remittance marketing campaigns.The deposit insurance premium increase of 28% is a result of the increase in deposits liable to the premium.

Provision for impairment and other losses of LKR 5,904 million is a substantial increase over 2011. (In 2011 it was a reversal of LKR 2,257 million). These impairments were calculated in compliance with newly adopted Sri Lanka Accounting Standards. The current year's impairment includes LKR 1,742 million from individually significant loans, LKR 2,374 million from collective impairment while LKR 1,788 million write down of the investment in SriLankan Airlines Ltd.

Asset quality came under pressure in 2012 as a result of the drought and floods that prevailed in the country together with high market interest rates. Our branch in Malé also experienced deteriorating asset quality as a result of political turmoil in the country. Non Performing Advances on total assets stands at 2.8% as compared to 2.1% in 2011. The Bank is satisfied with this level of NPA in light of the phenomenal asset growth this year. In addition the Bank has put in place adequate risk mitigation measures to continue to monitor asset quality and take preventive action when needed.

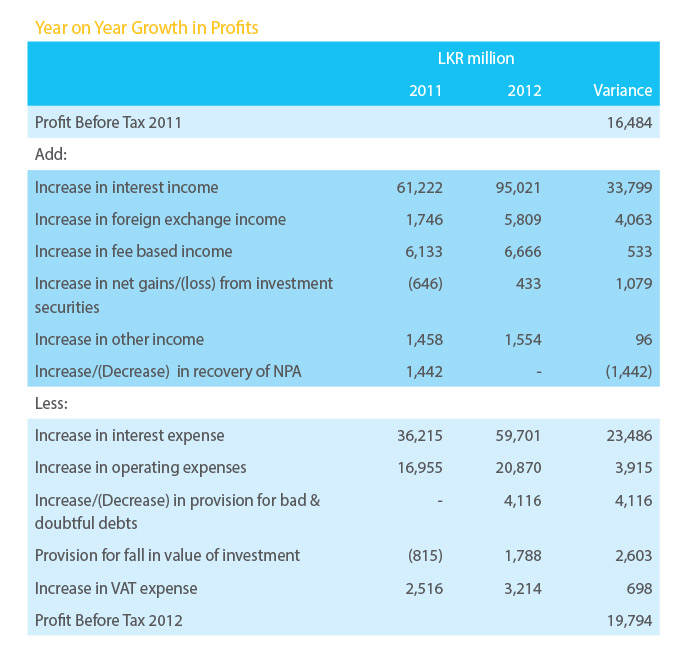

The Bank has achieved another milestone with profit before taxes reaching LKR 19,794 million, an increase of 20% compared to last year. Provision for tax of LKR 5,378 million was deducted to arrive at profit after tax of LKR 14,417 million recording a growth of 21%. This is the largest profit that the Bank has ever made and substantially above the planned target of LKR 10,000 million envisaged by our 2010-2012 corporate plan. Notwithstanding the exchange mark-up the Bank's earning mainly comes from core banking sources.

The profit growth of 20% year on year was achieved in the following manner

The Bank's profit journey is on a stable track with a positive Interest Margin of 3.7%, and aggressive 25% productivity increase measured by Profit per Employee, which is LKR 2.5 million per employee as compared to LKR 2.0 million in 2011. All these have positively contributed to the improving trend in cost/income ratio. Accordingly, the Bank could sustain a healthy Return on Average Equity (RoAE) of 31.2% which is a very competitive ratio compared to peers in the industry.

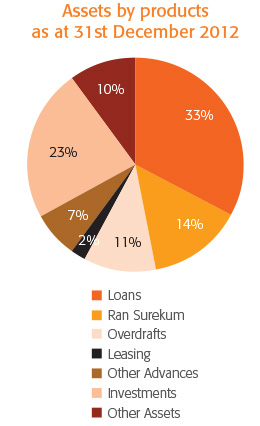

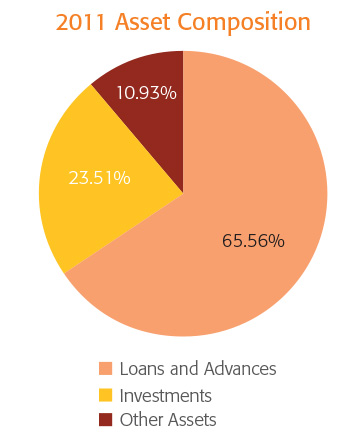

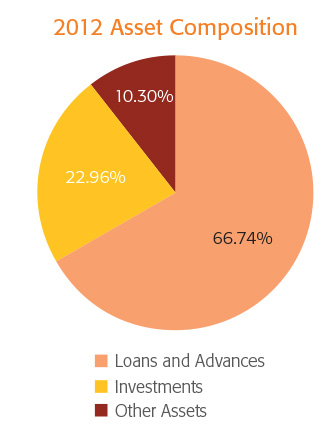

The Bank posted a sound balance sheet with a LKR 1.048 trillion assets base achieving a remarkable milestone in the history of the banking sector in Sri Lanka. This is a significant growth of 25% compared to previous year. The Bank's efforts of balancing asset distribution is reflected in the structure and composition of the main asset types in the balance sheet (see graph - asset composition). Loans and advances remains the major class of asset.

A substantial asset growth was recorded due to our engagement with the private sector, supporting fast growing infrastructure development activities, provision of working capital and investments in government financed projects.

A stable balance sheet is maintained by a funding base of deposits and borrowings, while maintaining adequate liquidity within the Bank.

The Bank's net asset per share has increased from LKR 8.2 million per share to LKR 10.1 million per share fostering confidence and credibility with our stakeholders.

Below is a detailed review of the balance sheet.

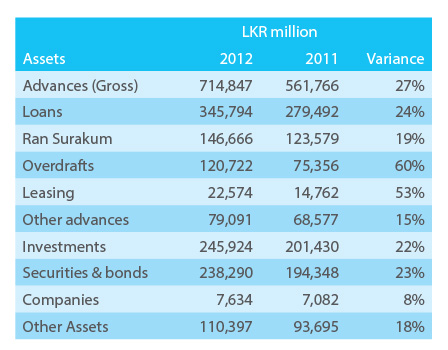

The two main asset classes of advances and investments grew by 27% and 22% respectively compared to previous year.

Gross loans and advances grew by 27%. Customer deposits and stable borrowings including borrowing from international lenders and investors funded the growth. The offshore banking division which does not come under the credit ceiling also contributed 35% to this growth.

The Bank launched special programmes in provinces to enhance credit in all economic sectors with the full engagement of the newly opened branches. The branch expansion focused on penetrating into new hitherto under banked periphery. The Bank increased its lending to the North and East Provinces contributing towards rapid rehabilitation in the area. Our commitment to develop the North and East is well evident from the increased credit granted to these two provinces of LKR 6,630 million or a 19% increase over 2011.

The leasing portfolio increased by 53% mainly due to assistance extended to small entrepreneurial businesses in acquiring their implements. Our gold pledged loans "Ran Surakum" which are primarily granted for agricultural purpose and urgent financial needs of the rural population including micro entrepreneurs increased by 19%. Term loans increased by LKR 66,302 million or 24% while overdraft also increased by 60% to LKR 120,722 million.

Other loans which includes trade finance, credit cards, staff loans granted increased by LKR 10,514 million or 15%. Credit card advances increased by LKR 399 million, 20.4% while the trade finance loans increased by LKR 5,110 million or 11.1%. Staff loans had gone through a special accounting treatment under the new accounting standards where LKR 6,585 million was transferred to pre-paid staff cost in 2011 which is being amortized. Due to this treatment the staff cost has increased by LKR 767 million in 2012.

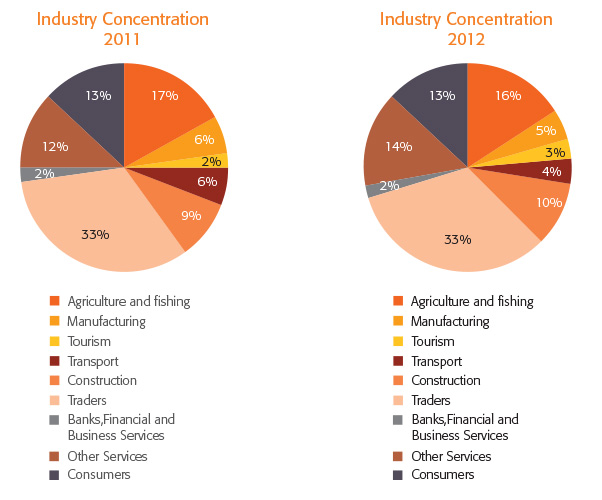

The Bank maintained a diversified loan portfolio which resulted in stable profitability streams flowing towards the Bank. Such a balanced loans growth in all sectors was made possible due to our risk management surveillance review practices.

In addition the Bank's lending in 2012 was approached with a view to striking right balance between profitability and risk.

Agriculture and fishing loans were increased by LKR 15,236 million, (16%), in order to uplift the fishing industry and agriculture value addition in the country specially providing assistance to small and medium sized enterprises. The agricultural loans include loans given for paddy conservation and price stabilisation, loans granted to develop the up-coming maize cultivation and its value chain for both domestic consumption and exports and other agricultural development including commercial agriculture. Agricultural loans also include the loans granted to dairy development in which the Bank has so far granted LKR 3,812 million.

The Bank continued its lending to the fisheries industry in providing loans through its SME (Small & Medium Enterprises) loan schemes. The Bank's outreach revolved around products and services derived in activities such as boat repairs, mending nets and long line fishing. The total loans granted during the year to the fisheries sector amounted to LKR 580 million a 36% growth over last year.

The credit granted to the manufacturing sector also increased by LKR 6,545 million which marks a growth of 20% compared to last year. Major components include the textile industry, steel manufacturing, packaging and industrial goods for domestic as well as export markets.

A substantial increase in credit granted to the tourism sector is due to the Bank's commitment to this sector to fast track the required infrastructure in meeting the growing demand. This was evident through the increase of LKR 5,225 million or 40% compared to last year. Some of these projects are still in progress and once completed will add substantial capacity to the industry value chain.

Complementing tourism is the Bank's commitment to the construction and infrastructure sector towards developing the infrastructure and enhancing the wealth of the nation. Credit granted to this sector increased by LKR 19,687 million or 37% which mainly includes real estates, roads, bridges and other infrastructure facilities. This is in addition to the substantial guarantees issued towards road developments.

Loans and advances granted for trading purpose increased by LKR 49,704 million or 27%. This was mainly due to the increase in loans granted towards fuel imports to the country. During the drought hydro electricity generative water streams dried up therefore electricity requirement of the country ran on thermal power engines resulting in increase in oil imports. The Bank had to substantially accommodate the extra imports requirement thereby increasing credit to this sector.

Credit granted to the transport service sector decreased during the year as the loans granted to Srilankan Airlines classified in this category was substantially settled.

Consumer lending also increased by LKR 16,310 million (22%) as a result of more credit appetite from the employed population and the increase in per capita income of the country.

Private sector advances increased by 19.6% while the Government & SOE credit increased by 42%. The increase is mainly due to the increased credit granted towards fuel imports. The retail sector grew faster than the corporate loans reaping the results of our penetration into provinces.

The aggressive growth in the loan portfolio has also resulted in an increase in Non Performing Advances ratio (NPA) calculated as per the Central Bank's regulations from 2.1% of the previous year to 2.8% in the current year. This was mainly due to the flood and the drought that affected the country's agricultural output affecting the entire value chain while increasing interest rates also resulted in affecting the assets quality of the loans. The Bank has risk management structures that have been strengthened throughout its network to retain asset quality and take pro-active action to ensure that NPA remains within the Bank's risk appetite levels.

The significant growth in investments was a result of the Bank investing in government securities including treasury bonds with the prime objective of effective fund utilisation. The Bank also received LKR 60,000 million in bonds in settlement of exposure to SOEs. The Bank has more than doubled its investment to LKR 99,842 million in Held to maturity Government treasury bonds as compared to LKR 40,728 million in 2011.

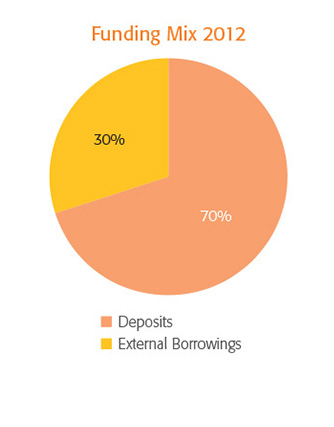

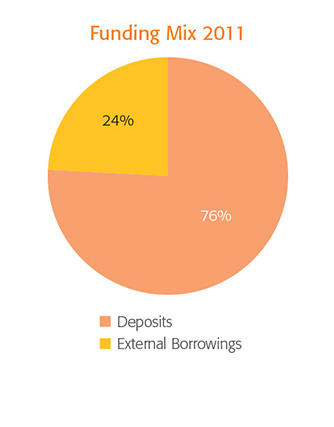

The Bank approached 2012 with a planned liquidity management mandate with the knowledge that domestic liquidity would be distressed and the cost of funding will increase. Accordingly the Bank began exploring alternative financing sources mainly concentrated on attracting international funds. While the major financing instrument to fund the asset base remains customer deposits representing 70% of the total funding base in 2012, a substantial portion of the asset base was also funded through external borrowings.

As the market deposit growth is not sufficient to support the credit growth, the Bank resorted to borrowings with longer tennor to fill the gap and minimise the liquidity gap. The total borrowing accordingly increased by LKR 103,549 million (55%) to LKR 291,038 millions.

Debt funding penetrated into the asset growth by increasing its balance sheet share from 24% in 2011 to 30% in 2012. The main contributors to this are the international Dollar bond through which the Bank raised US Dollar 500 million in May 2012 and the Rupee Debenture issue in December 2012 through which LKR 6,000 million was raised. Our US Dollar bond story is written elsewhere in this discussion.

During the year deposit mobilisation in the banking industry was extremely competitive as the funding needs of the Banks increased. While being moderate in deposit mobilisation efforts in the first three quarters as a competitive strategy, the Bank then adopted a market retention strategy to retain market share. In the last quarter the Bank launched a special campaign namely "BOC Mega Wasi". The total rupee deposit grew by 16% while the foreign currency deposits also grew by 17%. Overall the Bank was able to secure customer deposits of LKR 693,440 million.

There has been a migration of deposits from current and savings accounts to term deposits with higher interest rates. Accordingly rupee demand deposit contracted by 9% while rupee time deposit increased by 34%. On the other hand the foreign currency demand deposit contracted by 24% while foreign currency time deposit increased by 33%. This resulted in increasing the cost of funds for creating additional pressure on margins.

Foreign currency borrowing increased mainly due to the US Dollar 500 million senior unsecured five year bond the Bank raised from the international market in May 2012 and other bilateral borrowings from international lenders. This was the first time a commercial bank in Sri Lanka was able to successfully raise such a large quantum of money from the international market. (refer to Our Bond Story)

Rupee borrowing was reduced as a result of the Rupee funds received by a swap of the Dollars raised through the US Dollar bond. In addition the Bank also issued LKR 6,000 million unsecured, subordinated, redeemable rupee debenture in December 2012. The debenture is listed on the Colombo Stock Exchange and was oversubscribed further consolidating investor confidence. This debenture qualifyies for tier II capital as well.

As a result of the loan book being substantially funded through debt, the loan to deposit ratio increased to 103% as compared to 94% in 2011. While the Bank is presently comfortable with this level of ratio, the Bank has laid down strategies to reduce the ratio in the medium to long term.

Compared to the previous year, the liquid assets ratio declined marginally due to aggressive credit expansion and the Bank's strategy on maintaining a prudent tradeoff between liquidity and earning assets. Liquidity was maintained at reasonably high level, above the required regulatory levels laid down by Central Bank of Sri Lanka which is 20%. The Bank calculates the liquid asset ratio on a monthly basis for its domestic liabilities as well as foreign currency liabilities.

In line with the increased profitability and increased borrowings, the Bank had a capital adequacy buffer of 11.39% as at the end of 2012 compared to 10.88% in the previous year which is well above the minimum 10% required by the Central Bank of Sri Lanka.

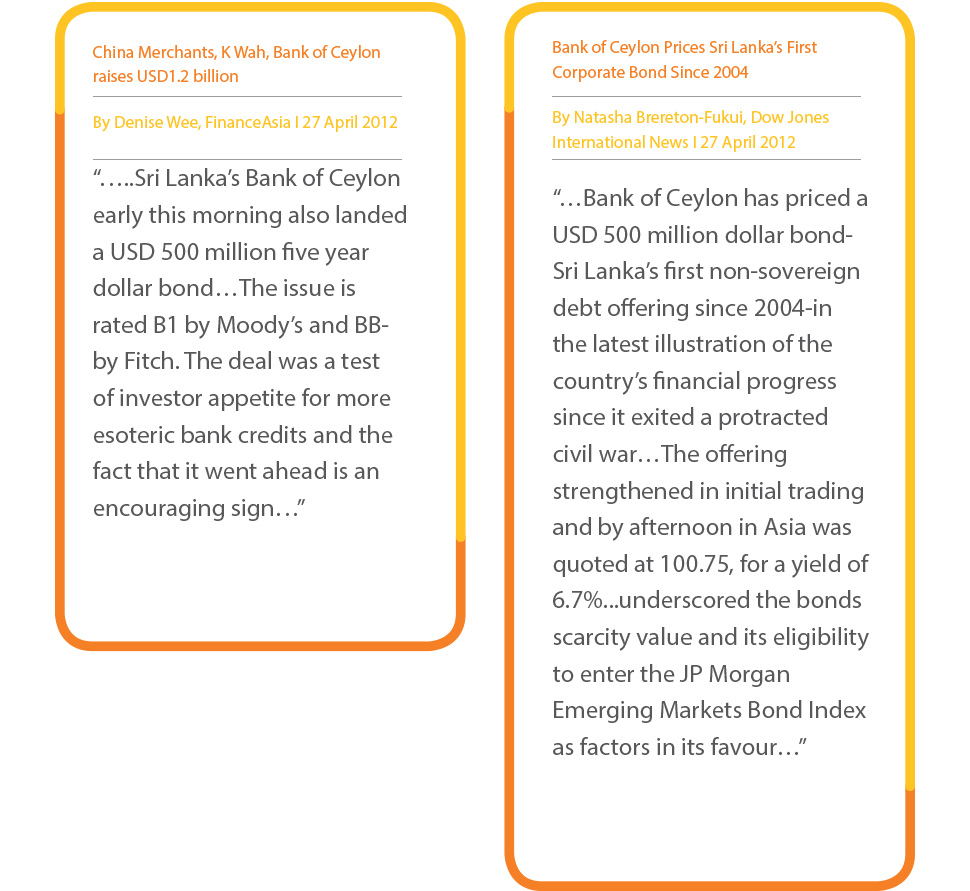

On April 26th 2012, the Bank of Ceylon successfully printed its debut international bond issuance. The USD 500 million senior unsecured notes issuance represents a key milestone for the Bank of Ceylon, providing access to an expanded global investor base.

The Bank conducted a highly effective international roadshow lead by a top team of the Bank's senior management team, which included the Chairman Gamini Wickremasinghe (retired on 08th January 2013), General Manager W A Nalani (retired on 03rd June 2012), Chief Financial Officer Asoka Rupasinghe, DGM (International & Treasury) P A Lionel and AGM (Treasury) S M S Jayasuriya. These roadshows were extensive resulting in meetings with over 40 key investor accounts in Asia, Europe and USA marketing the issue.

The roadshow highlighted the Bank of Ceylon as the market leader in the country's commercial banking industry commanding 23% of total banking assets and 21% of total deposits with loans and advances totaling 21% as a whole. It also emphasised that the Bank handles a 38% share of worker remittances to Sri Lanka and holds over 30% of the foreign currency deposits in commercial banks. The Bank's performance and strong franchise was well received by potential investors.

The roadshow paved the way for a very strong order book. Generating interest from high quality investors across the globe. The offering was oversubscribed by 7.7 times with total orders received amounting to USD 3.86 billion.

Initial pricing thoughts were released at around 7.125% and final pricing guidance was tightened to between 6.875% - 7.000%. The overwhelming demand helped the Bank price the notes at the lower end of the final pricing guidance at 6.875%.

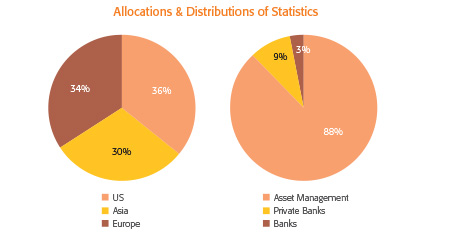

In terms of allocation, quality accounts anchored the order book with Asset Managers representing 88% of the allocations, followed by Private Banks (9%) and Banks (3%). In terms of geography, the book was almost evenly distributed across Asia (30%), Europe (34%) and US (36%).

Joint lead managers and book runners for the issue were HSBC, Citibank, Bank of America and Merrill Lynch.

Analysts regarded this bond issue to be a landmark in the history of the Bank of Ceylon, long established as the country's leading commercial bank, as well as for Sri Lanka's banking industry. The net proceeds were used for general corporate purposes.