The ‘sanhinda’ was where people would gather to resolve matters of governance, initiate community discussions and enjoy social interaction.

Var . ri . ga Ree . thi

Governance & Risk Management

A very detailed analysis of our corporate governance philosophies, policies and practice.

The ‘Code of Best Practice on Corporate Governance 2013’ (The Code) issued jointly by the Securities and Exchange Commission and The Institute of Chartered Accountants of Sri Lanka recommends that a Senior Independent Director (SID) be appointed in the event of the Chairman heading the executive function of the Company.

The presence of a SID provides a workable mechanism to review the role played by the Chairman. Whilst the role of the Chairman entails providing leadership in observing best practices of corporate governance, my role as the SID calls for a review of the Board’s effectiveness. The presence of the SID also provides emphasis to transparency in matters relating to governance.

Dimo is committed to principles of good governance and always strives to live by the Best Practices of Corporate Governance. The governance culture of the Company is strongly embraced by the Board of Directors. The Company follows a policy of strict compliance with laws, regulatory requirements and the Code of Ethics.

A Director is permitted to obtain independent professional advice that may be required in discharging his responsibilities, at the Company’s expense.

As the SID, which role I have played since May 2009, I am consulted by the Chairman on major strategic and governance issues. As the SID, I make myself available to any Director to have any confidential discussion on the affairs of the Company, should the need arise. By virtue of being the Chairman of the Audit Committee, I also meet Independent Auditors and Internal Auditors and obtain their views on any matters of concern.

R.Seevaratnam

Senior Independent Director

23rd May 2014

Colombo

Enterprise Governance is at the core of the corporate philosophy of Dimo. It perceives good governance as an uncompromising pursuit that provides the platform for growth in a sustainable manner; not as a set of controls that stifles growth.

Dimo is committed to a policy of transparent, accountable and responsible governance. In doing so, the Board accepts the position of trusteeship, stewardship, and accountability that is placed upon it. The Board’s objective is to deliver superior returns to all stakeholders and it is done in conformity with acceptable corporate behaviour.

Primary authority for identifying, overseeing and evaluating economic concerns is vested in the Board of Directors and regular monitoring is delegated to the Group Management Committee (GMC), which consists of executive members of the Board and senior management. The GMC together with the heads of business units is responsible for implementing and monitoring the performance and conformance aspects of governance.

The Sustainability Committee, containing members of the Board and management, has the primary responsibility to oversee the Group’s activities with regard to the identification and management of environmental and social concerns and the achievement of the sustainability objectives. It is the duty of this Committee to report critical issues to the Board for action. Operational aspects relating to management of environmental and social impacts are delegated to the respective business units.

The Board identifies the scope of Enterprise Governance, which that is implemented starting from the Board Room throughout the Value Creation process. This signifies that the conformance and performance aspects of Governance should be identified in relation to managing the capitals and value creation activities. Duties of responsible trusteeship, faithful stewardship and uncompromising accountability underpin the manner in which Dimo is committed to good governance through its Value Creation process, in its pursuit of creating value and accumulating financial and non- financial wealth for its stakeholders. Conformance and Performance requirements demand a robust enterprise governance framework.

The ultimate responsibility for good governance rests with the Board of Directors. In order to effectively fulfill this responsibility, the Board has in place a governance structure and a process to monitor its effectiveness. The Audit Committee, Remuneration Committee and Nomination Committee together with the Group Management Committee play a leading role in ensuring effective enterprise governance.

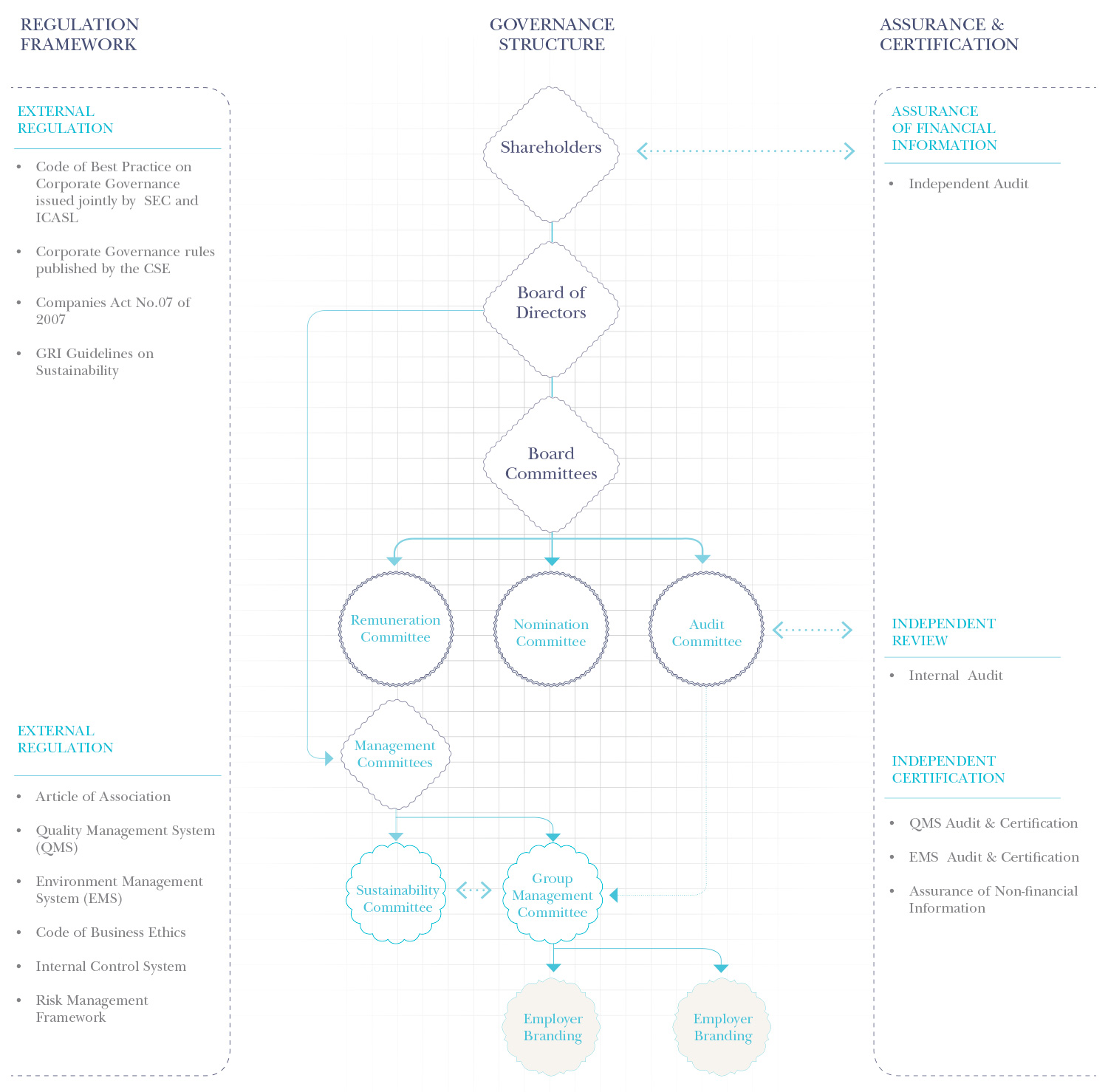

The governance framework is designed taking into consideration the demands placed by the aspects of conformance and performance along with legislative and regulatory requirements and best practices of enterprise governance. It consists of a governance structure, regulation framework and assurance and certification sources.

Governance Framework

The driving force of conformance and performance is the onus that is placed upon the Board by the expectations of trusteeship, stewardship and accountability although there are many laws, regulations, best practices and expectations that shape these two dimensions of governance. Arising from the responsibilities placed upon it, the Board endeavours to meet the demands through the structures and the processes that are in place.

The table … illustrates key conformance and performance aspects arising from value creation activities and capitals and the point of reference through which they are addressed, regulated and reported. The point of reference is the source that provides guidance for conformance or performance. A point of reference could be a code of best practice, guideline, standard, system, process or even a body of persons that could provide guidance and direction in conformance and performance.

|

Capital / Activity |

Key Conformance Aspects |

Point of Reference |

Key Performance Aspects |

Point of Reference |

|

Value creation activities |

Meet regulatory standards with regard to product and services. |

Quality Management System |

Quality and safe products and services |

Quality Management System |

|

|

|

Code of Business Ethics |

||

|

|

Meet Regulatory standards and business ethics in performing supply chain activities. |

Quality Management System |

On-time delivery

|

Quality Management System |

|

|

|

Code of Business Ethics |

||

|

|

Product responsibility |

Quality Management System |

||

|

Monetised Capital |

Internal Control |

Audit Committee |

Business Strategy Formulation |

Group Management Committee |

|

|

|

Group Management Committee |

||

|

|

Internal Audit |

Audit Committee |

Operational Excellence |

Group Management Committee |

|

|

|

Quality Management System |

||

|

|

Uncertainty Management |

Risk Management Framework |

Environmental Management System |

|

|

|

Assurance |

Audit Committee |

||

|

|

|

Independent Auditors |

||

|

Customers |

Meeting Customer Expectations |

Quality Management System |

Customer satisfaction |

Quality Management System |

|

Customer Health & Safety |

Quality Management System |

Customer Relationship Management |

Quality Management System |

|

|

Customer Privacy |

Quality Management System |

Customer Complaint Handling |

Quality Management System |

|

|

Employees |

Employee safety |

Quality Management System |

Employee satisfaction |

HR Scorecard |

|

Employee Rights |

UN Global Compact Principles |

Training & development |

HR Scorecard |

|

|

Code of Business Ethics |

Retention |

HR Scorecard |

||

|

Equal opportunities |

UN Global Compact Principles |

Employee Engagement |

HR Scorecard |

|

|

Reducing gender inequality |

Sustainability Objectives |

|||

|

Comply with legislation and regulations relating to employees |

Code of Business Ethics |

|||

|

Business Partners |

Compliance with Principals’ requirements of ethical practices |

Quality Management System |

Expectation management |

Quality Management System |

|

Honor Agreements with Principals |

Quality Management System |

|||

|

Intellectual capital |

Data security and integrity |

Quality Management System |

Quality and accuracy of information |

Quality Management System |

|

Meet the requirements of the legislative enactments applicable to the Group. |

Code of Business Ethics |

Not applicable |

||

|

|

Enhance and preserve the reputation of the company by following best practices relating to good governance and sustainability. |

Code of Best Practice on Corporate Governance jointly issued by SEC and ICASL |

||

|

CSE Listing Rules |

||||

|

Articles of Association |

||||

|

GRI G4 Guidelines |

||||

|

Society |

Anti-corruption |

Code of Business Ethics |

Benevolence & Philanthropy |

Sustainability Committee |

|

|

UN Global Compact Principles |

Social development |

Sustainability Committee |

|

|

Environment |

Comply with all requirements of the Environment Management System- |

Environmental Management System |

Carbon foot-print Management |

Environmental Management System |

|

Meet Legal and Regulatory requirements regarding Environment |

Environmental Management System |

Energy & Fuel Management |

Environmental Management System |

|

|

UN Global Compact Principles |

Water Management |

Environmental Management System |

||

|

Code of Business Ethics |

Waste Management |

Environmental Management System |

||

|

Material Usage |

Environmental Management System |

|||

|

Noise & Air Emissions |

Environmental Management System |

|||

|

Re-cycle & Re-use |

Environmental Management System |

|

Point of Reference |

Aspect of Regulation |

Status |

|

The Code of Best Practices on Corporate Governance jointly issued by The Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of |

Best practices of Corporate Governance |

All requirements of the code and the compliance level is given on the table laid out in the company’s website at www.dimolanka.com/investors/stewardship |

|

Listing Rules of the Colombo Stock Exchange |

Listing rules to be followed by listed companies in Sri Lanka including on Corporate Governance relating to; – Non Executive Directors – Independent Directors – Disclosures relating to Directors – Remuneration Committee – Audit Committee |

Complied. The Compliance level is given on the tables Corporate Governance "Disclosures" Containing the level compliance with code |

|

Legislative enactments applicable to the Group |

Legal requirements that the Group is subject to |

The Code of Business Ethics specifically requires that all employees comply with all applicable laws. Employees sign a declaration to the effect that they will follow Code of Business Ethics. |

|

Articles of Association |

Requirements prescribed by the Articles of Association |

Complied |

|

Code of Business Ethics

|

Compliance requirements applicable to all employees |

All employees sign declarations to the effect that all requirements in the Code will be complied with. |

|

Global Reporting Initiative (GRI) guidelines on Sustainability Reporting. |

To report on sustainability related performance in a complete generally accepted manner as specified by GRI G4 guidelines. |

Complied. GRI index is available on the company’s website at www.dimolanka.com/sustainability/sustainability-performance The Report on the Independent Assurance obtained on Non- Financial Reporting is available in Appendices |

|

Environment Management System (EMS) |

Meet the requirements of the Group’s Environmental Management System accredited by ISO 14001:2004 Standard.

|

Complied. The Group’s Environmental Management System is certified with ISO 14001:2004 with certification provided by Det Norske Veritas AS (DNV) |

|

Quality Management System (QMS) |

Meet the requirements of the Group’s Quality Management System accredited by ISO 9001:2008 Standard. |

Complied. The Group’s QMS is certified with ISO 9001: 2008, with certification provided by Det Norske Veritas AS (DNV) |

|

UN Global Compact Ten Principles |

To comply with the requirements of the declaration made on UN Global Compact Ten Principles covering Human Rights, Labour, Environment and Anti – Corruption. |

Communication in progress is available on company’s website at www.dimolanka.com/sustainability/sustainability-performance |

|

HR Scorecard |

Specifies the KPIs to be attained with regard to HR related objectives that includes objective relating to Employee Satisfaction, Training & Development, Retention and Engagement |

HR scorecard is compiled every month and actual KPI’s are compared with targets. |

|

Audit Committee |

Among other responsibilities, to review effectiveness of Internal Control, Internal Audit and Independent Assurance |

Effectiveness of internal controls is reviewed with Internal auditors and Independent Auditors. Performance of Internal Auditors and Independent Auditors is also reviewed by the Audit Committee. Where necessary, members of the Group Management Committee are called upon to explain matters relating to internal controls. |

|

Group Management Committee |

Among other responsibilities, to install and review effectiveness of internal controls and to work towards operational excellence |

Effectiveness of internal controls is reviewed by the Group Management Committee from the feed – back received internally and from internal audit findings. Performance standards are set through KPIs and Objectives set for Business Units and Support Service Units and performance levels are reviewed periodically. |

|

Sustainability Committee |

To carry out the Group’s sustainability efforts as per its terms of reference |

Initiatives are planned and progress is reviewed by the sustainability committee. Key sustainability initiatives are reported in the Annual Report. |

|

Risk Management |

To manage risks that the Group is exposed to |

Please refer the Risk Management Report. |

The governance practices of the Company are conceived out of the corporate philosophy of achieving sustainable growth through good governance. While being fully compliant with demands of the laws and regulations relating to corporate governance, the Company recognizes that best practices provide a robust framework for sustainable growth and meeting stakeholder expectations.

Enterprise Governance requires a high level of commitment across the organization and it is essential that an enabling governance culture is created. This envisages creation of awareness at all levels. All employees are expected preserve the corporate values and respect the code of business ethics in achieving their own objectives set by the management and in achieving the objectives of the Company. The sustenance of enterprise governance principles is facilitated by aligning the corporate values into value creation activities, and making a conscious effort to continually improve the governance framework and processes.

Compliance is monitored through the monitoring of the point of reference/s. In the event of the points of reference being a code of best practice, guideline, legislation or a rule, the compliance is monitored through ascertainment of compliance with the point of reference. On the other hand where the point of reference is a body of persons such as a management committee, the compliance is monitored by comparing the stated expectations or goals with the actual status.

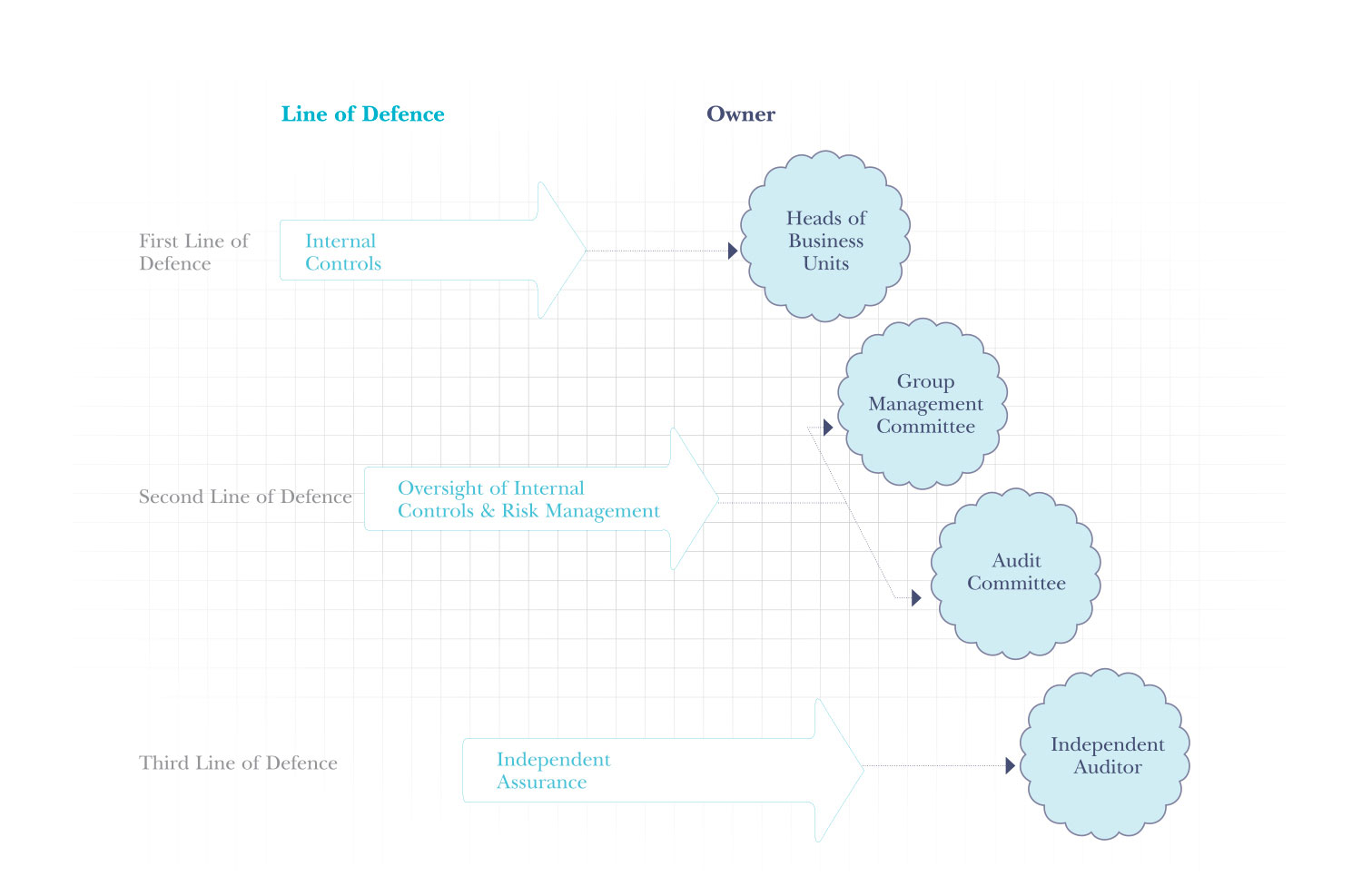

Independent assurance, independent review, oversight and independent certification are key sources of assurance and comfort with regard to integrity and due functioning of the enterprise governance framework. This is depicted in the governance framework appearing. The three lines of defence approach, which is described later, provides comfort on the effectiveness of internal controls and risk management.

The comfort level derived from assurance is reliant upon the internal controls that are in place. Whilst the internal controls focus on the current operations and decisions, the risk and management process focuses on the uncertainties that the Group is exposed to. The “Three Lines of Defence” model given below depicts the approach followed in ensuring effectiveness of internal controls and risk management.

The Board has delegated the oversight function of the internal controls to the Audit Committee. Implementation of suitable internal controls rests with the Group Management Committee (GMC). The internal audit function is constructed to Messrs SJMS Associates – Chartered Accountants. The internal audit findings include areas requiring improvements in internal controls and instances of any non- compliance. In addition, independent auditors present their findings with regard to possible improvements to the internal controls and instances of non- compliance that they come across during their engagement. The independent auditors present their findings to the Audit Committee.

The extent of compliance with the code of best practices on corporate governance jointly issued by the Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of Sri Lanka is available in the company’s website at www.dimolanka.com/investors/stewardship

Group’s code of business ethics provides guidelines for ethical business conduct. The Group also has a Human Resource Policy, Human Right Policy, Whistle Blowing Policy, Communication Policy and IT Policy.

The Company maintains an open door policy which encourages the prompt discussion of any issues relating to business conduct. The Whistle Blowing Policy has documented mechanisms to directly contact the personnel responsible in order to report any issues. The Code of Business Conduct, the Human Resources and Human Rights Policies contain grievance handling mechanisms. No external ombudsmen are involved in the identification and resolution of internal issues.

The tables given below provide the required and applicable details, disclosures or cross references to details/ disclosures mandated by the Companies Act No. 07 of 2007 and the listing rules of the Colombo Stock Exchange.

|

Information required to be disclosed as per the |

Reference to the Companies Act |

Section Reference |

|

(i) The nature of the business of the Group and the Company together with any change thereof during the accounting period |

Section 168 (1) (a) |

|

|

(ii) Signed Financial Statements of the Group and the Company for the accounting period completed |

Section 168 (1) (b) |

|

|

(iii) Auditors’ Report on Financial Statements of the Group and the Company |

Section 168 (1) (c) |

|

|

(iv) Accounting Policies and any changes therein |

Section 168 (1) (d) |

Basis of Preparation of Financial and specific Accounting Policy |

|

(v) Particulars of the entries made in the Interests Register during the accounting period |

Section 168 (1) (e) |

|

|

(vi) Remuneration and other benefits paid to Directors of the Company during the accounting period |

Section 168 (1) (f) |

|

|

(vii) Corporate Donations made by the Company and its during the accounting period |

Section 168 (1) (g) |

|

|

(viii) Information on Directorate of the Company and its Subsidiaries during and at the end of the accounting period |

Section 168 (1) (h) |

|

|

(ix) Amounts Paid/payable to the External auditor as audit fees and fees for other services rendered during the accounting period |

Section 168 (1) (i) |

|

|

(x) Auditors’ relationship or any interest with the Company and its Subsidiaries |

Section 168 (1) (j) |

|

|

(xi) Acknowledgement of the contents of this Report and Signatures on behalf of the Board |

Section 168 (1) (k) |

The following table shows the level of compliance with the Section 7.10 of Listing Rules of the Colombo stock Exchange, pertaining to Corporate Governance.

|

Rule No. |

Subject |

Applicable requirement |

Compliance status |

Details |

|

7.10.1.(a) |

Non-Executive Directors |

At least two or one third of the Directors, whichever is higher, should be Non-Executive Directors |

Compliant |

Four out of Ten Directors are Non-Executive Directors |

|

7.10.2.(a) |

Independent Directors |

Two or one-third of Non-Executive Directors, whichever is higher, should be independent. |

Compliant |

Three of the Four Non-Executive Directors are independent |

|

7.10.2.(b) |

Independence of Directors |

Each Non-Executive Director should submit a declaration of independence/non-independence |

Compliant |

Non-Executive Directors have submitted the declaration in the prescribed format |

|

7.10.3.(a) |

Disclosures relating to Directors |

Names of Independent Directors should be disclosed in the Annual report. |

Compliant |

Please refer Profiles of Leadership/ The Board of Directors |

|

7.10.3.(b) |

Independence of Directors |

The Board shall make a determination annually as to the Independence or Non-independence of each Non-Executive Director |

Compliant |

The Board has determined that Independent Directors identified in Profiles of Leadership/ The Board of Directors meet the criteria of an Independent Director |

|

7.10.3.(c) |

Disclosures relating to Directors |

A brief resume of each Director should be included in the Annual Report including the area of expertise |

Compliant |

Please refer Profiles of Leadership/ The Board of Directors |

|

7.10.3.(d) |

Appointment of new Directors |

Provide brief resume of any new Director appointed to the Board. |

Not Applicable |

Not Applicable |

|

7.10.5 |

Remuneration committee |

A listed company shall have a Remuneration Committee |

Compliant |

Names of the members of the Remuneration Committee are available in the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 |

|

7.10.5.(a) |

Composition of Remuneration committee |

Shall comprise Non-Executive Directors, a majority of whom shall be independent |

Compliant |

Remuneration Committee consists of four Non-Executive Directors of which on are independent. Chairman of Remuneration Committee is an Independent Non-Executive Director |

|

7.10.5.(b) |

Functions of Remuneration committee |

The Remuneration Committee shall recommend the remuneration of the Chief Executive Officer and the Executive Directors |

Compliant |

Please refer the Remuneration Committee |

|

7.10.5.(c) |

Disclosure in the Annual Report relating to Remuneration committee |

The Annual Report should set out; a) Names of Directors comprising the Remuneration Committee |

Compliant |

Please refer the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 |

|

|

|

b) Statement of Remuneration policy

|

Compliant |

Please refer the Remuneration Committee report |

|

|

|

c) Aggregate remuneration paid to Executive & Non-Executive Directors |

Compliant |

Please refer to note 5.1.1 (b) the financial statements |

|

7.10.6 |

Audit committee |

A listed company shall have an Audit Committee. |

Compliant |

Names of the members of the Audit Committee are available on the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 |

|

7.10.6.(a) |

Composition of Audit committee |

Shall comprise Non-Executive Directors, a majority of whom are independent |

Compliant |

Audit Committee consists of four Non-Executive Directors of which whom three are independent. Chairman of Audit Committee is a Non-Executive independent Director |

|

|

|

Chief Executive Officer and the Chief Financial Officer should attend Audit Committee Meetings The chairman of the Audit Committee or one member should be a member of a professional accounting body |

Compliant

Compliant |

Chief Executive Officer and Chief Financial Officer attend Audit Committee meeting by invitation Chairman of the Audit Committee is a member of The Institute of Chartered Accountants of Sri Lanka and the Institute of Chartered Accountants of England & Wales |

|

7.10.6.(b) |

Function of Audit committee |

Should be as outlined in the Section 7.10 of the Listing Rules |

Compliant |

The terms of reference of the Audit Committee adopted by the Board on 20th June 2007 cover the areas outlined. |

|

7.10.6.(c) |

Disclosure in the Annual Report relating to Audit Committee |

a). Names of Directors comprising the Audit Committee |

Compliant |

Please refer pages the Composition of the Board and Board Committees and attendance at Meetings for 2013/2014 |

|

|

|

b). The Audit Committee shall make a determination of the independence of the Auditors and disclose the basis for such determination |

Compliant |

Please refer Audit Committee report |

|

|

|

c). The Annual report shall contain a Report of the Audit Committee in the prescribed manner |

Compliant |

Please refer Audit Committee report |

The Annual Report also contains disclosures specified above. There is no evidence of the book value being substantially different from the market value of land and other fixed assets of the Company or its subsidiaries.

|

Board Member |

Date of Appointment to the Board |

Board

|

Committee Members |

|||||||

|

Audit Committee |

Nomination Committee |

Remuneration Committee |

||||||||

|

First |

Re-election |

Position |

Attendance |

Position |

Attendance |

Position |

Attendance |

Position |

Attendance |

|

|

A.R. Pandithage |

June 1977 |

Not Applicable |

Chairman/MD |

7/7 |

No |

- |

Member |

1/1 |

No |

- |

|

R. Seevaratnam |

January 2007 |

June 2013 |

Senior Independent Director |

7/7 |

Chairman |

4/4 |

Member |

1/1 |

Member |

1/1 |

|

Dr. H. Cabral |

October 2006 |

June 2011 |

Independent Director |

3/7 |

Member |

3/4 |

Chairman |

1/1 |

Member |

1/1 |

|

Prof. U. Liyanage |

October 2006 |

June 2012 |

Independent Director |

7/7 |

Member |

3/4 |

Member |

1/1 |

Chairman |

1/1 |

|

A.M. Pandithage |

September 1982 |

June 2012 |

Non-Executive Director |

6/7 |

Member |

3/4 |

Member |

1/1 |

Member |

1/1 |

|

A.N. Algama |

November 1984 |

June 2012 |

Executive Director |

7/7 |

No |

- |

No |

- |

No |

- |

|

S.C. Algama |

November 1984 |

June 2012 |

Executive Director |

7/7 |

No |

- |

No |

- |

No |

- |

|

A.G. Pandithage |

December 1995 |

June 2013 |

CEO /Director

|

7/7 |

No |

- |

No |

- |

No |

- |

|

B.C.S.A.P. Gooneratne |

April 2006 |

June 2011 |

Executive Director |

7/7 |

No |

- |

No |

- |

No |

- |

|

R.C. Weerawardane |

June 2002 |

June 2013 |

Executive Director |

6/7 |

No |

- |

No |

- |

No |

- |

|

T. G. H. Peries* |

August 1977 |

June 2010 |

Executive Director |

1/1 |

No |

- |

No |

- |

No |

- |

* Mr. T. G. H. Peries resigned from the Board with effect from 28th June 2013.