Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group/Company and the revenue and associated costs incurred or to be incurred can be reliably measured. Revenue is measured at the fair value of the consideration received or receivable net of trade discounts and sales taxes. The Group/Company separately identifies different components of a single transaction in order to reflect the substance of the transaction. The following specific criteria are used for the purpose of recognition of revenue.

Sale of goods

Revenue from the sale of goods is recognised when the significant risks and rewards of ownership of the goods have been passed to the buyer, usually on delivery of the goods.

Provision of services

Revenue from services rendered is recognised in the Income Statement once all significant performance obligations have been provided.

Constructions related contracts

Revenue from construction related contracts is recognised in the Income Statement by reference to the stage of completion of the transactions at the end of the reporting date. The stage of completion is assessed by reference to surveys of work performed. When the outcome of a construction contract cannot be estimated reliably, contract revenue is recognised only to the extent of contract costs incurred that are likely to be recoverable.

Service support income

Service support income which is included in revenue represents income received from foreign principals on indent sales. Such income is recognised on an accrual basis at the time of supply of goods and services relating to the service support provided by the Group.

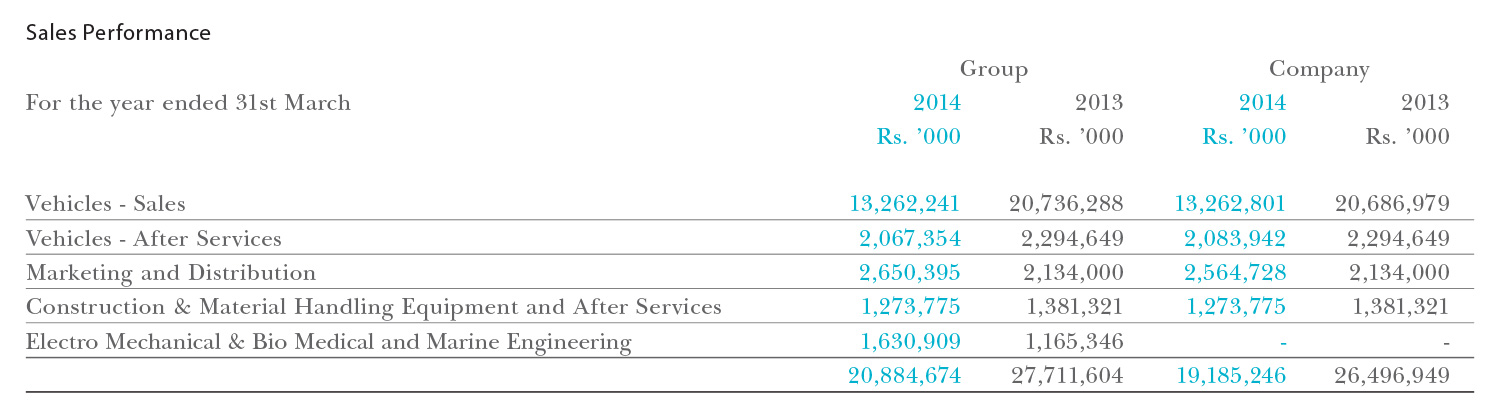

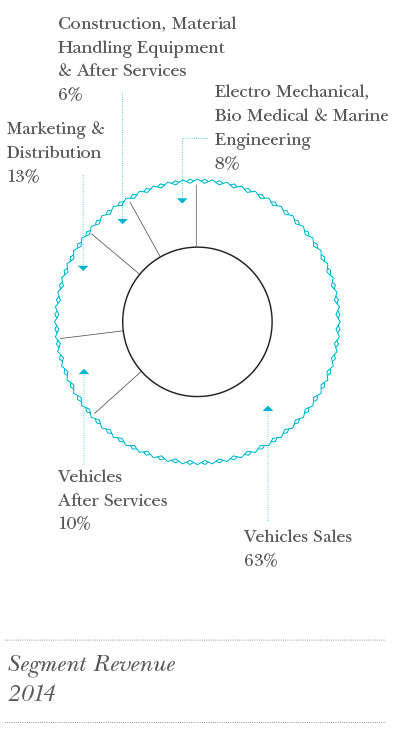

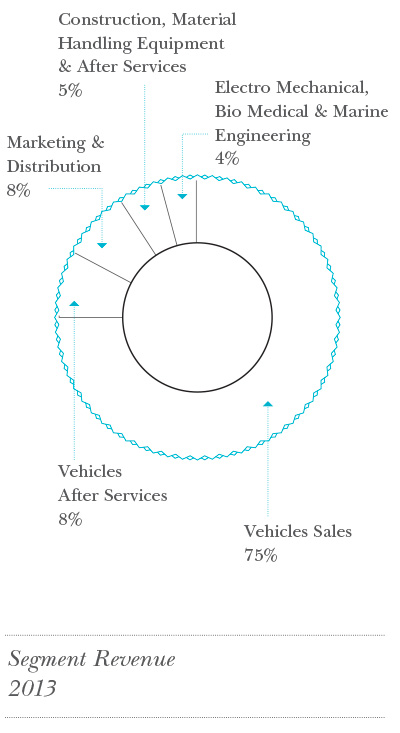

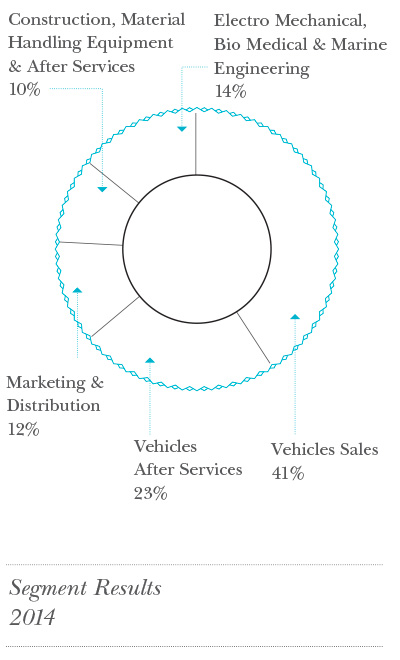

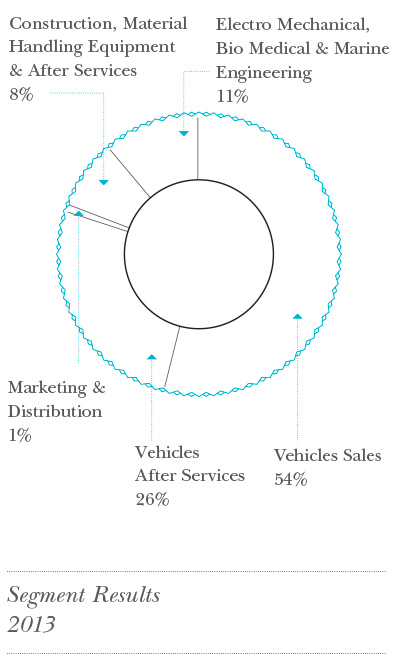

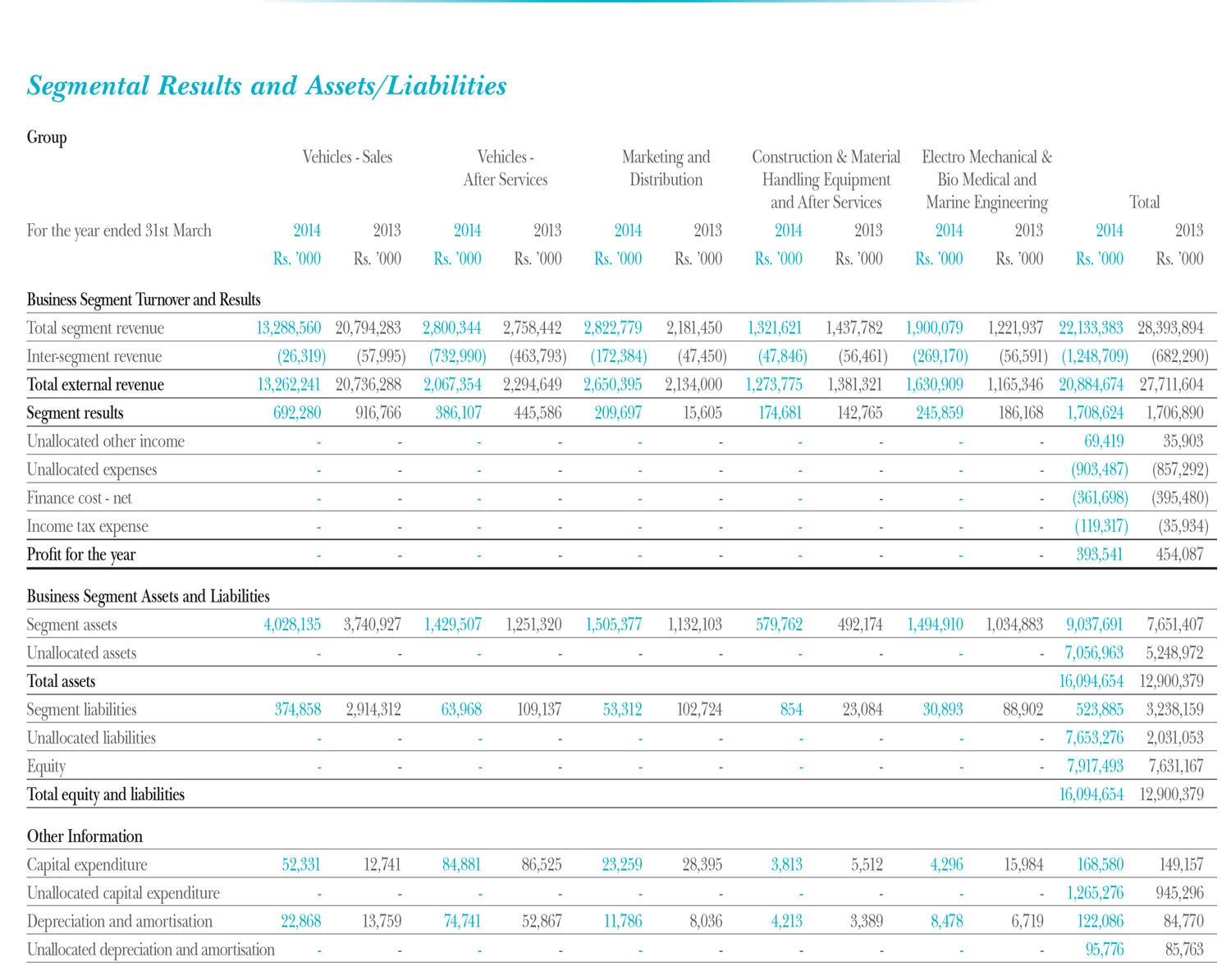

The Operating business are organised and managed separately according to the nature of the products and services provided. The Primary segment reporting format is determined based on products and services offered as the Group’s risks and returns are affected predominantly by differences in the products and services provided.

The Group comprises of the following main business segments as per the products and services offered:

Vehicles - Sales

Sale of brand new passenger vehicles, commercial vehicles, agri machinery, special purpose vehicles and pre-owned passenger vehicles.

Vehicles - After Services

Repair and Service of vehicle included in the vehicle-sale segment, sale of vehicle spare parts, accessories and components.

Marketing and Distribution

Sale of power tools and accessories, lamps, lighting fittings and accessories, tyres and retreaded tyres.

Construction & Material Handling Equipment and After Services

Sales and services of earth moving machinery, road construction machinery, forklifts, material handling machinery, racking systems, dock levellers and car parking systems.

Electro-Mechanical, Bio Medical and Marine Engineering

Sale, installation, commissioning and maintenance of medical equipment, generating sets, diesel engines for marine propulsion and rail traction, building management systems, fluid management systems, industrial refrigeration systems and power engineering equipment and systems.

Inter-segment transfers are based on fair market prices (arm’s length basis in a manner similar to transactions with third parties). Segment results, assets and liabilities include items directly attributable to a segment as well as those that can be allocated on a reasonable basis.

Unallocated assets and liabilities comprise mainly of assets and liabilities that cannot be attributed to a particular segment.

Finance income and expenses and income taxes are managed at Group level and are not allocated to business segments.

Sales to any single customer does not represent more than 10% of the total sales and no segments are determined based on the geographical area as all the segments are operating in the same economic environment.

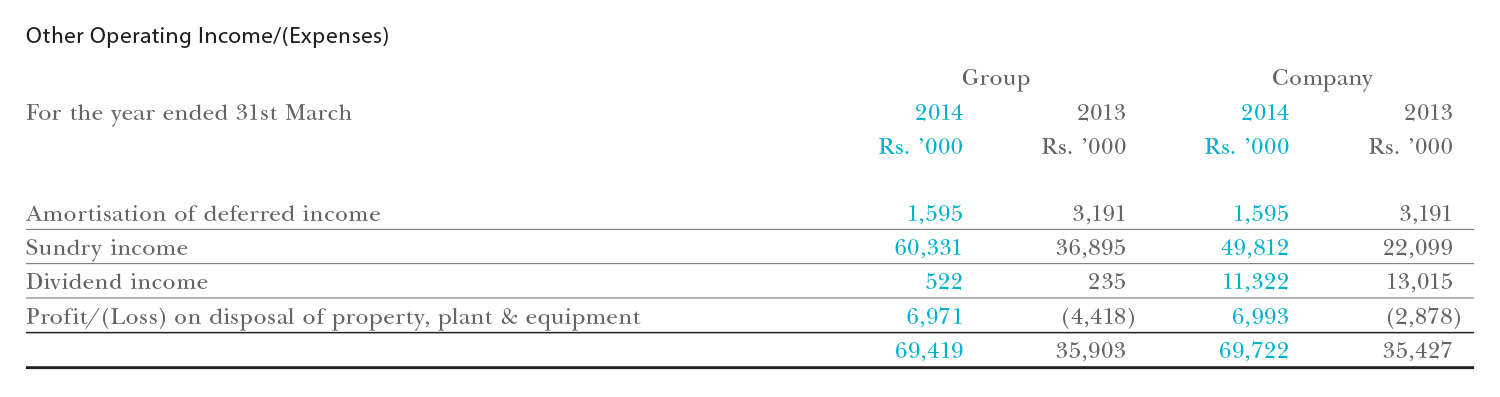

Income earned and expenses incurred on other sources, which are not directly related to the normal operations of the group are recognised as other operating income/(expenses).

The following specific criteria are used for the purpose of recognising income.

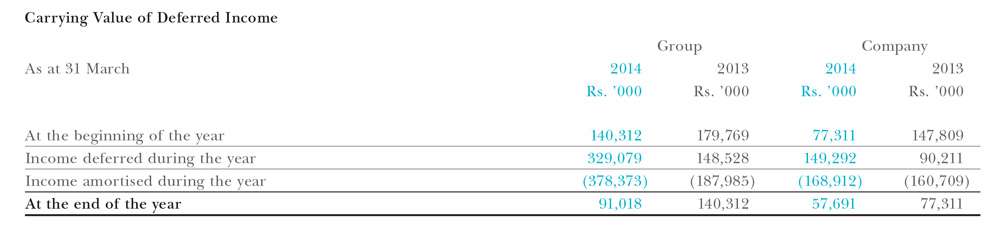

Deferred Income on sale and lease back transactions

The excess of sales proceeds over the cost of an asset in a sale and lease back transaction is classified as deferred income. Deferred income is systematically amortised to the Income Statement over the lease period.

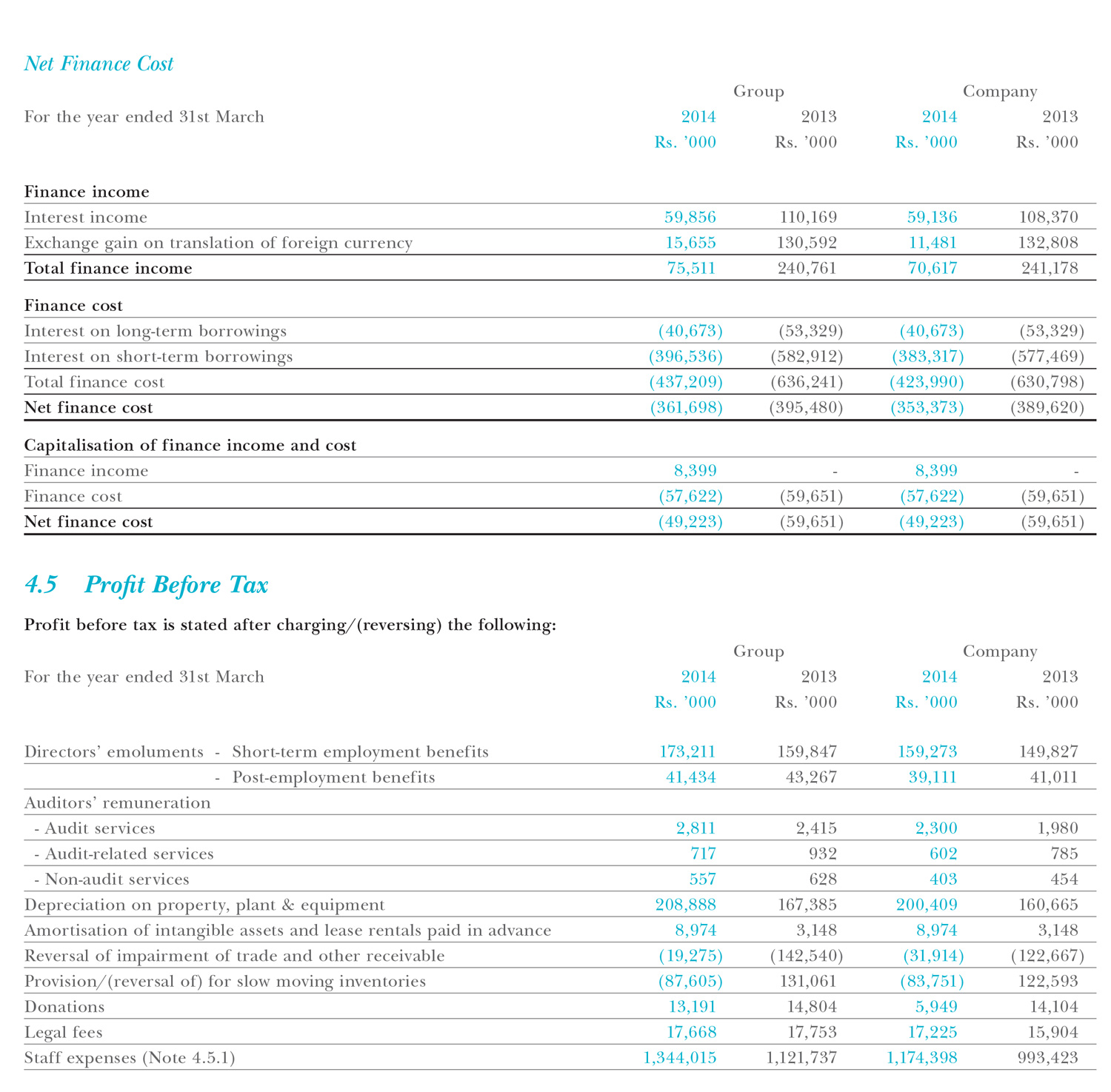

Finance income comprises of interest income. Interest income is recognised as it accrues, using the effective interest method.

Finance costs comprise interest expense on borrowings and impairment losses recognised on financial assets (other than trade receivables). Interest expenses are recognised using the effective interest method.

Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset are capitalised as part of the cost of the asset. A qualifying asset is an asset which takes a substantial period of time to get ready for its intended use or sale. Other borrowing costs are recognised in the Income Statement in the period in which they occur.

Foreign currency gains and losses are reported on a net basis as either finance income or finance cost depending on whether foreign currency movements are in a net gain or net loss position.

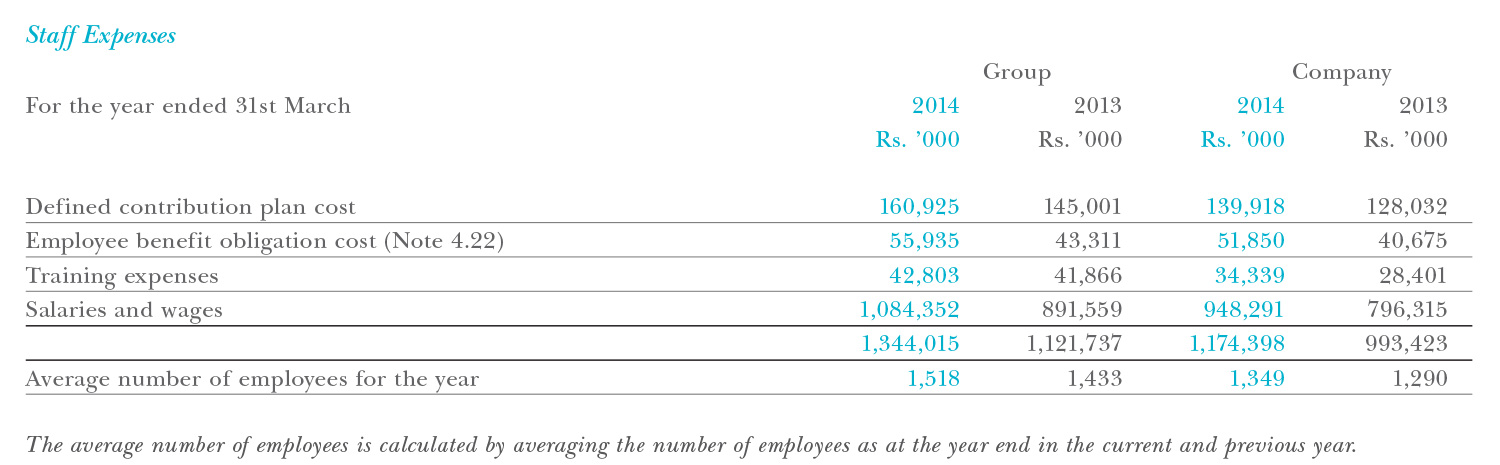

Salaries and wages, contribution to EPF and ETF, training expenses and current service cost of defined benefit plans are measured at cost and recognised as an expense in the year in which the related services are provided.

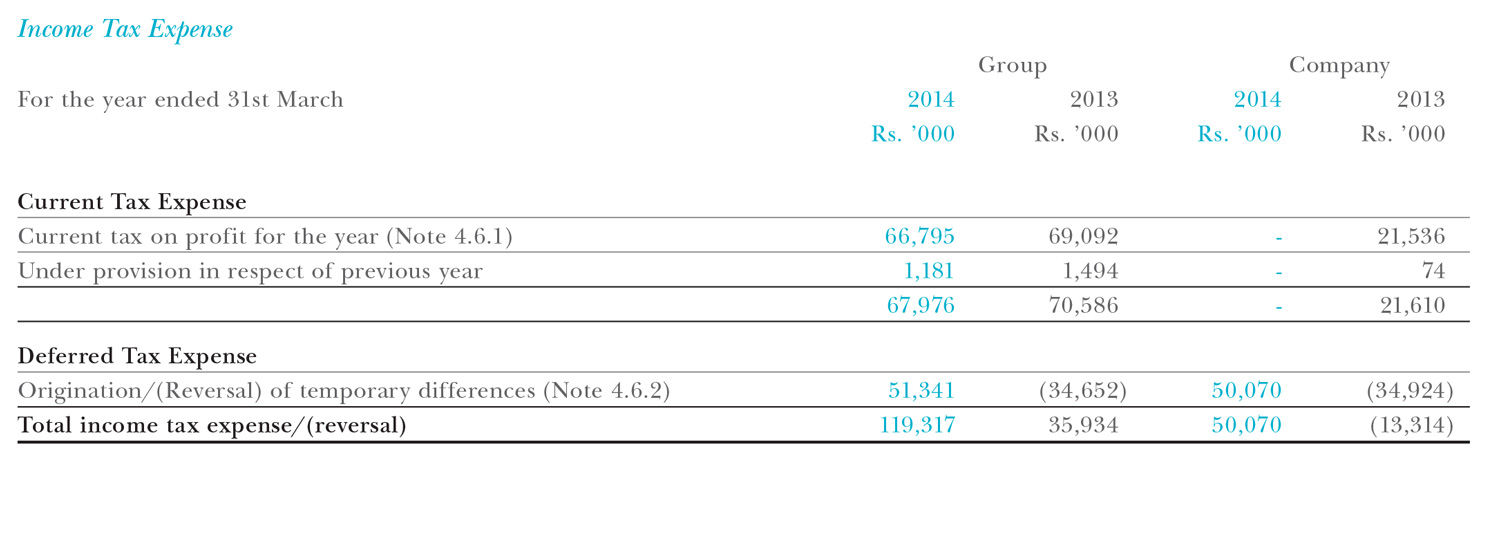

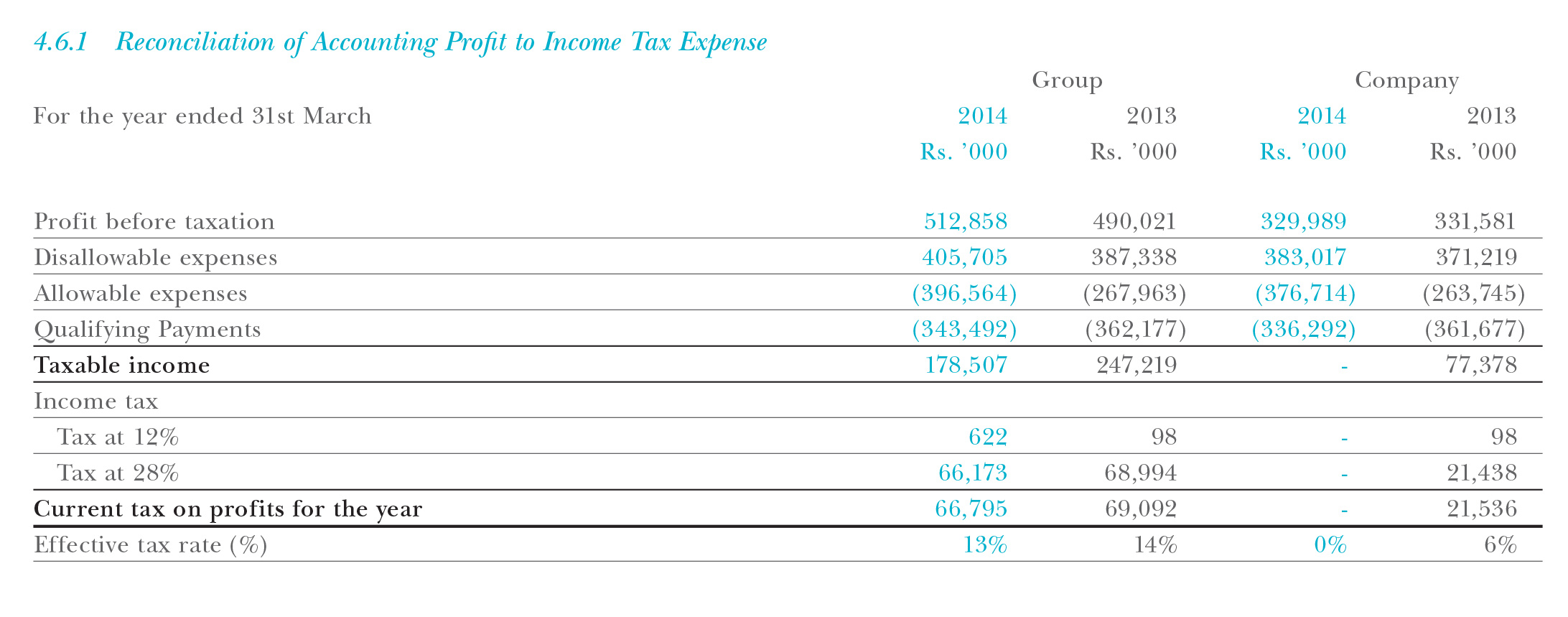

Income tax expense/(reversal) for the year comprises current and deferred tax including adjustments to previous years and changes in tax provisions. It is recognised in the Income Statement except, to the extent it relates to items recognised directly in Equity or in Other Comprehensive Income (OCI).

Current tax

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted at the reporting date and any adjustments to tax payable in respect of previous years.

The Group/Company recognises liabilities for anticipated tax, based on estimate of taxable income where the final tax outcome of these matters is different from the amount that were initially recorded, such differences will be adjusted in the current year’s income tax charge and/in the deferred assets/liabilities as appropriate in the period in which such determination is made.

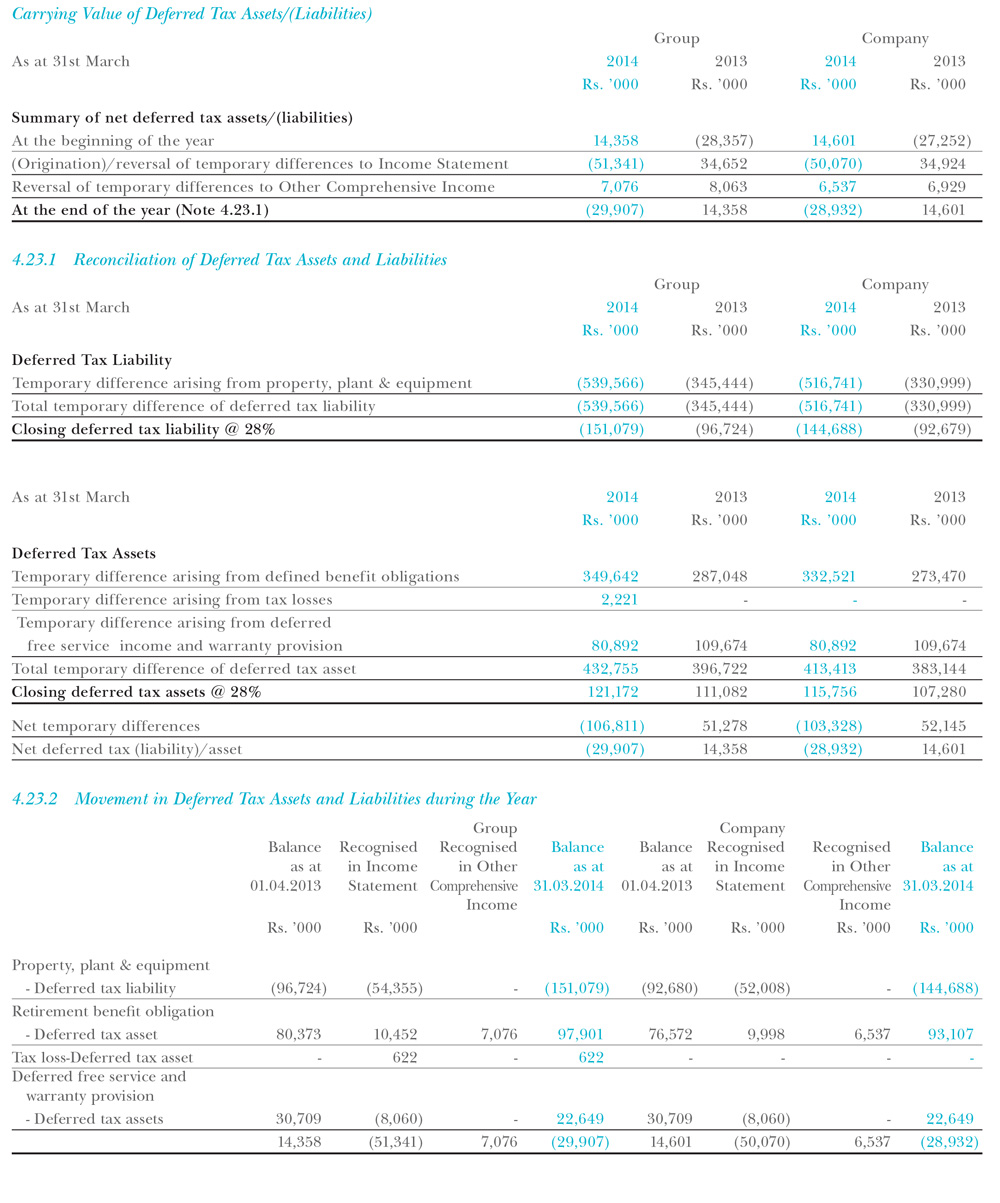

Deferred tax

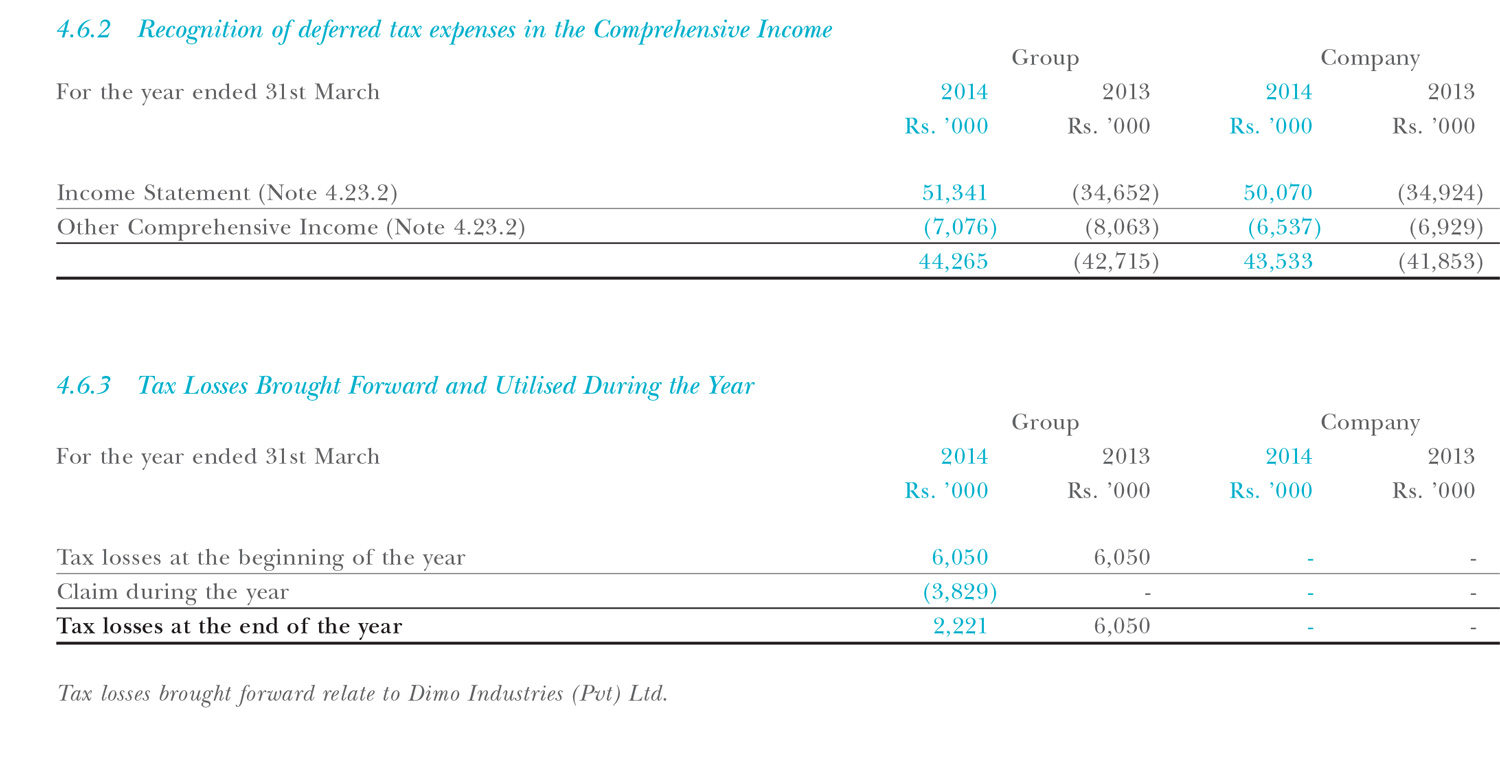

A detail disclosure of accounting policies and estimate of deferred tax is available in Note 4.23.

Current tax has been computed in accordance with the Inland Revenue Act No. 10 of 2006 and amendments thereto. The companies within the Group are liable to income tax at 28%. The tax on export profits is 12%.

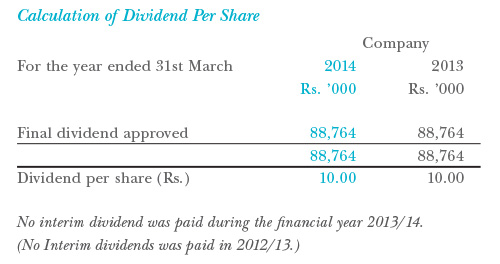

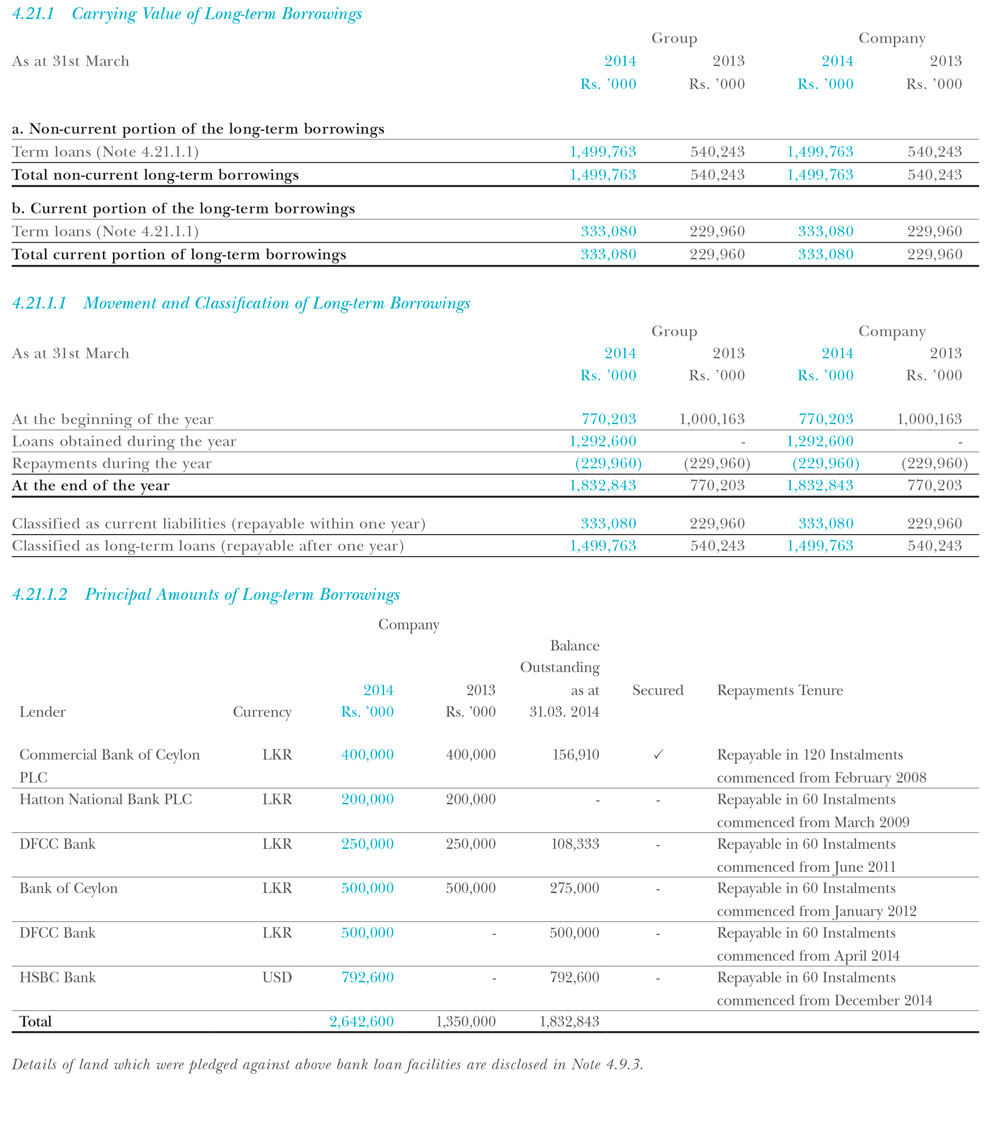

Withholding tax on the final dividend approved on 23rd May 2014 is Rs. 8.8 mn. The actual liability arises in the year in which dividend is paid. Therefore, no liability is recognised in these Financial Statements.

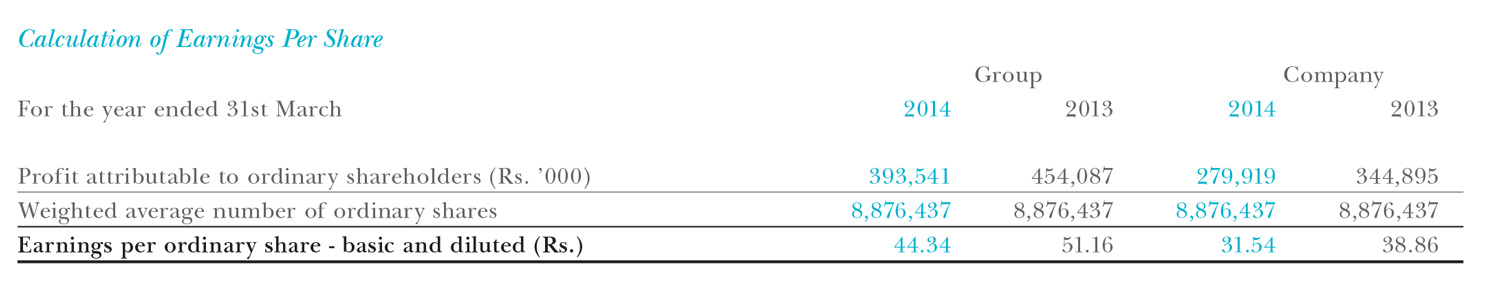

Earnings per share has been calculated by dividing the profit for the year attributable to equity holders of the Company by the weighted average number of ordinary shares outstanding during the year.

The weighted average number of ordinary shares outstanding during the year and the previous year are adjusted for events that have changed the number of ordinary shares outstanding during the year.

On 23rd May 2014, the Board of Directors of the Company has recommended the payment of a first and final dividend of Rs. 10.00 per share for the year ended 31st March 2014 (2012/13 - final dividend of Rs. 10.00 per share). In accordance with the - LKAS 10 on ‘Events after the Reporting Period’, this final dividend has not been recognised as a liability in the Financial Statements as at 31st March 2014.

As required by Section 56 of the Companies Act No. 07 of 2007, the Board of Directors of the Company satisfied the solvency test in accordance with Section 57, prior to recommending the final dividend. A statement of solvency completed and duly signed by the Directors on 23 May 2014 has been audited by Messrs KPMG, Chartered Accountants.

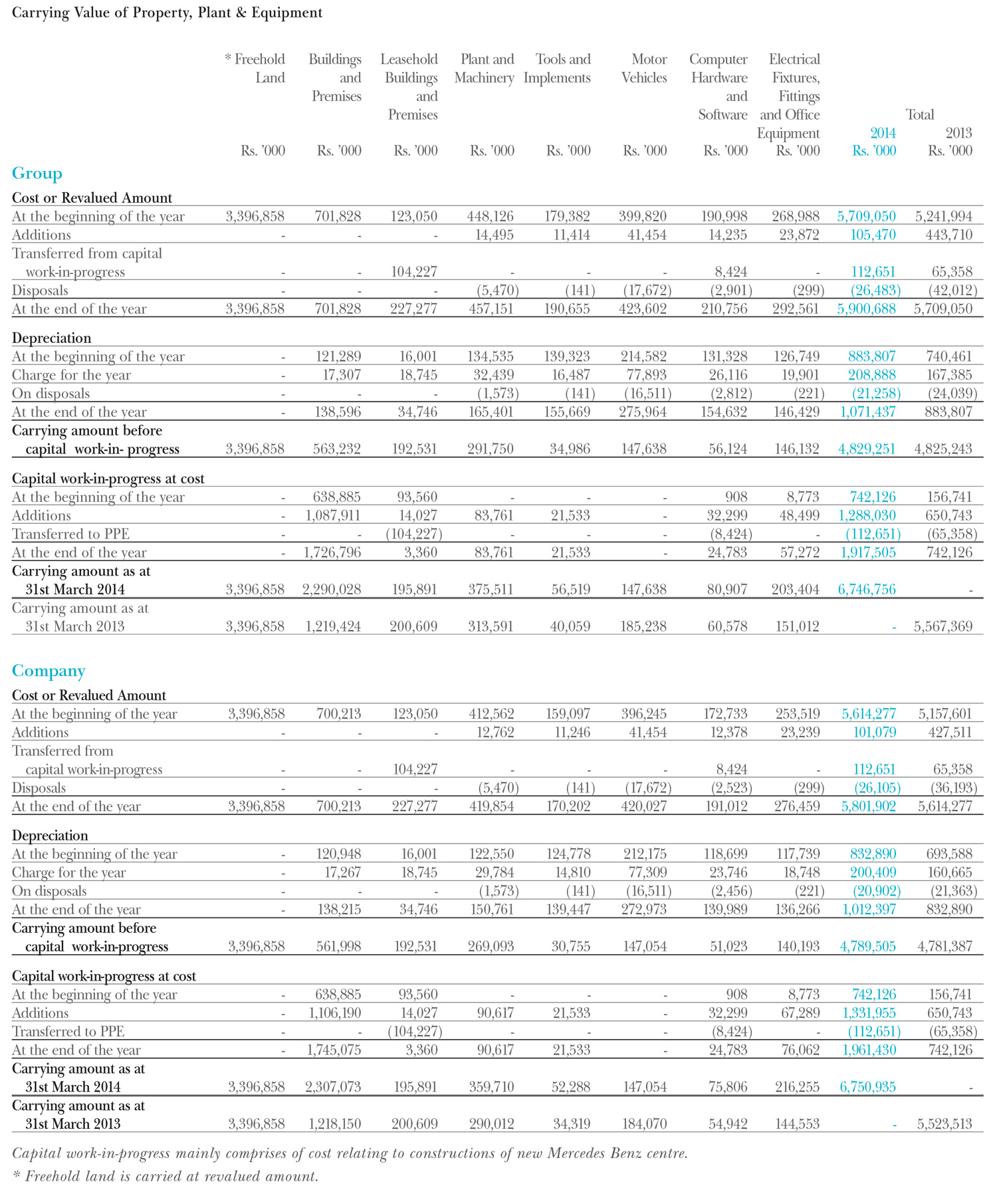

Property, plant & equipment are recognised if it is probable that future economic benefits associated with the asset will flow to the Group/Company and cost of the asset can be measured reliably.

Purchased software which is integral to the functionality of the related equipment is capitalised as part of that equipment.

Basis of measurement

All property, plant & equipment are initially measured at its cost. Cost includes expenditure that is directly attributable to the acquisition of the asset and subsequent costs. The cost of self-constructed assets includes the cost of materials, direct labour, any other costs directly attributable to bringing the asset to a working condition for its intended use, the costs of dismantling and removing the items and restoring the site on which they are located and borrowing costs that are directly attributable to the asset under construction.

Cost model

Property, plant & equipment (excluding freehold land), is stated at cost, net of accumulated depreciation and accumulated impairment losses, if any.

When an asset’s carrying value is higher than it’s estimated recoverable amount, the carrying value is written down to its recoverable amount. (please refer 3.9 - Impairment of non-financial assets)

Revaluation model

Freehold land is stated at cost at the time of acquisition and subsequently measure at fair value at the next revaluation. The Group policy is to revalue all freehold land at every three years or when there is a substantial difference between the fair value and the carrying amount.

Any revaluation surplus is recognised in Other Comprehensive Income and accumulated in equity in the capital reserve, except to the extent that it reverses a revaluation decrease of the same asset previously recognised in the Income Statement, in which case the increase is recognised in the Income Statement. A revaluation deficit is recognised in the Income Statement, except to the extent that it offsets an existing surplus on the same asset recognised in the capital reserve. Upon disposal, any revaluation reserve relating to particular assets being sold is transferred to retained earnings.

Subsequent cost

When significant parts of a property, plant and equipment are required to be replaced at regular intervals, the Group derecognises the replaced part, and recognises the new part with its own associated useful life and depreciated accordingly. Ongoing repair and maintenance costs are recognised in the Income Statement as incurred.

Derecognition

An item of property, plant & equipment is derecognised upon disposal, replacement or when no future economic benefits are expected from its use or disposal. Any gain or loss arising on derecognition of the asset is included in the Income Statement in the period the asset is derecognised.

Depreciation

Depreciation is based on straight-line method over the estimated useful lives of the assets. Freehold land is not depreciated.

Depreciation of an asset begins from the date they are available for use or in respect of self constructed assets from the date that the asset is completed and ready for use. Depreciation ceases at the earlier of the date that the asset is classified as held for sale and the date that the asset is derecognised.

Class of Asset |

Year |

Buildings |

36 - 40 |

Buildings on leasehold land |

Over the lease period |

Plant and machinery |

08 - 13 |

Workshop Implements |

03 - 04 |

Motor vehicles |

03 - 04 |

Furniture & Fittings |

09 - 13 |

Office equipment & electrical fittings |

06 - 10 |

Computer hardware & software |

03 - 04 |

Residual values, useful lives and methods of depreciation are reviewed at each financial year end and adjusted if appropriate.

Capital work-in-progress

Capital work-in-progress is stated at cost, including borrowing costs, less any accumulated impairment losses. These would be transferred to the relevant asset category in PPE when the asset is completed and available for use i.e. when it is in the location and condition necessary for it to be capable of operating in the manner intended by management.

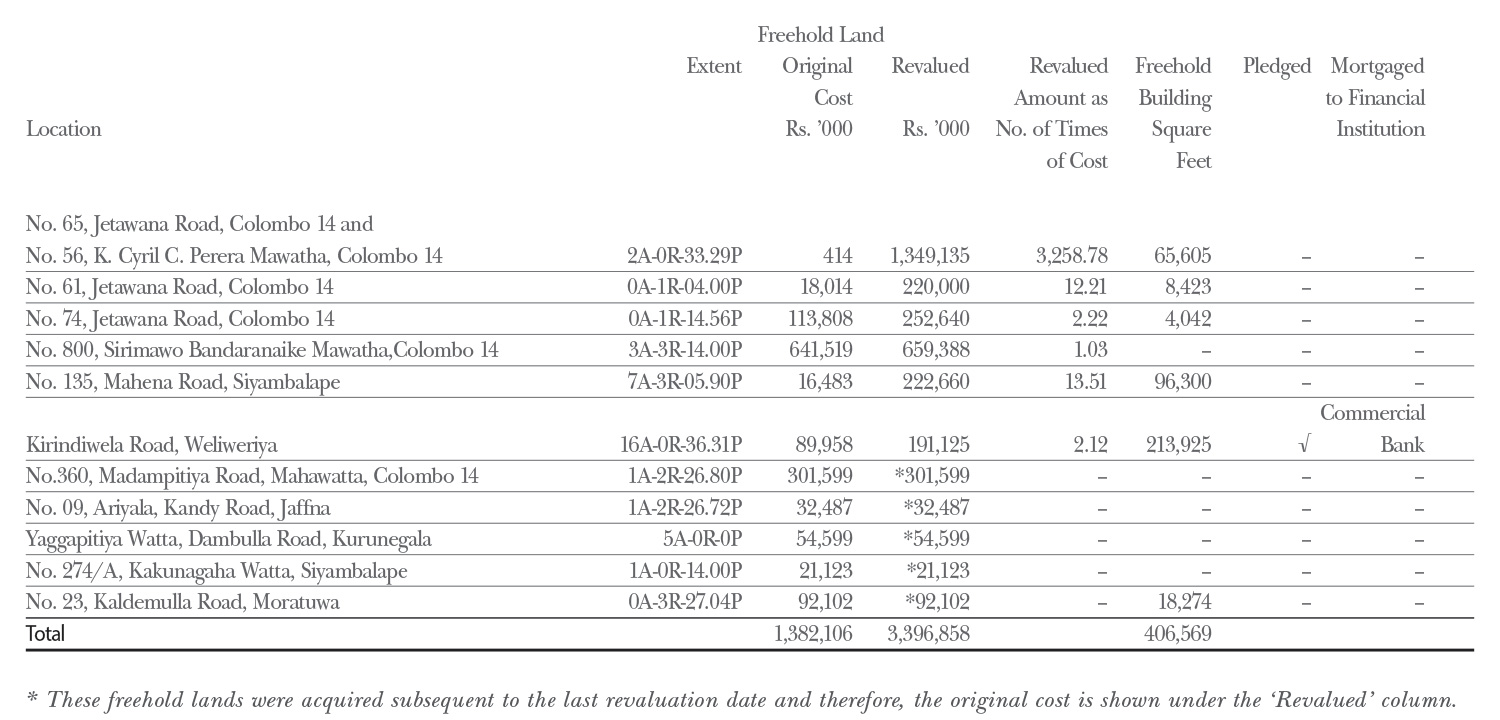

Freehold land was revalued as at 30th September 2011 by Mr. K. Arthur Perera, A.M.I.V. (Sri Lanka) who is a professionally qualified independent valuer.

The revaluation was carried out by taking into account the observable prices in active market or recent market transactions on arm’s length terms, adjusted for any difference in the nature, location or condition of the specific property.

The revaluation surplus, amounting to Rs. 879.14 mn was credited to the capital reserve account during the year 2011/12.

The value of freehold land has been written up to correspond with the market value and the details are as follows:

Property, plant & equipment totalling to Rs.435.6 mn (2013 - Rs. 433 mn) at cost have been fully depreciated and continue to be used by the Group. The cost of fully-depreciated assets of the Company amounted to Rs. 404.6 mn (2013 - Rs. 403 mn).

Land and buildings with a carrying value of Rs. 191 mn (2013 - Rs. 666 mn) have been pledged as security against term loans obtained.

There is no permanent fall in the value of property, plant & equipment which require a provision for impairment.

There were no restrictions that existed on the title to the property, plant & equipment of the Group/Company as at reporting date.

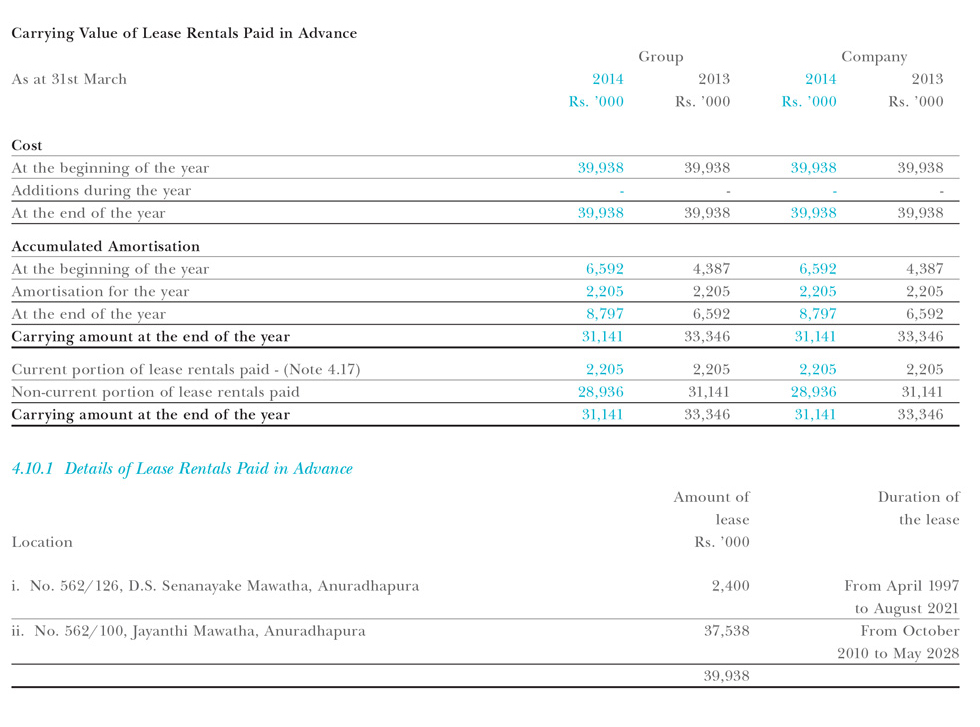

Lease rentals paid in advance is stated at cost less accumulated amortisation. Such carrying amounts are amortised over the remaining lease period or useful life of the leasehold property whichever is shorter.

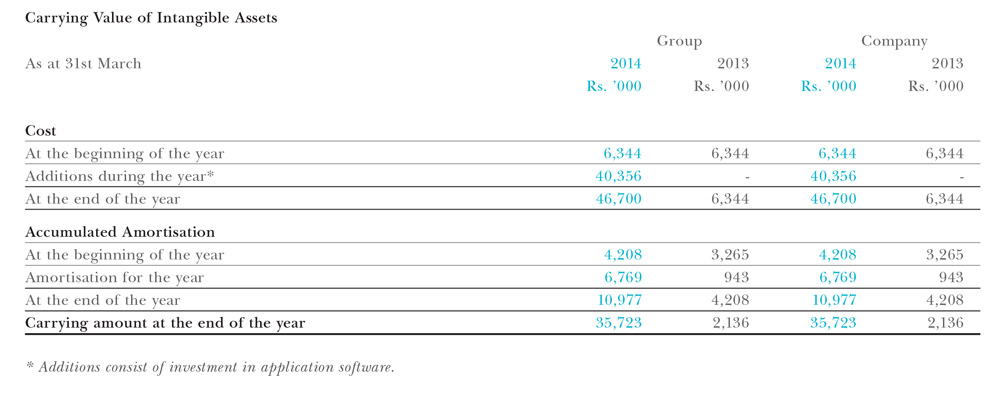

Basis of recognition

An intangible asset is recognised if it is probable that future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably.

Basis of measurement

Acquired Intangible assets are measured at cost less accumulated amortisation and accumulated impairment losses.

Subsequent expenditure

Subsequent expenditure is capitalised only when it increases the future economic benefits embodied in the specific asset to which it relates. All other expenditure is recognised in the Income Statement when incurred.

Useful economic lives, amortisation

Intangible assets with finite lives are amortised on a straight-line basis over their estimated useful life from the date that they are available for use. These assets are assessed for impairment whenever there is an indication that the intangible asset may be impaired.

Intangible assets mainly represent cost of computer software and the amortisation rate is as follows:

Computer software 4 Years

Above rate is consistent with the rate used in the previous years. Amortisation methods, useful lives and residual values are reviewed at each reporting date and adjusted if appropriate.

Derecognition

Intangible assets are derecognised on disposal, replacement or when no future economic benefits are expected from its use. Any gain or loss arising on derecognition of the asset is included in the Income Statement in the period the asset is derecognised.

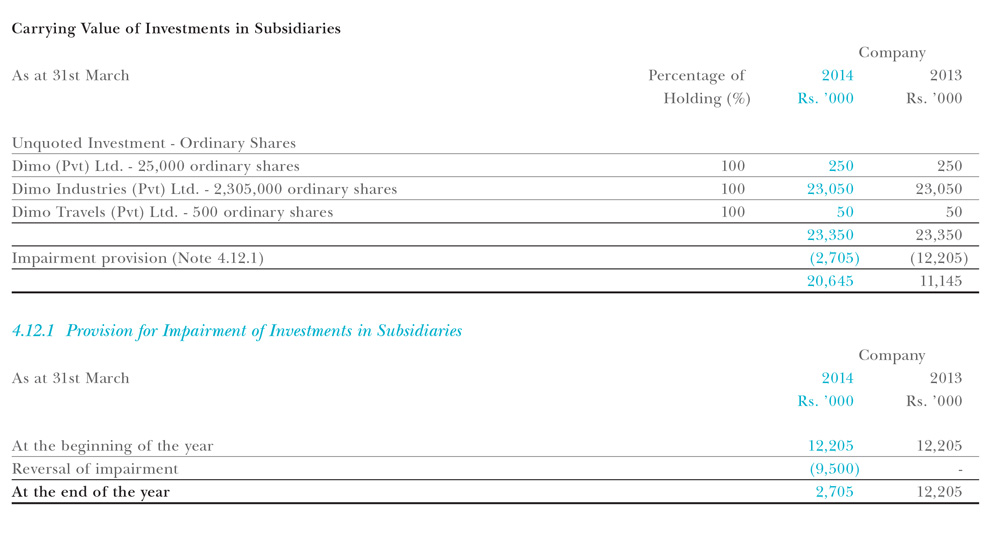

Investments in subsidiaries are recorded at cost less impairment in the Financial Statements of the Company. The net assets of each subsidiary are reviewed at each reporting date to determine whether there is any indication of impairment. If any such indication exists, then the recoverable amount of the investment is estimated and the impairment loss is recognised to the extent of its net assets loss.

An impairment assessment was carried out as at 31st March 2014 and it was concluded that net realisable value of all the investments included under unquoted investments exceed its carrying value except for DIMO Industries (Pvt) Ltd. Based on an assessment made for impairment, a provision of Rs. 2.7 mn (2012/13 - Rs. 12.2 mn) in relation to the investment in Dimo Industries (Pvt) Ltd. was considered to be adequate as at reporting date. The management has implemented a revitalisation plan for Dimo Industries (Pvt) Ltd. and commenced tyre trading activities with effect from 1st April 2013.

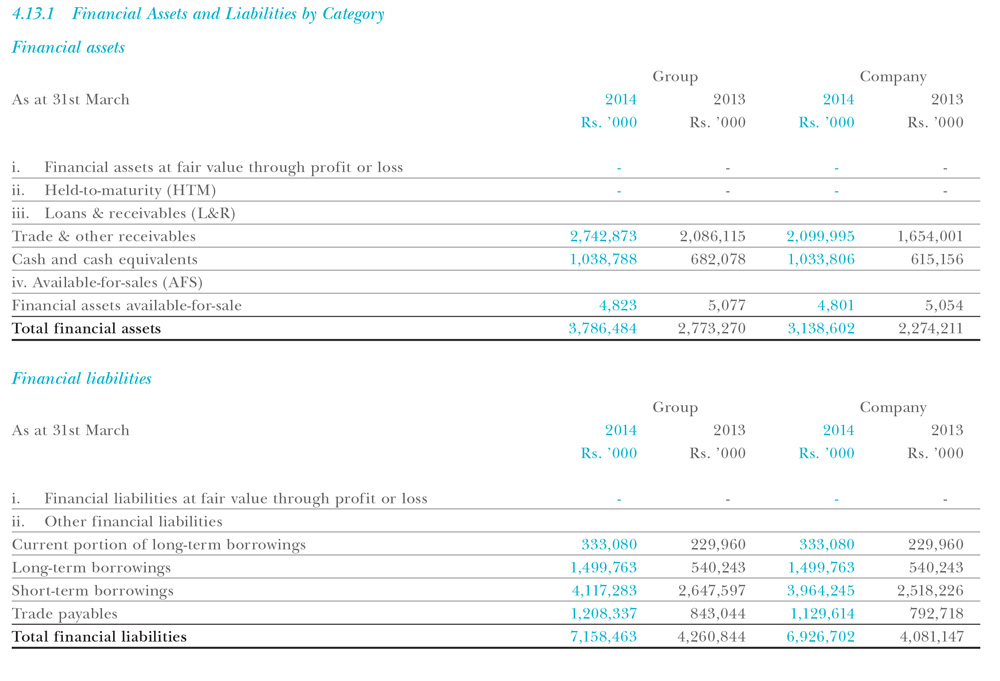

Initial recognition and measurement

Group/Company classifies financial assets at initial recognition as available-for-sale financial assets or loans and receivables based on the purpose of each investment. At the end of each reporting period all classifications are re-evaluated to the extent that such classification is permitted and required.

All the financial assets are initially recognised at fair value plus directly attributable transaction cost.

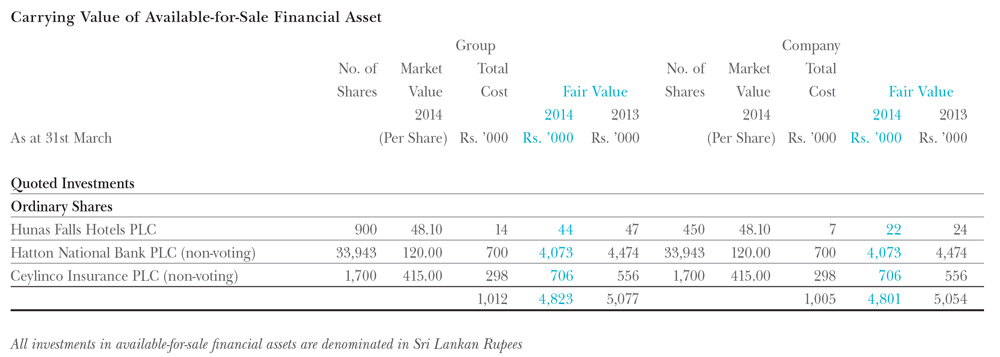

Available-for-sale financial assets (AFS)

Available-for-sale financial assets are those non-derivative financial assets that are designated as available for sale financial assets or are not classified as loans and receivables, held-to-maturity investments or financial assets at fair value through profit or loss.

Available-for-sale financial assets consist of investments in quoted shares held for earnings on income or for capital appreciation.

Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. Loans and receivables mainly consist of trade and other receivables.

Derecognition of financial assets

A financial asset (or, where applicable a part of a financial asset or part of a group of similar financial assets) is derecognised when:

a. The right to receive cash from the asset has expired

b. The Group has transferred its right to receive cash flows from the asset or has assumed an obligation to pay the received cash in full without material delay to a third party under a ‘pass through’ arrangement, and either,

i. The Group: has transferred substantially all the risks and rewards of the asset, or

ii. has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset

Initial recognition and measurement

Group classifies financial liabilities at initial recognition as other financial liabilities. At the end of each reporting period all classifications are re-evaluated to the extent that such classification is permitted and required.

All the financial liabilities are initially recognised at fair value, net of transaction cost. Other financial liabilities mainly consist of trade and other payables and bank borrowings. Subsequently they are carried at amortised cost.

Derecognition

A financial liability is derecognised when the obligation under the liability is discharged or cancelled or expires.

Offsetting of financial assets and liabilities

Financial assets and financial liabilities are offset and the net amount is reported in the Statement of Financial Position if, and only if, there is a currently enforceable legal right to offset the recognised amounts and there is an intention to settle on a net basis, or to realise the assets and settle the liabilities simultaneously.

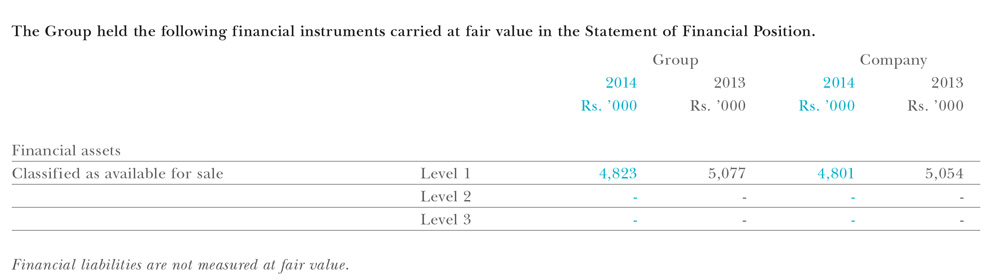

Fair value estimation of financial assets and liabilities

The Group/Company uses the following hierarchy for determining and disclosing the fair value of financial instruments.

Level 1: quoted (unadjusted) prices in active markets for identical assets or liabilities;

Level 2: other techniques for which all inputs with significant effects on the recorded fair values are observable, either directly or indirectly;

Level 3: techniques that use inputs that have a significant effect on the recorded fair values that are not based on observable market data.

The group’s activities are exposed it to a variety of financial risks such as;

a. Market risk (Including currency risk, fair value interest rate risk and cash flow interest rate risk)

b. Credit risk

c. Liquidity risk

The groups’ overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the groups’ financial performance.

The overall objectives and policies for the Group’s financial risk management are as per the internal treasury practices. It will cover foreign exchange policy, Investment policy, financing policy and policies on credit risk and risk limits.

(a) Market risk

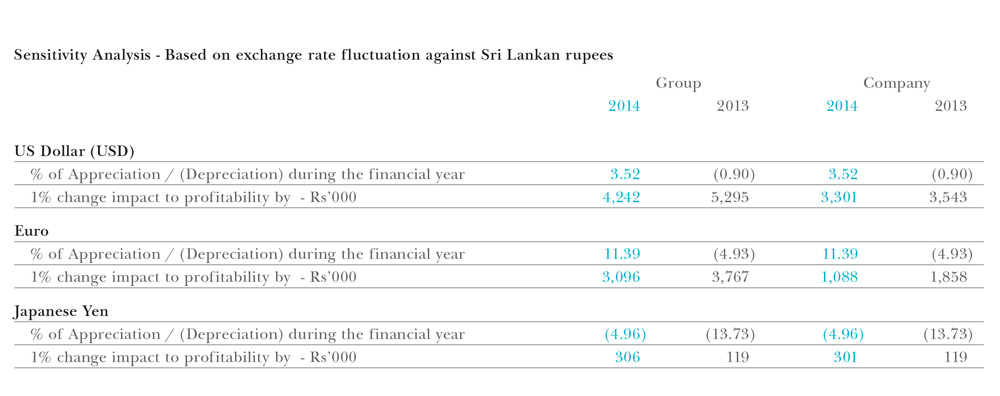

(i) Foreign exchange risk

The Group is sensitive to the fluctuations in exchange rates and is principally exposed to fluctuations in the value of Sri Lankan Rupee (LKR) aginst the US Dollar (USD), Euro and Japanese Yen. Group’s functional currency is the Sri Lankan Rupee (LKR) in which most of the transactions are denominated and all other currencies are considered foreign currencies for reporting purposes. The Group had taken measures to manage risk by having foreign currency trade receivables and foreign currency bank accounts balances to cover the exposure on foreign currency payables. Hence the overall objective of foreign exchange risk management is to reduce the short term negative impact of exchange rate fluctuations on earnings and cash flow, thereby increasing the predictability of the financial results.

(ii) Interest rate risk

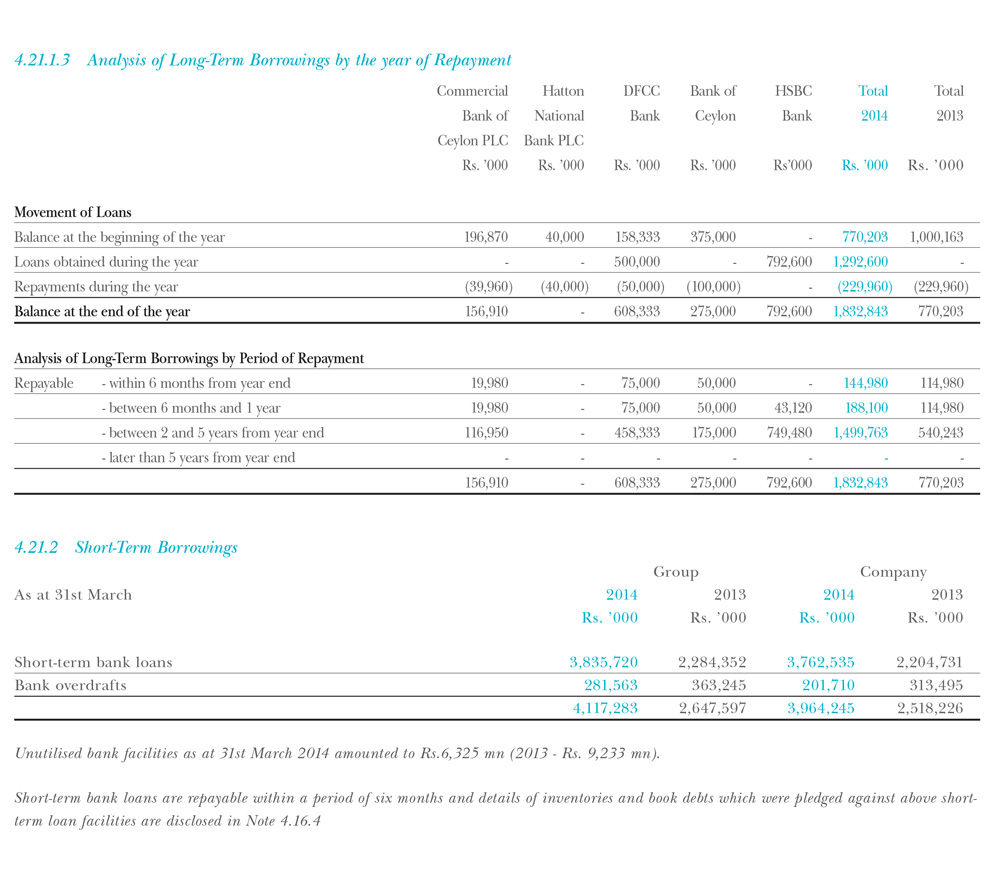

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The group’s exposure to the risk of changes in market interest rates relates primarily to the group’s long-term debt obligations with floating rates. The Group manages its interest rate risk by monitoring and managing cash flows, negotiating favourable rates on borrowings and deposits including and maintaining an appropriate combination of fixed and floating rate debt.

Sensitivity Analysis

If interest rates had been higher/lower by 100 basis points and all other variables were held constant, the profit before tax for the period ended 31 March 2014 would decrease/increase by 12.2 Mn (2013 Rs 7.7 Mn). This is mainly attributable to the Group’s exposure to interest rates on variable rate of interest.

(iii) Price risk

The Group is exposed to price risk because of investments in quoted shares held by the Group classified as financial assets available-for-sale. The value of these investments is subjected to the performance of investee company and the factors that affects the status of the stock market. Sensitivity analysis on the value of the investments is not provided as it is deemed to be not material.

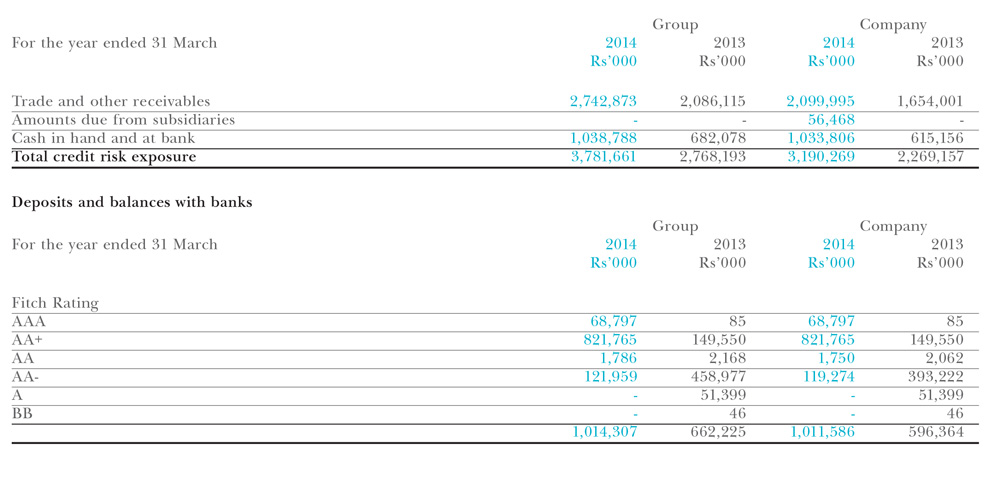

(b) Credit risk

The Group extends credit facilities to customers during the course of business. Therefore, non-payment of trade debts is a key risk associated with trade receivables.

The Group has taken several measures to manage and mitigate the credit risk including carrying out a credit evaluation as per the Group credit policy, prior to extending credit. A review of age analysis of trade debtors and follow-up meetings are carried out by the business unit managers at least once a month and by the Group Management Committee (GMC) at least once a quarter. In the event of a debt becoming doubtful, legal action is initiated by the Manager - Legal.

Credit risk exposure

The maximum risk exposure of financial assets which are generally subject to credit risk are equal to their carrying amounts. Following table shows the maximum risk positions.

(c) Liquidity risk

This is the risk that the group will encounter in meeting the obligations associated with it’s financial liabilities that are settled by delivering cash or another financial asset.

In the management of liquidity risk, the Group monitor and maintain a level of cash and cash equivalents deemed adequate by the management to finance the Group’s operations and to mitigate the effects of fluctuations in cash flows. The Group’s objective is to maintain a balance between continuity of funding and flexibility through the use of bank overdrafts and bank loans. Access to source of funding is sufficiently available.

Maturity profiles and specific risk management strategies with regards to trade payables and bank borrowings are given in the respective notes.

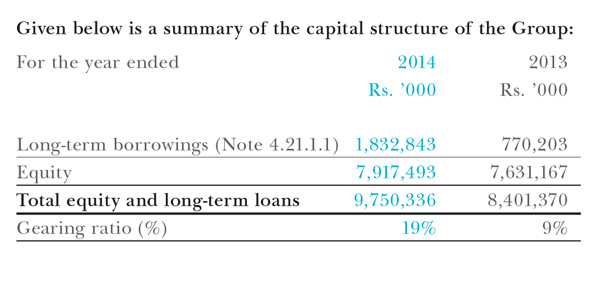

The objectives of the capital management can be summarised as follows:

a. Appropriately allocate capital to meet strategic objectives.

b. Enable the Group to face any economic down turn/ crisis situation.

The Group’s policy is to maintain a strong capital base so as to ensure investor, creditor and market confidence in order to sustain future development of the business. The impact of the shareholders’ return is also recognised and the Group recognises the need to maintain a balance between higher returns that might be possible with greater gearing and the advantages and security afforded by a sound capital position.

The Company manages its capital structure and adjusts it accordingly in line with changes in global and local economic and market conditions and its overall risk appetite.

Available-for-sale financial assets are subsequently measured at fair value and the resulting unrealised gains and losses arising from changes in the fair value are recognised in Other Comprehensive Income (available-for-sale reserve). When financial assets classified as available-for-sale are sold or impaired, the accumulated fair value adjustments are included in the Income Statement.

The fair values of quoted shares are based on current bid prices at the end of the reporting period.

Dividend income is recognised in the Income Statement when the Group becomes entitled to receive the dividend.

The Group assesses at each reporting date whether there is any objective evidence that an asset or a group of assets is impaired. In the case of equity investments classified as available-for-sale, objective evidence would include a significant or prolonged decline in the fair value of the investment below its cost. ‘Significant’ is evaluated against the original cost of the investment and ‘prolonged’ against the period for which the fair value has been below its original cost. Where there is evidence of impairment, the cumulative loss measured as the difference between the acquisition cost and the current fair value, is removed from Other Comprehensive Income (available-for-sale reserve)

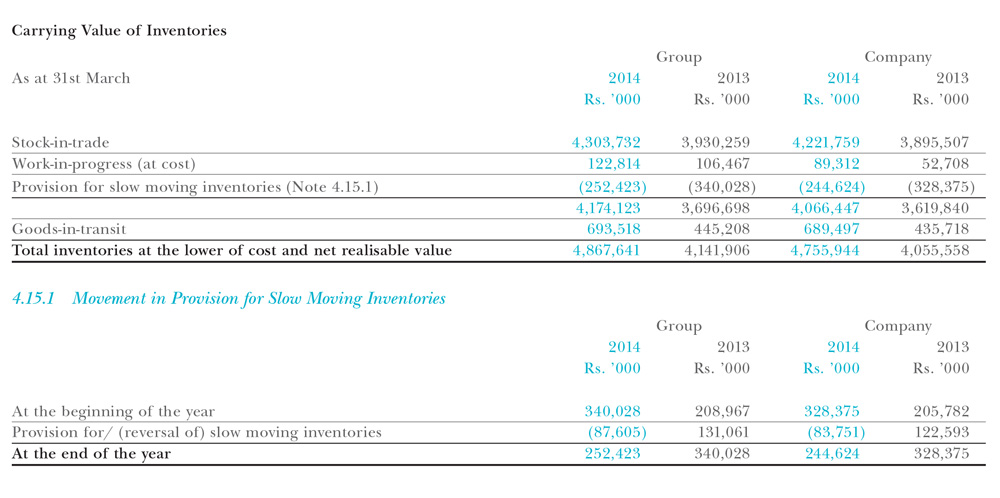

Inventories are measured at the lower of cost and net realizable value.

The cost of inventories that are not interchangeable are recognized by using specific identification of their individual cost and other inventories are based on weighted average cost formula. The cost of inventories includes expenditure incurred in acquiring the inventories and other costs incurred in bringing them to their present location and condition but excluding borrowing cost.

Net realizable value is the estimated selling price in the ordinary course of business less the estimated selling expenses.

Goods-in-transit are recognised at purchase cost.

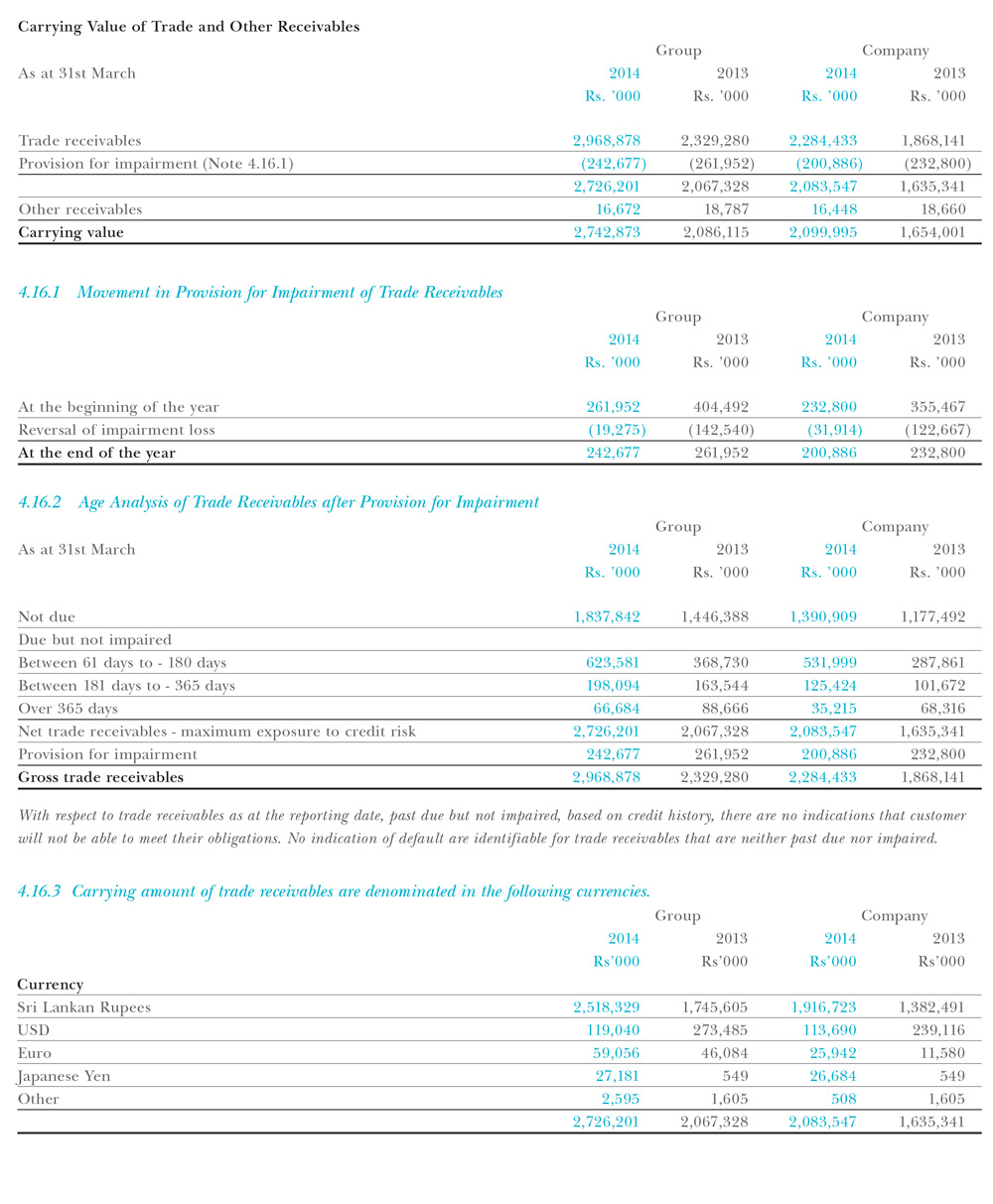

Trade receivables are amounts due from customers for goods sold or services performed in the ordinary course of business. Other financial nature receivables are recognised as other receivables. If collection is expected in one year or less (or in the normal operating cycle of the business if longer), they are classified as current assets. If not, they are presented as non-current assets.

Trade and other receivables are initially recognised at fair value and subsequently measured at amortised cost using the effective interest method, less provision for impairment.

The Group/Company considers evidence of impairment for receivables at both specific asset level and at collective level. All individually significant receivables are assessed for specific impairment by considering objective evidences i.e. Experiencing a significant financial difficulty or default in payments by a customer. Receivables that are not individually assessed are then collectively assessed for any impairment by grouping receivables together with similar risk characteristics.

In assessing collective impairment, the Group/Company uses historical trends of the probability of default, the timing of recoveries, and the amount of losses incurred, adjusted for management’s judgment as to whether current economic and credit conditions are such that the actual losses are likely to be greater or less than suggested historical trends.

4.16.4 Trade debtors jointly with inventories are pledged as security for short-term borrowings up to a limit of Rs.95 mn (2012/13 - Rs. 95 mn).

Trade and other receivables are non-interest-bearing and are expected to be received before 60 days.

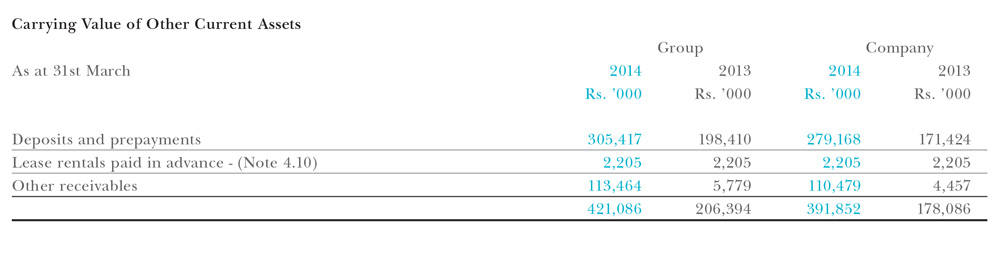

The Group/Company classifies all non financial current assets under other current assets. Other current assets mainly comprises of advances, deposits, prepayments and current portion of the lease rentals paid in advance.

Advances and deposits are carried at historical value less provision for impairment. Prepayments are amortised over the period during which it is utilised and carried at historical value less amortisation charge and any impairment.

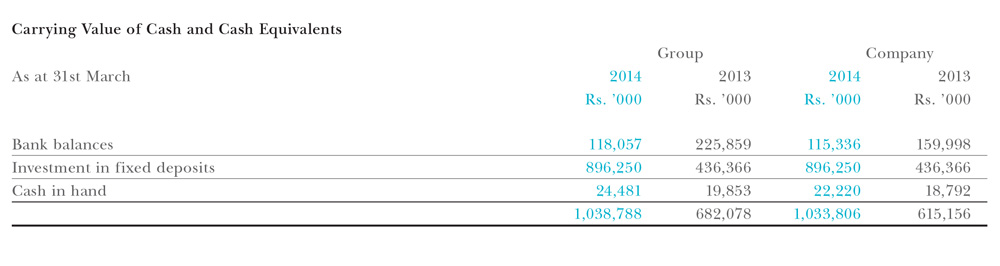

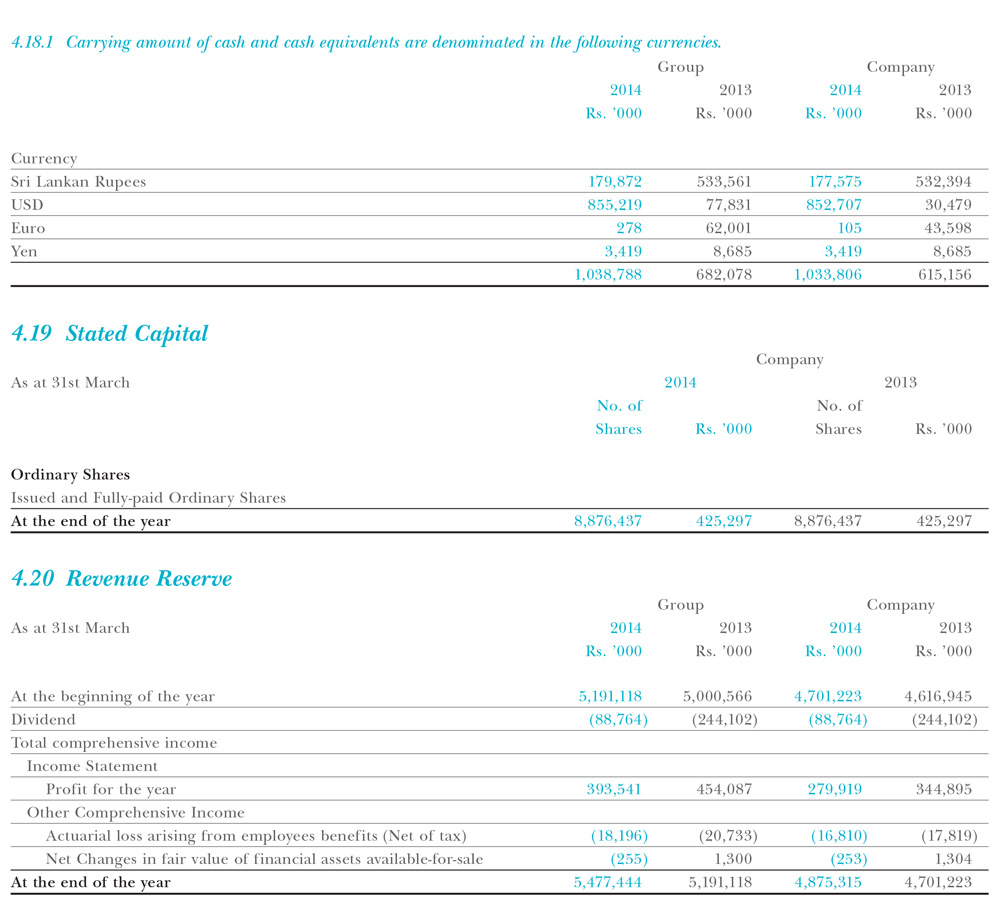

Cash and cash equivalents comprise of cash balances, investments in short-term deposits with an original maturity of three months or less. Cash and Bank balances are stated at recoverable values. Short-term deposits are stated at recoverable value of the deposit. There were no cash and cash equivalents held by the Group companies that were not available for use.

Bank overdrafts and short-term borrowings that are repayable on demand and forming an integral part of the Group’s cash management are included as a component of cash and cash equivalents for the purpose of the Statement of Cash Flows.

Review of Credit & Interest Rate Risks

The Group’s cash and cash equivalents comprise of bank balances and fixed deposits which are invested in commercial banks and does not bear a credit risk.

Fixed deposits have been placed with the maturity period less than three months and carrying a fixed rate of interest. Investments in fixed deposits are made for varying periods of between one month to three months.

Borrowings are initially recognised at fair value net of transactions cost. Subsequently, they are stated at amortised cost; any difference between the proceeds (Net of transaction cost) and the repayable amount (including interest) is recognised in the Income Statement over the period of the loan using effective interest method.

Defined contribution plans

A defined contribution plan is a post-employment benefit plan under which an entity pays fixed determinable contributions into a separate entity and will have no legal or constructive obligation to pay further amounts.

Employees are eligible to Employees’ Provident Fund (EPF) contributions and Employees’ Trust Fund (ETF) contributions as per the respective statutes. These obligations come within the scope of a defined contribution plan as per LKAS -19 on ‘Employee Benefits’. The contributions made are expensed to the Income Statement as and when the contributions are made.

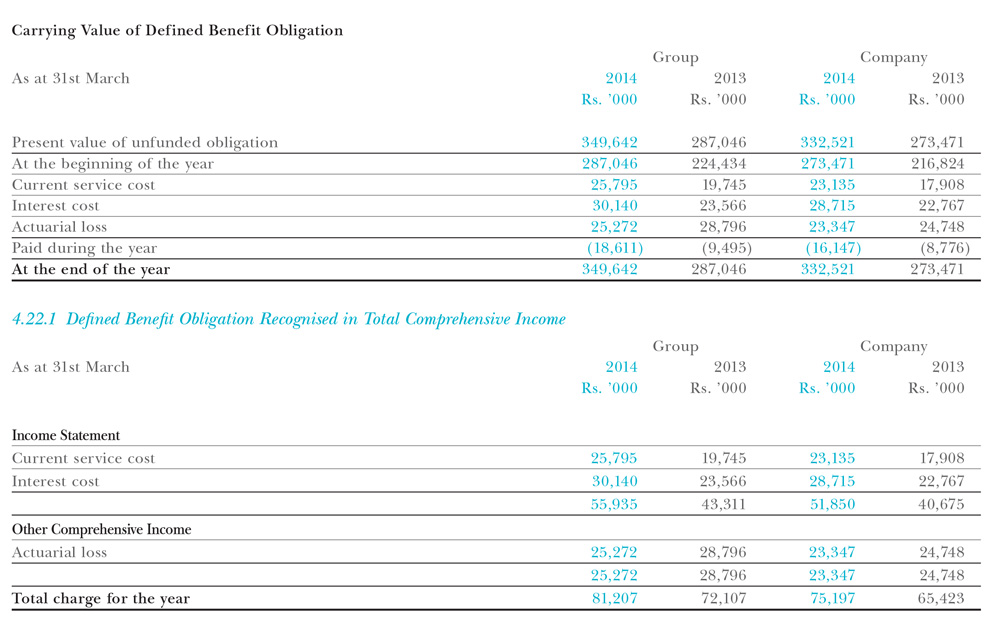

Defined benefit obligations

In accordance with the Gratuity Act No. 12 of 1983, a liability arises for a defined benefit obligation to employees. Such defined benefit obligation is a post-employment benefit obligation falling within the scope of Sri Lanka Accounting Standard LKAS -19 on ‘Employee Benefits’.

The liability recognised in the Statement of Financial Position is the present value of the defined benefit obligation at the reporting date. The calculation is performed annually by a qualified actuary using the projected unit credit method (PUC). Any actuarial gains and losses arising are recognised immediately in Other Comprehensive Income. The discount rate has been derived considering the yield of government bonds.

The liability is not externally funded.

The actuarial valuation involves making assumptions about discount rates, expected rates of return on assets, future salary increases, and mortality rates. Due to the long term nature of these obligation, such estimates are subject to significant uncertainty.

An actuarial valuation was carried out by Mr. M. Poopalanathan, AIA, of Messrs Actuarial and Management Consultants (Pvt) Ltd., a firm of professional actuaries as at 31st March 2014.

The following assumptions and data were used in valuing the defined benefit obligation by the actuarial valuer:

Assumptions regarding future mortality are based on a 67/70 mortality table, issued by the Institute of Actuaries, London.

Normal retirement age of an executive employee is assumed to be 60 years while a non-executive employee is assumed to retire at the age of 55 years.

The current service cost for the year under review is included under Administration Expenses.

However, according to the Payment of Gratuity Act No. 12 of 1983, the liability for gratuity to an employee arises only on completion of five years of continuous service. The liability as required by the Payment of Gratuity Act for the Group and the Company as at 31st March 2014 amounted to Rs. 330 mn and Rs. 316 mn respectively.

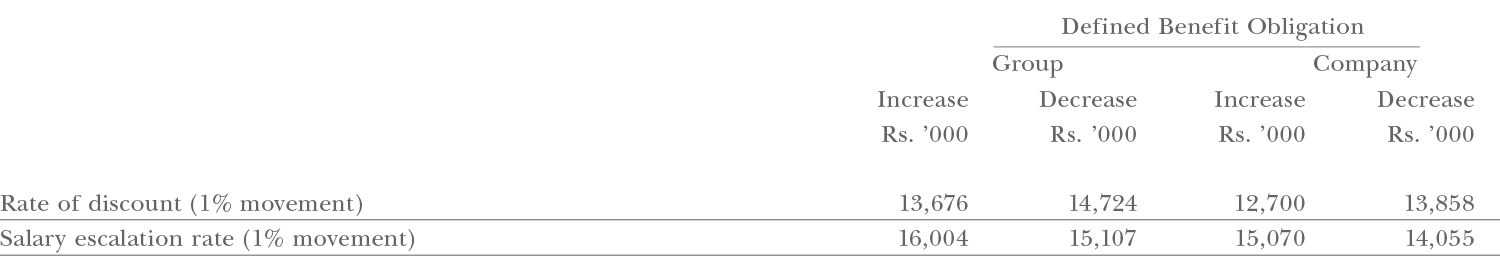

Sensitivity Analysis

Reasonably possible changes at the reporting date to one of the relevant actuarial assumptions, holding other assumptions constant, would have affected defined benefit obligation by the amounts shown below.

Deferred tax is provided using liability method on temporary differences as at the reporting date between the tax written down value and their carrying amounts in financial reporting, for Company and Group.

Deferred tax provision is calculated by applying on the temporary difference, the income tax rate that is applicable at the time of reversal. In the absence of the availability of the income tax rate applicable on the reversal date, the income tax rate applicable on the reporting date is used.

A deferred tax asset is recognised only to the extent that it is probable that future taxable profits will be available against which the temporary difference can be utilised.

The carrying amount of deferred tax assets is reviewed at each reporting date and reduced to the extent that is no longer probable that sufficient taxable profits will be available to allow all or part of the deferred tax assets to be utilised. Unrecognised deferred tax assets are reassessed at each reporting date and are recognised to the extent that it is probable that future taxable profits will allow the deferred tax assets to be recovered.

Deferred tax assets are recognised in respect of tax losses to the extent that it is probable that future taxable profits will be available against which the losses can be utilised. Judgment is required to determine the amount of deferred tax assets that can be recognised, based upon the likely timing and level of future taxable profits.

Undelivered free services relating to vehicle sales

The Company sells vehicles bundled with free services to the customers with warranty limitations on mileage or usage period. The unprovided free services are deferred at the time of selling the vehicles at its relative fair value and recognised as revenue when the recognition criteria are fulfilled i.e. upon provision of the service or expiration of entitled period or/and criteria, whichever occurs first.

Relative fair value of free services

The amount charged by the service provider in respect of each service is recognised as the relative fair value of free services. These amounts are estimated using the combination of historical experience in service and price changes.

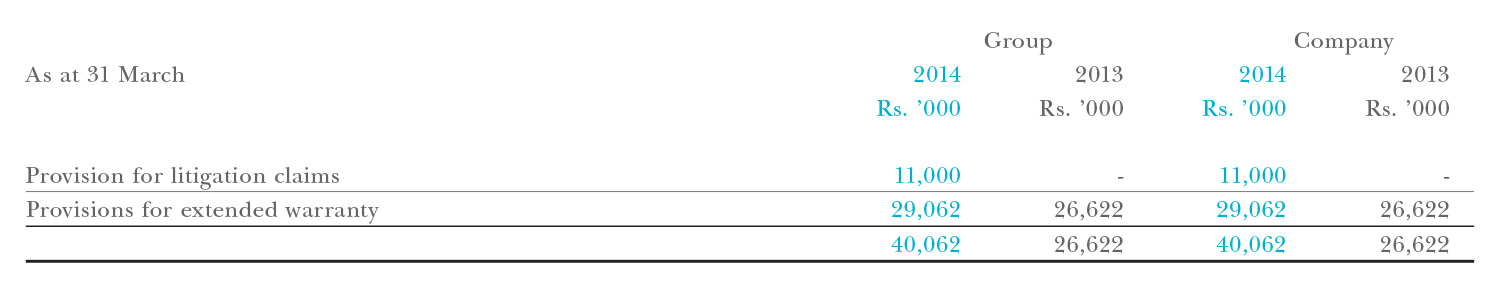

Provisions

Provisions are recognised when the Group/Company has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. Where the Group expects some or all of a provision to be reimbursed, for example under an insurance contract, the reimbursement is recognised as a separate asset when the reimbursement is certain. The expense relating to any provision is presented in the Income Statement net of any reimbursement. If the effect of the time value of money is material, provisions are discounted using a current pre-tax rate that reflects, where appropriate, the risks specific to the liability. Where discounting is used, the increase in the provision due to the passage of time is recognised as a finance cost.

Provisions are calculated based on the historical experience and the specific terms in the individual cases. The Group arrives at an estimate on the basis of an evaluation of the most likely outcome.

All known provisions have been accounted for in preparing the Financial Statements.

Provisions for extended warranty

The Company may offer extended warranties on vehicles on its own account in certain circumstances. The extended warranty is provided by giving a warranty period that goes beyond the warranty provided by manufacturers.

A provision for warranty is recognised when the underlying products are sold. The quantum of the provision is based on the historical experience. The said extended warranty provision will be reversed upon expiration of warranty period.

The Management considers likelihood of any claim succeeding in making provisions. The time of concluding legal claims is uncertain, as is the amount of possible outflow of economic benefits. Timing and cost ultimately depend on the due process in the respective legal jurisdictions.

Contingent liabilities

Contingent Liabilities are possible obligations whose existence will be confirmed only by uncertain future events or present obligations where the transfer of economic benefit is not probable or cannot be readily measured. Further, provisions for which no reliable estimate can be made are disclosed as contingent liabilities.

Currently the Group/Company is involved in pending litigations and claims arising out of the normal conduct of the business. Group/Company does not expect the pending litigations and claims, individually and in aggregate, to have a material impact on Group’s financial position, operating profit of cash flow in addition to amounts accrued as provision for legal disputes. Disclosure relating to contingencies are setout in Note 5.2.

Trade payables are obligations to pay for goods or services, that have been acquired in the ordinary course of business. Trade payable are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). If not, they are presented as non-current liabilities.

Trade payables are recognised initially at fair value and subsequently measured at amortised cost using the effective interest method.

Generally trade payables are due within ninety days.

Carrying Value of Trade Payables

Trade payables are non-interest-bearing and have settlement periods less than 90 days. The quick assets ratio of the Company as at the year-end was 0.70:1 (in 2012/13 - 0.72:1). As a liquidity risk management measure, the entities continually compare trade payables with receivables, cash and cash equivalents and unutilised banking facilities.

The trade payables of the Group include an amount of Rs. 693.5 million as bills payable corresponding to goods shipped but not received (Goods-in-Transit). At the time of settlement of such bills, entities will obtain short-term loans to cover the working capital cycle period of the imports.

Unutilised banking facilities are given in Note 4.21.2

Group classifies all non financial current liabilities under other current liabilities. Other current liabilities include accruals and advances and these liabilities are recorded at the amounts that are expected to be paid.

Carrying Value of Other Current Liabilities

Group |

Company |

|||

|

As at 31st March |

2014 |

2013 |

2014 |

2013 |

|

|

Rs. ’000 |

Rs. ’000 |

Rs. ’000 |

Rs. ’000 |

|

Advances received |

12,367 |

124,185 |

12,367 |

124,185 |

|

Interest payable |

6,568 |

8,035 |

6,568 |

8,035 |

|

Unclaimed dividend |

6,025 |

6,503 |

6,025 |

6,503 |

|

Value Added Tax (VAT) |

3,882 |

10,583 |

- |

5,269 |

|

Other payables and accrued expenses |

398,117 |

334,980 |

375,513 |

318,262 |

|

|

426,959 |

484,286 |

400,473 |

462,254 |

Other current liabilities are non-interest bearing and are payable within three months excluding advances and unclaimed dividends. Advances received are expected to be set-off within three months.

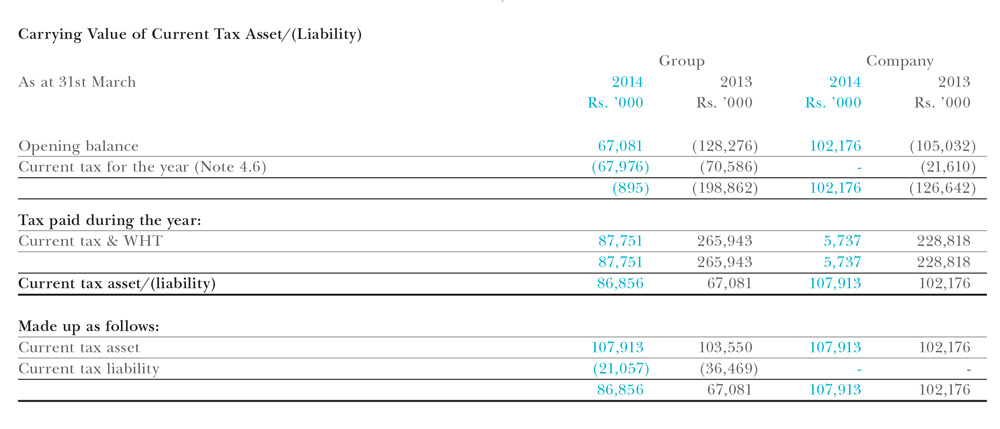

Current tax assets are recognised at historical value less impairment. Income tax liabilities are recorded at the amounts expected to be paid.

Carrying Value of Current Tax Asset/(Liability)

|

|

Group |

Company |

||

|

As at 31st March |

2014 |

2013 |

2014 |

2013 |

|

|

Rs. ’000 |

Rs. ’000 |

Rs. ’000 |

Rs. ’000 |

|

Opening balance |

67,081 |

(128,276) |

102,176 |

(105,032) |

|

Current tax for the year (Note 4.6) |

(67,976) |

(70,586) |

- |

(21,610) |

|

|

(895) |

(198,862) |

102,176 |

(126,642) |

|

Tax paid during the year: |

|

|

|

|

|

Current tax & WHT |

87,751 |

265,943 |

5,737 |

228,818 |

|

|

87,751 |

265,943 |

5,737 |

228,818 |

|

Current tax asset/(liability) |

86,856 |

67,081 |

107,913 |

102,176 |

|

Made up as follows: |

|

|

|

|

|

Current tax asset |

107,913 |

103,550 |

107,913 |

102,176 |

|

Current tax liability |

(21,057) |

(36,469) |

- |

- |

|

|

86,856 |

67,081 |

107,913 |

102,176 |

|

|

|

|

|

|