A close look at our risk management framework.

The constantly evolving economic/business environment and the challenging business operations present the Group with risks and opportunities. These risks have the potential to impact the capitals and the value creation activities. Thus, a need arises to identify and manage risks that may affect the value creation process in the short, medium and long term. The systematic approach required for risk management calls for measures that ensure that risks are identified on time, evaluated in terms of risk appetite of the Group and that effective management and monitoring mechanisms are installed.

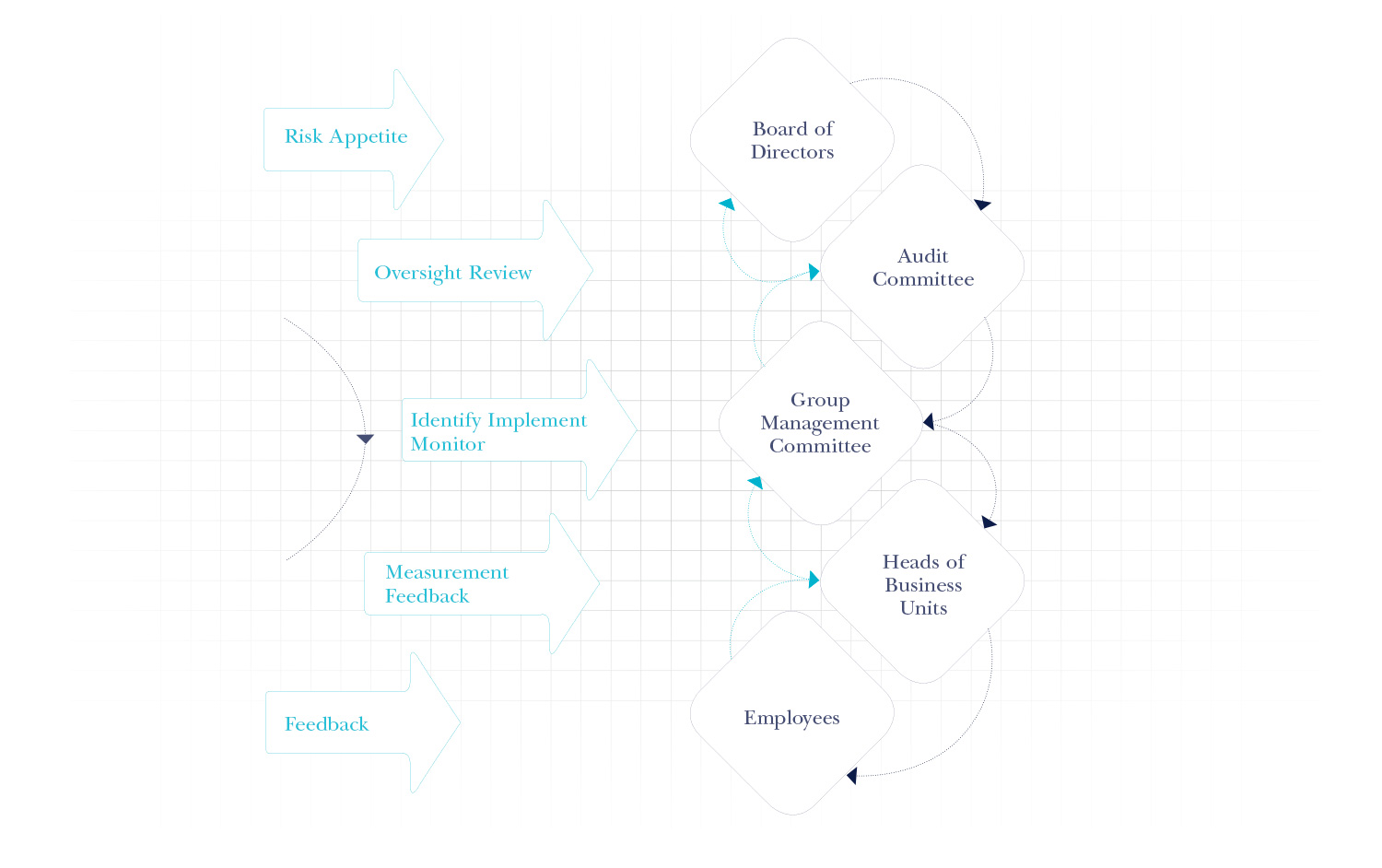

The Board is primarily responsible for ensuring that the risks are identified and appropriately managed across the Group through the value creation process and embedding this into the “Dimo way”. The Audit Committee has been delegated the responsibility for reviewing the effectiveness of the Group’s risk management process, including the systems established to identify, assess, manage and monitor risks. The Internal Audit function also plays a key role in risk identification.

The Group Management Committee (GMC) takes the lead at the implementation level in identifying risks. The GMC examines processes and events, uncertainties and changes in environment that expose the group to situations that could seriously reduce earnings, impair its liquidity position or create legal, regulatory or reputation risks. The GMC also evaluates options available to mitigate risks and to identify risks that do not match the risk appetite of the Group. Monitoring of risk management measures is a responsibility that rests with the GMC.

Heads of Business Units provide useful information and feed back to the GMC for risk management with the assistance of the employees of the Group

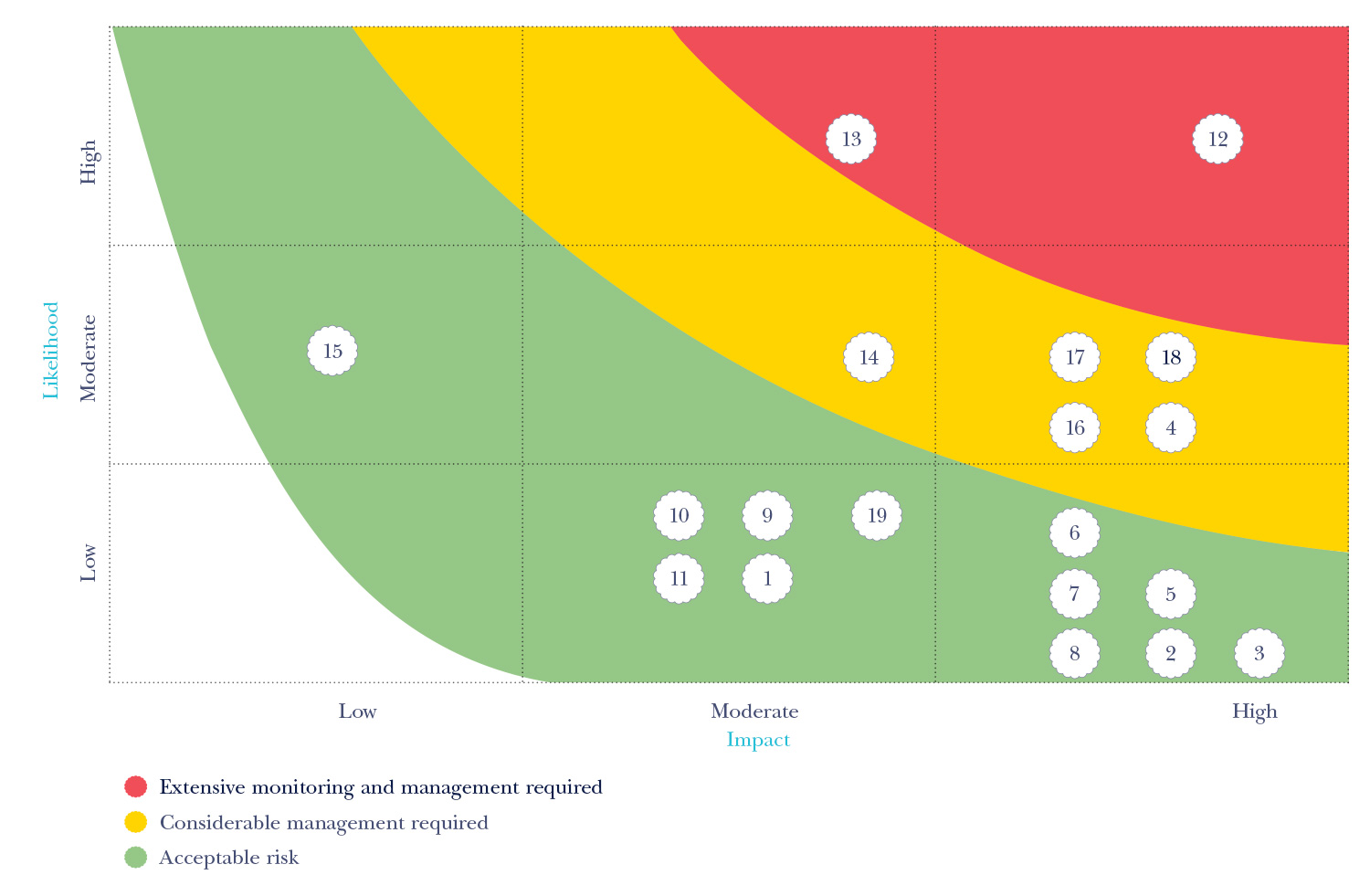

Where a risk is evaluated it takes into account the likelihood of an event and its potential impact on the business. Impacts are quantified or assessed in terms of potential loss or damage. Risks are assessed both as gross risk and net risk. The assessment of gross risk involves the potential harm it can cause without mitigating actions, whereas net risk assessment considers potential harm or loss when mitigating action is taken. Risks and their corresponding mitigating action plans are reviewed by the GMC.

Risk mapping is carried out in order to assess the likelihood of occurrence and consequences of an event/set of events:

Upon assessment of the likelihood of occurrence and the extent of the impact of each risk, it is subjected to the following matrix in order to derive the nature and intensity of action required.

The table given below sets out an assessment of risks that the value creation activities and capitals were subject to during the year and risk mitigating actions that were/are in place:

|

|

Category/ Segment affected |

Risk Statement |

Risk Mitigation |

Change in Risk Profile |

||

|

|

|

|

|

2013/14 |

2012/13 |

2011/12 |

|

01 |

Monetised Capital |

Increase in interest rates impacting on the Group’s cost of funding |

Ensuring proper mix of short and long term borrowings Maintain an appropriate combination of fixed and floating rate borrowings |

|

|

|

|

02 |

Monetised Capital |

Unavailability of sufficient funds impacting smooth functioning of the day-to-day operations of the Group |

The finance and treasury functions ensure that banking facilities are in place to cover its forecasted cash needs for at least a period of twelve months The Group maintains a desired mixture of cash and cash equivalents |

|

|

|

|

03 |

Monetised Capital |

Damages resulting from natural disasters such as fire and floods |

Preventive measures of safety are taken to minimise damage to people and property in the case of fire or floods The Group has a disaster recovery plan in place Indemnity from insurance policies |

|

|

|

|

04 |

Customers |

Loss of customers and resulting impact on business due to dissatisfied customers. |

Availability of a Quality Management System. Dedicated unit for Customer Relationship Management Continuous training of employees on customer care and aftercare Inclusion of customer care and customer satisfaction index in employees’ and business unit objectives. A detailed narrative on delivering value to customers is available in the Value Creation Report "Customers" |

|

|

|

|

05 |

Employees |

Adverse impacts arising from failure to recruit/retain skilled employees |

Due importance is given to the human resources management function of the Group Top management involvement in talent management led by the Human Resources Department Adoption of Best Practices in human resources management Conducting employee satisfaction surveys Investment in training and development Policy of competitive remuneration More employee-related information is available Value Creation Report "Employees" |

|

|

|

|

06 |

Employees |

Losses from low productivity and low employee engagement as a result of industrial disputes |

An ‘Open door policy’ is in place to discuss grievances with superiors An employee council meets every month to provide for employee representation HR clinics are held at business locations where representatives from HR Department visit locations to listen to employee grievances. |

|

|

|

|

07 |

Business Partners |

Performance being adversely impacted as a result of disruptions to relationships with principals. |

The Group has focused on developing a mutually beneficial relationship with principals in an effort to minimise the risk. Independent survey on expectations of principals Emphasis on meeting expectations of principals Periodic evaluation of Principals’ satisfaction levels A detailed account of our relationships with principals is given Value Creation Report "Business partners". |

|

|

|

|

08 |

Intellectual Capital |

Loss of confidential data through security breaches / system down in the IT systems |

Extensive controls and reviews to maintain efficiency of IT infrastructure and data Regular back up of data & off-site storage of data backup system Disaster recovery plan |

|

|

|

|

09 |

Society |

Potential exposure of the Group to financial losses, litigation and unacceptable corporate behaviour |

The Code of Business Ethics of the Group requires that all employees comply with laws and regulations. A written undertaking is obtained from every employee, that the Code of Business Ethics will be followed by him/her. The Code requires that all employees comply with all laws applicable to the Group. Internal and independent assurance provides comfort on compliance with laws and regulations. |

|

|

|

|

10 |

Society |

Loss of social licence to operate Damage to the reputation and loss of stakeholders’ interest as a result of social rejection Loss of reputation arising from corporate behaviour against the interests of the society |

Engagement in various community related activities, including community development Philanthropy Developing the social and physical infrastructure of the community Upholding of the principles of Global Compact relating to social development. More details on interactions with the community are available on Value Creation Report "Society". |

|

|

|

|

11 |

All stakeholders |

Loss of confidence/business opportunities/depletion of group image due to group not being perceived as a responsible citizen. |

Environmental sustainability is a part of the decision making process in day to day operations and strategy formulation Existence of a sustainability committee to manage environmental sustainability related issues The Group’s Environmental Management System is accredited with ISO 14001:2004 The Group follows GRI Guidelines on sustainability reporting. The GRI index is available at www.dimolanka.com/sustainability/sustainability-performance |

|

|

|

|

12 |

Vehicle Sales Segment |

The vulnerability of the vehicles market to negative changes in interest rates and fiscal policy would adversely impact on group’s performance. |

Reduce the dependency on vehicle segment, by gradually strengthening the other business segments such as Marketing & Distribution, Construction & Material handling Equipment and Electro Mechanical, Bio Medical Engineering and Marine Solutions. |

|

|

|

|

13 |

Medical and Power Engineering Businesses |

This business segment caters to a limited customer base, and therefore the bargaining power of customers is high. This may impact profit margins. |

Diversifying into different markets and product /services. Strengthening the service levels and product offering in this sector. Enhance value addition by Dimo through wider participation in the supply chain. |

|

|

|

|

14 |

Construction & Material Handling Equipment Businesses |

Intense competition from cheaper substitute products. |

Enhancing the customer awareness on product’s high quality and durability and after sales services. Offer a “value for money” proposition |

|

|

|

|

15 |

All Business Segments |

Failure to secure delivery of products on time. |

Maintaining a sound working capital management strategy, Relationship management with principals. |

|

|

|

|

16 |

All business segments |

Technological obsolescence will impact on the inability to compete in the market |

The Group makes regular investments in new technology in providing after sales services and in IT infrastructure Staff are consistently exposed to new technology and trained to handle them The Group is backed by world renowned brands, some of whom are technology leaders. Therefore, technology is leveraged to compete with others |

|

|

|

|

17 |

All Segments |

Possibility of incurring losses on receivables due to adverse economic conditions/poor credit management |

Strict adherence to Group Credit Policy that includes evaluation of a customer prior to granting credit and credit administration. Periodic review of receivables by the Group Management Committee |

|

|

|

|

18 |

All Segments |

Negative changes in exchange rates causing potential losses on assets & liabilities and transactions denominated in foreign currency |

Hedging through forward foreign exchange contracts, where desirable Hedging through foreign currency bank account balances and trade receivables |

|

|

|

|

19 |

All Segments |

Losses resulting from slow moving inventory items becoming obsolete |

Leverage information technology to manage inventory and ordering |

|

|

|